What can social media conversations tell us about current attitudes towards house buying?

We analyzed over 30 million mentions on social media to find out. Let’s dive in.

You can get content like this direct to your inbox by subscribing to the Brandwatch Bulletin here.

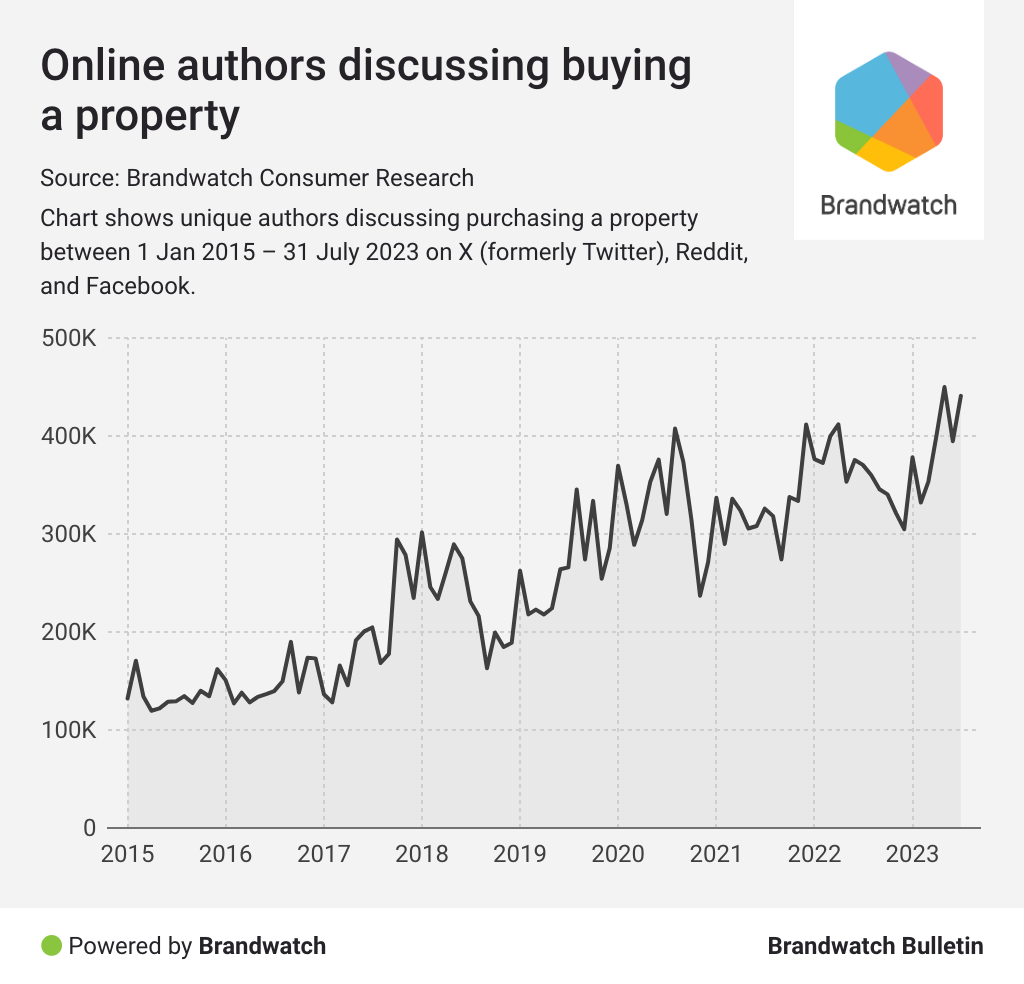

Online mentions about house buying are peaking

We used Brandwatch Consumer Research to discover how people talk about house buying online. First, we looked into how many people are discussing buying a property.

Since 2015, there’s been a steady increase in the conversation. And just a few months ago, discourse hit a peak – in May, almost 450,000 people were chatting online about buying a house.

With interest rates on mortgages skyrocketing to the highest they’ve been since 2000, people are taking to social media to chat about the difficulties of the cost of homeownership.

