Brand research methods

As with any research, the most robust methodology will include information taken from multiple sources. Some will be easier or cheaper to obtain than others, but investing wisely means you will develop a more detailed picture of the landscape and reduce the possibilities for bias that are inherent in any form of research.

Surveys

The good old fashioned survey is still a great source of consumer views on brands and product categories, and can be useful regardless of what development stage the brand is at.

You can conduct surveys in person, by telephone or online. Each has its own set of biases that researchers have to be aware of.

Surveys can provide the quantitative insights for brand research, understanding consumer views on a larger scale. SurveyMonkey is probably the most well known and popular online survey software.

Workshops and focus groups

Bringing different types of people, from customers to employees, into a workshop can bring some qualitative insights into the research mix. Asking open-ended questions allows you to gain deeper perceptions, opinions and emotional responses to your brand, product or service.

Twitter recently launched a service that turns 12,000 users into a quick research panel, allowing brands to gauge what a cross section of consumers thinks of a campaign or product. The service can be used before or during campaigns, offering focus group insights at speed and without using the same level of resources.

Employees

Any customer facing employee should have some insight into what prospects and customers think of your brand. Salespeople, account managers, shop assistants and customer service representatives will all have stories from the front line that can add to the qualitative research.

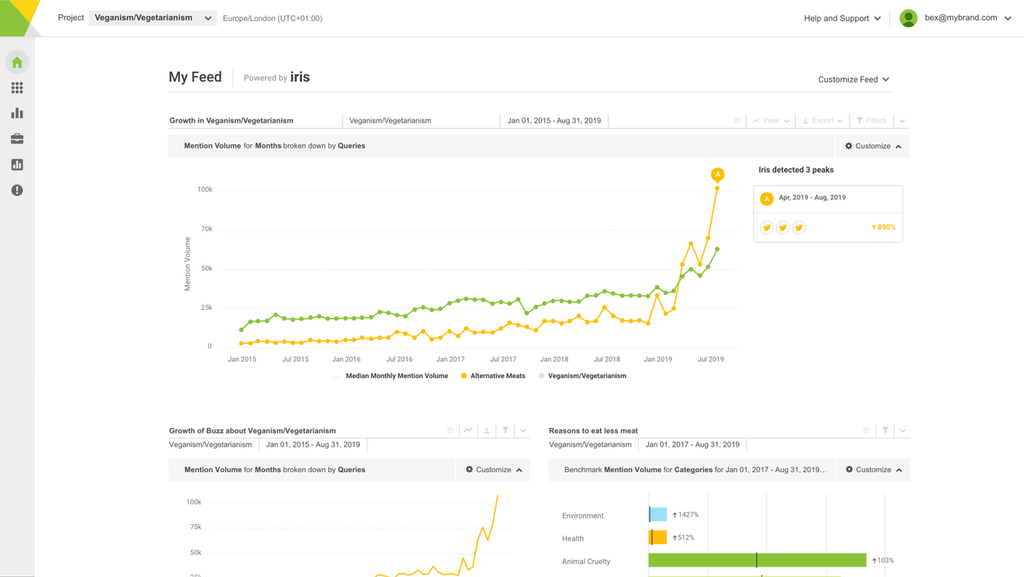

Social Intelligence

Social intelligence offers a unique blend of research. Used well, it can offer a mix of the qualitative and quantitative. The organic nature of conversations reduces response bias found in surveys while the volume of conversations means that you are not limited to a specific set of questions. You simply need to devise the methodology to best answer the questions you’d like answered while also being able to find aspects of the conversation you hadn’t anticipated.

While collecting social media metrics for campaign monitoring has long been a popular use case, deeper business insights can also be found. Even brands at pre-launch or relatively new or small brands with lower volumes of conversation can gain insights by looking at broad topics and types of conversation. Segmenting the data using tags and categories is vital for highlighting relevant information in your data.

Ways to conduct brand research

With surveys and focus groups you can obviously just ask people the questions, although you need to design the questions to reduce bias where possible and keep them open ended. With social intelligence, you also have to design your methodology. One advantage is that you may come across insights you hadn’t previously considered.

Below are some topics and themes that you may wish to track, but the list is not exhaustive. There may be brand or industry specific insights you wish to search for.

Competitive analysis

Whether you are launching a new brand or are an established player, understanding the current landscape is vital. Undertaking competitive analysis can give insights to help you position and improve your offering.

With social intelligence, you can uncover the strengths and weaknesses of the competition, understand their unique selling point in the eyes of the customer, and get an overview of the level of competition among different markets and demographics by measuring share of voice.

Brand awareness

Are people aware of your brand and are they able to recall it unprompted? Focus groups are best for measuring brand awareness, but surveys and social intelligence can also be used to understand the level of fame your brand has achieved.

Brand perception

Measuring brand awareness will tell you if people know your brand, but measuring brand perception will tell you what those people think of the brand. What does the brand represent for consumers? What do they think of its products and services? How does this perception compare with competing brands?

Brand associations

Following on from brand perception, you can discover and measure brand associations consumers have when thinking about your business. If you are a luxury brand, you need to know that you are maintaining that exclusivity and admiration. If you aim at the opposite end of the market, do people associate your brand with savings and economy or cheap, inferior products?

Sentiment and satisfaction

Sentiment analysis in social intelligence platforms can provide a quick overview of public opinion on any topic. A human analysis of the data can surface more nuanced emotions, such as joy, humor, frustration, anger, and so on. Working through the data you can understand if customers are satisfied or frustrated and why, helping you address any issues.

Whether your shopfront is brick-and-mortar or e-commerce, understanding perceptions of your shopping experience is also valuable. Average shopping cart abandonment rate for e-commerce stores is 68%. While shoppers don’t tend to abandon carts in physical stores, experiences can still be improved through data led approaches.

General brand research tips

- Don’t be afraid to ask simple questions. Often you can find that by asking simple questions people open up and explain in greater detail.

- Seek emotional and rational responses. There are different reasons why someone chooses one brand over another. Trying to uncover a mix of the two will help your brand research.

- Don’t start with assumptions or bring your own views into the research. Facilitate the conversation to discover true insights, don’t lead the conversation to where you expect it to go.

- Think about the best presentation methods. Present your findings well, with methodology and key findings first, followed by clearly presented data and qualitative insights.

There is no one way to create the perfect brand research strategy. The best method will use a mix of data sources, developing a tailored approach to suit your brand and industry. Some of the findings may be great, and others may be painful. The painful ones can often be the best as they lead to opportunities to improve.