Market research is used to manage the risk associated with offering up new products or services, but if you’ve ever had to undertake some form of it – think surveys, focus groups, interviews – you’ll recognize the difficulties and limitations.

You want to know what the public think of a potential new product. You want to know whether people like your competitors’ products or services more than yours.

You need to do some in-depth audience profiling – work out who your target market really is before spending big bucks on iterating and then ultimately launching your new offering.

The most obvious problems with traditional means of carrying out this research is that it is costly, time consuming and resource heavy, but there are other, underlying issues.

The most obvious problems with traditional means of carrying out this research is that it is costly, time consuming and resource heavy, but there are other, underlying issues.

Bias destroys the value of your data

As an example, in qualitative market research there are the five categories of bias – moderator bias, biased questions, biased answers, biased samples and biased reporting.

These need to be avoided in order to build a complete and true picture of what you’re trying to research – something that is very difficult if using the face-to-face methods of old. These biases can completely destroy the value of your data.

Luckily, the growth of social media has heralded a transformation in the market research industry.

Luckily, the growth of social media has heralded a transformation in the market research industry.

It’s now so much easier and cheaper to source opinions on products, advertising or branding online – but that’s not where it ends.

In the early years of social media, researchers could look at volume and share of voice of social mentions. As analytics tools developed, sentiment analysis and category analysis were added, and now online analysis tools are pretty much as broad – or as narrow – as researchers require.

We show you how to harness this considerable advantage in our new market research guide.

[cta_button title=”Market Research Guide” text=”Free Guide: Market research” target=”https://www.brandwatch.com/guide-market-research/”]

Getting started with market research: The five Ws

When getting started with your market research plan, you’re going to need to ask yourself some questions.

- Why – What do you actually want to find out? Are you trying to prove a hypothesis, or are you fishing for insights? How will you know if/when you’ve answered this question?

- Who – Who are you researching? Who do you want to listen to? Is it everyone? Or perhaps just your customers, or competitors? Do you want to limit by geography, or age? Do you want to limit by any other criteria?

- What – What are you actually trying to find out? Is it what people think about something you’ve done, or something a competitor has done? Is it where you fit into a sector, or whether or not there’s a big enough market in the first place? Is it about people’s intention to buy something or take an action, e.g., to donate time/money/to change their behavior? Is the research to work out when is best to target people? Is it research to identify whether the end-users of a product are the actual purchasers?

- When – What’s the time frame you’re looking at? How far back are you going?

- Where – Which channels are you most concerned about? How do you account for different channels performing different functions for your audiences? Do different audiences on different channels behave differently? Does it matter?

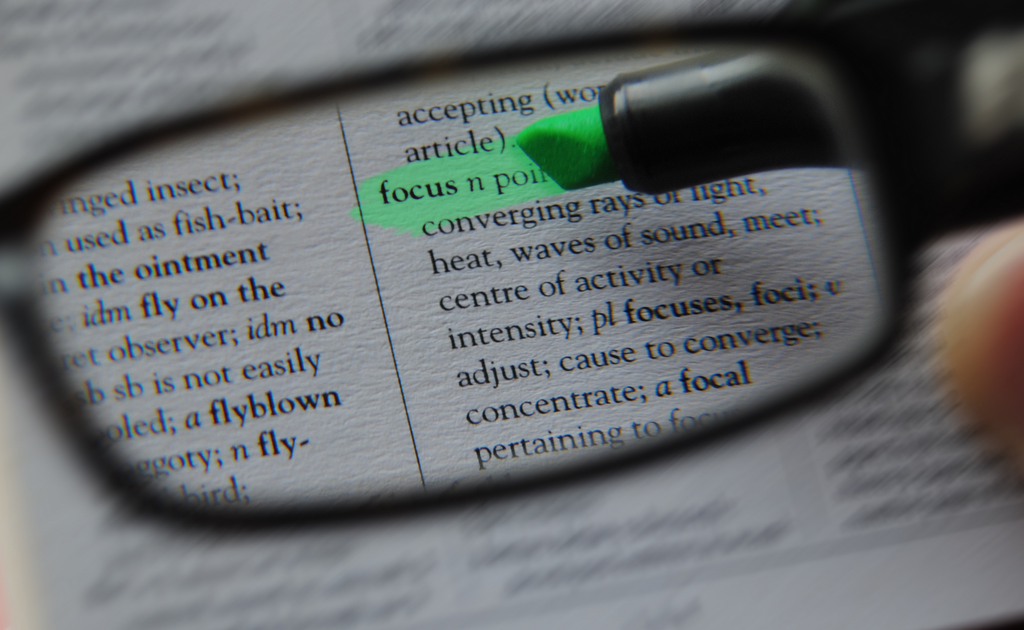

We cover these in more detail in the guide, but essentially, once you have thrashed out your answers to these questions, your focus should be nice and clear.

Although social listening tools make it easier to gather and collate relevant data than ever before, that data still needs careful analysis to offer the most insightful results.

And of course, we have to recognize that social media analytics will only ever bring back research from people who regularly use social media channels; the audience you’re sampling from is initially self-selecting and may not represent the population as a whole.

However, even with this limitation, the volume and accuracy of data available can help generate tangible insights for all sorts of organizations and brands, saving them time, money and resource.

Using social data in this way to complement traditional means of analysis will enhance and improve your market research extensively.

This guide shows you how.