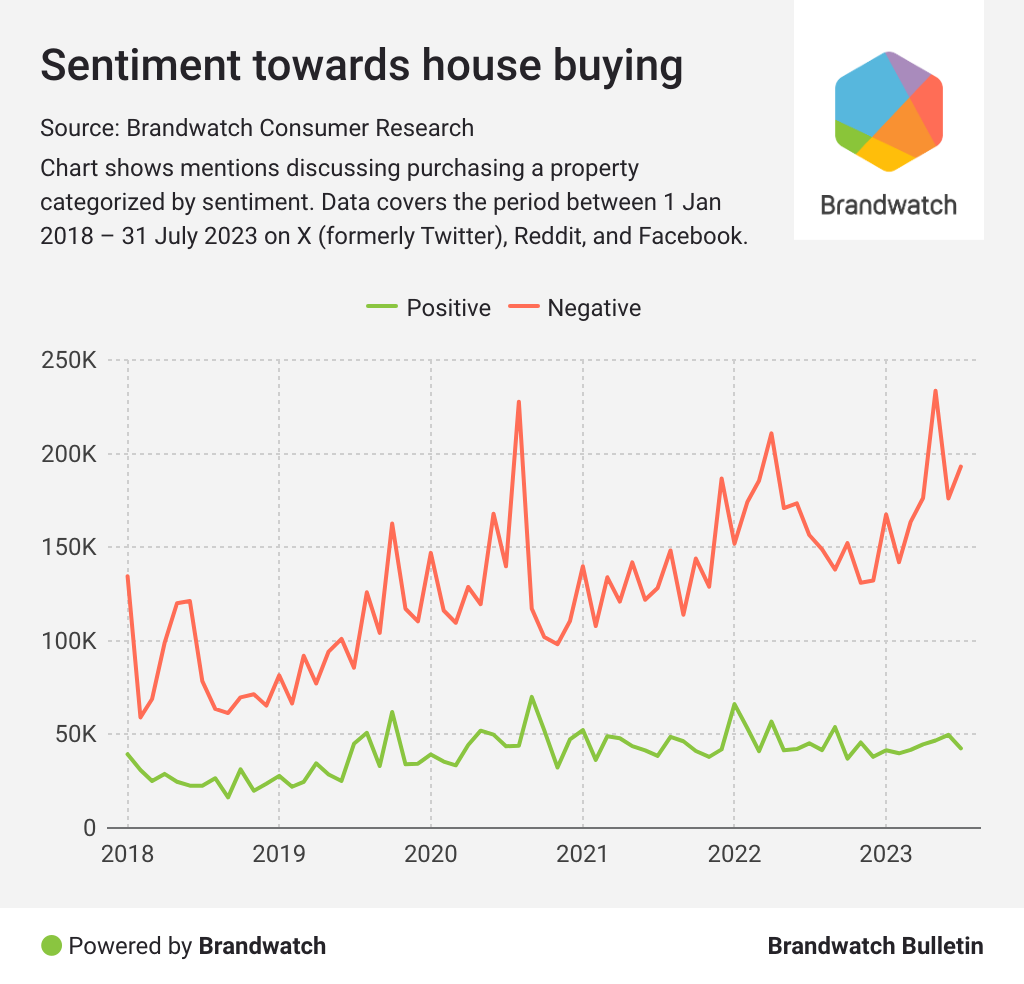

Despite the rising online chatter about purchasing a property, positive sentiment in the conversation hasn’t increased. Instead, an ever-growing cynicism is dominating the house-buying conversation, widening the gap between the graphs representing positive and negative mentions.

Over the last five years, negative sentiment has continued to peak. With an unsurprising climax in negative sentiment-categorized mentions after the start of the pandemic, pessimism about house purchasing has continued to creep up.

So, what does this mean?

As expected, house buying is causing people strain. From costly mortgages to painful purchasing processes, buyers – and wannabe buyers – are venting online.

But there’s a gap opening in the conversation between homeowners who bought their properties decades ago and new buyers – usually from younger generations – who are struggling in the current economic climate.

Let’s look deeper into this gap.

The generational divide

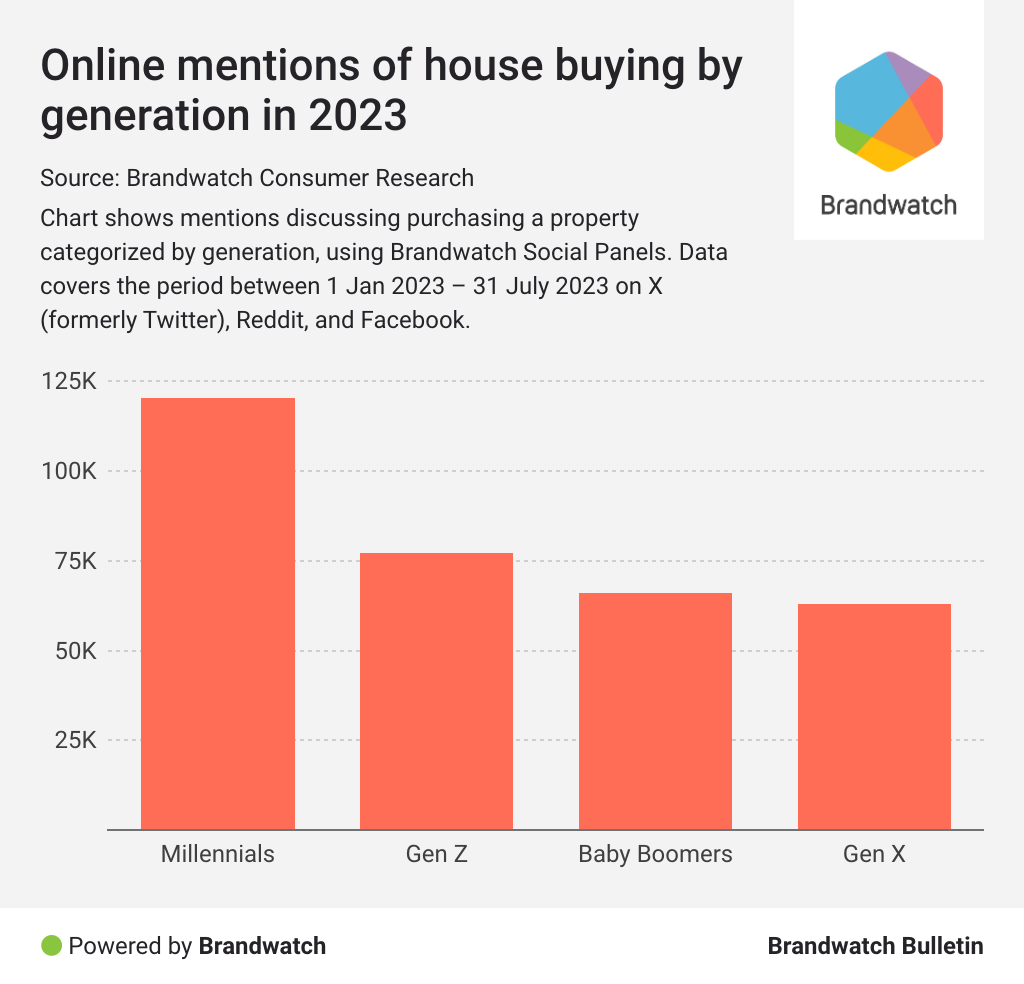

By splitting mentions by generation, we can get a sense of the discrepancies in the house buying conversation.

In 2023, millennials are discussing house buying the most – with over 40k more mentions than Gen Z, who had the second highest mention numbers.

Earlier this year, Redfin reported that millennials seem to be at a disadvantage when it comes to house buying. Both Gen Z and baby boomers own more houses than millennials. Gen Zers are “tracking ahead of their parents’ homeownership rate” – 30% of 25-year-olds owned their home in 2022. Just 28% of millennials – and 27% of Gen Xers – owned property when they were the same age.

This manifests in frustration online for millennials and Gen Xers, who were handed a tough market to buy in.

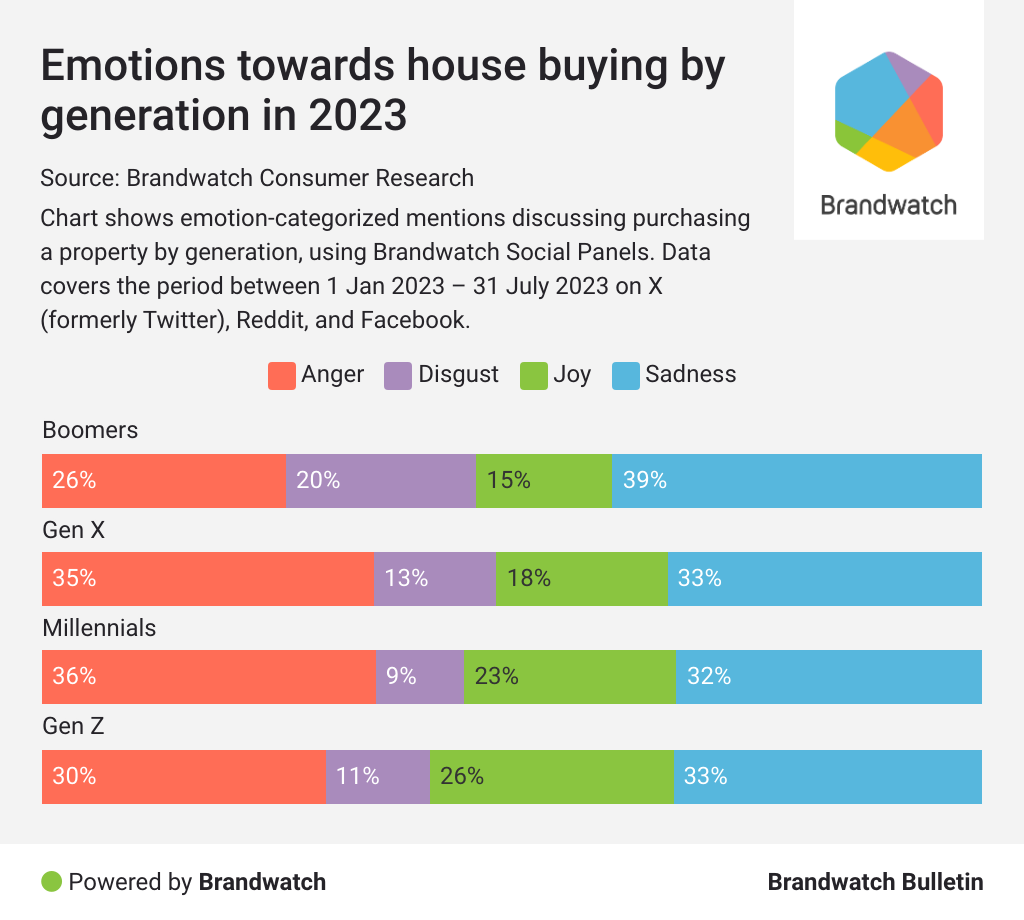

Millennials had the largest percentage of angry mentions, with 36% of emotion-categorized mentions being angry. This was closely followed by Gen Xers, who – while discussing house buying the least – also have a high percentage of angry mentions.

Many of these mentions lean towards frustration in simply being dealt a bad hand in the housing market, making buying harder.

On the other hand, Gen Zers had the most emotion-categorized mentions expressing joy. The eldest of Gen Z are only 26, meaning buying a house is still a dream for many. As a result, there are plenty of happy mentions discussing hoping to own a property in the future.

A key talking point among younger generations is the generational differences in purchasing a property – especially when older generations do not seem to understand the difficulties of younger generations.

But is this really the case?

Boomers had the highest percentage of emotion-categorized mentions expressing sadness. Interestingly, a lot of these mentions voice sorrow towards the current housing market – including how hard it is for their children and grandchildren to purchase a home. Having bought homes of their own, boomers are keen for their younger family members to do the same.

Let’s take a look at how people are overcoming the house price boom.

Alternative housing

With purchasing your own property becoming increasingly difficult, people are looking at alternative ways to access housing.

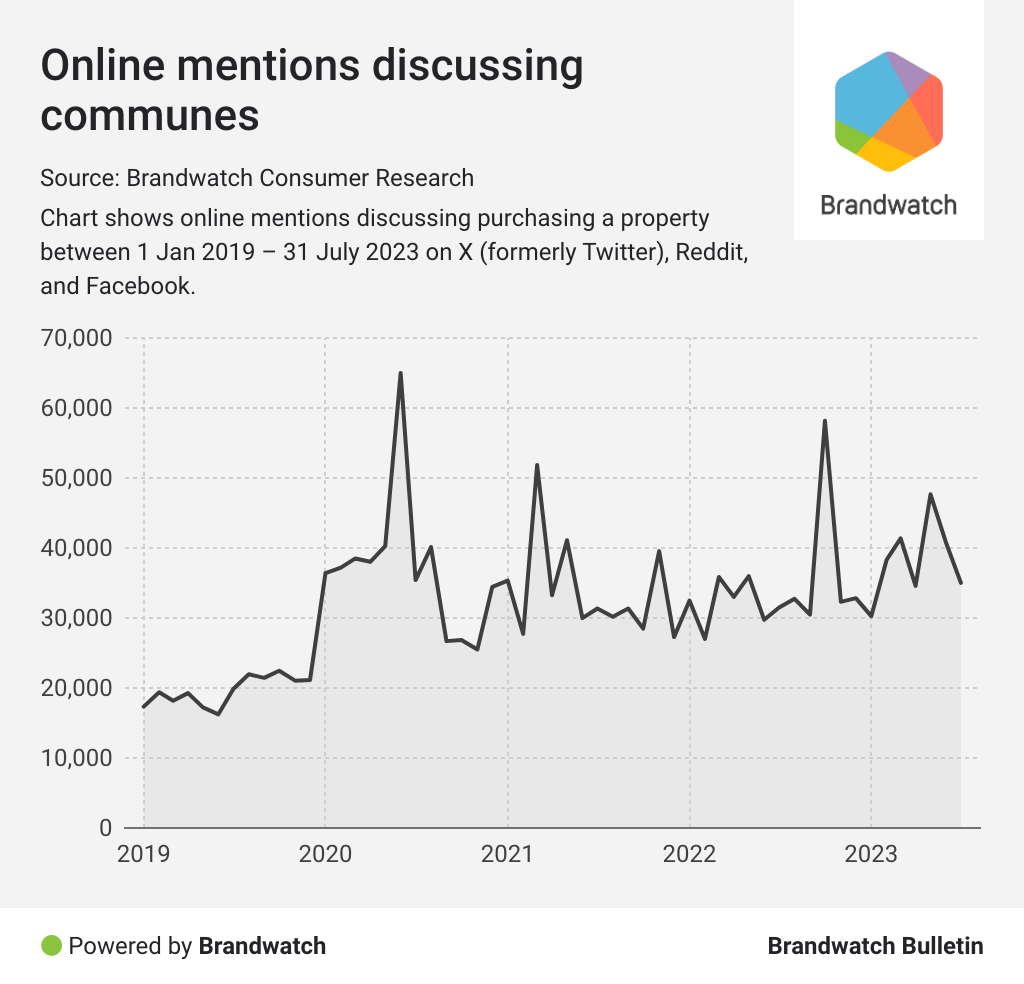

From communes for older women to purchasing property with friends, unconventional ways of living are emerging thanks to the housing crisis. And people are chatting about these methods on social media.

Online mentions of communes have risen steadily over the last few years as people explore these new ways of living.

The emotions surrounding these conversations are positive, with joy being the most prevalent emotion – joy was found in 35% of emotion-categorized mentions about communes.

Friends are also pooling together to get on the property ladder. Some best friends in London recently gained over a million TikTok followers by sharing their unconventional house-buying journey online. Olamide and Cullen – as they’re called – have documented their experience buying a house as friends, and fans are watching with keen interest.

Looking forward

While the online conversation around housing is pretty bleak, there are pockets of online communities finding solace in shared anguish. Whether it’s boomers discussing how to make buying more affordable for their children or friends chatting about buying a home together, people are finding creative ways to beat the system.

With these new ways of house buying emerging, brands might find themselves needing to market to a different audience. Perhaps mortgage lenders will need to appeal to friend duos as well as couples, and letting agents might need to keep communes in mind on property listings.

But let’s not jump the gun on that one; it's an ever-changing market, after all.