The pandemic has accelerated the shift to digital payment, and we’ve since seen an expansion in the variety of ways consumers can pay for goods and services, online and offline.

Let’s take a look at the stats around some of the most discussed payment methods in the last 19 months.

Popular payment methods

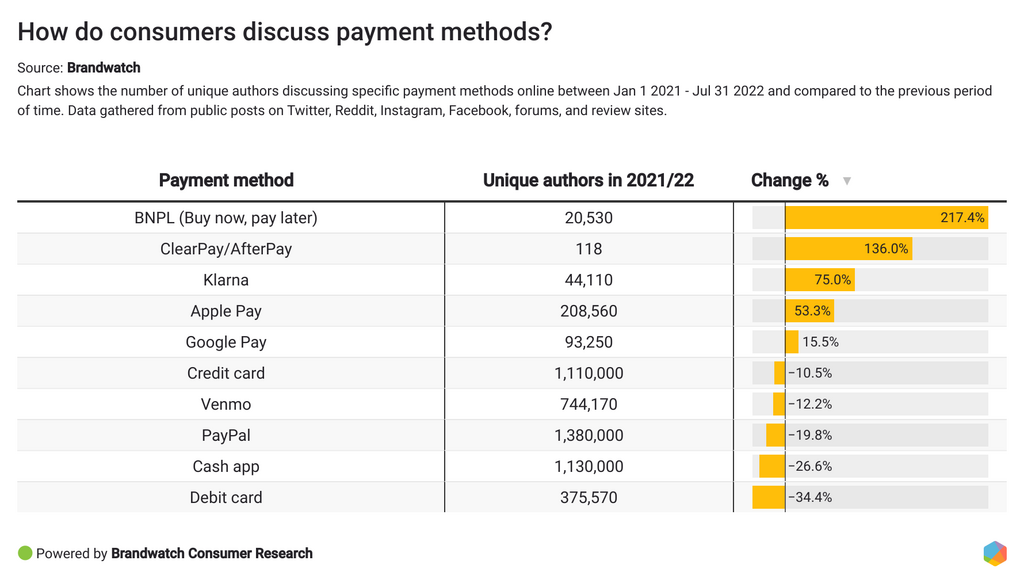

We’ve found that while PayPal, Cash App, and credit and debit cards were mentioned a lot more in conversations than any other payment method, the number of unique authors mentioning these brands had fallen compared to the previous 19-month period.

On the other hand, the number of people mentioning ‘buy now, pay later’ (BNPL) grew by a whopping 217%. Klarna, ClearPay, and Apple Pay also grew in mention volume by 136%, 75%, and 53% respectively.

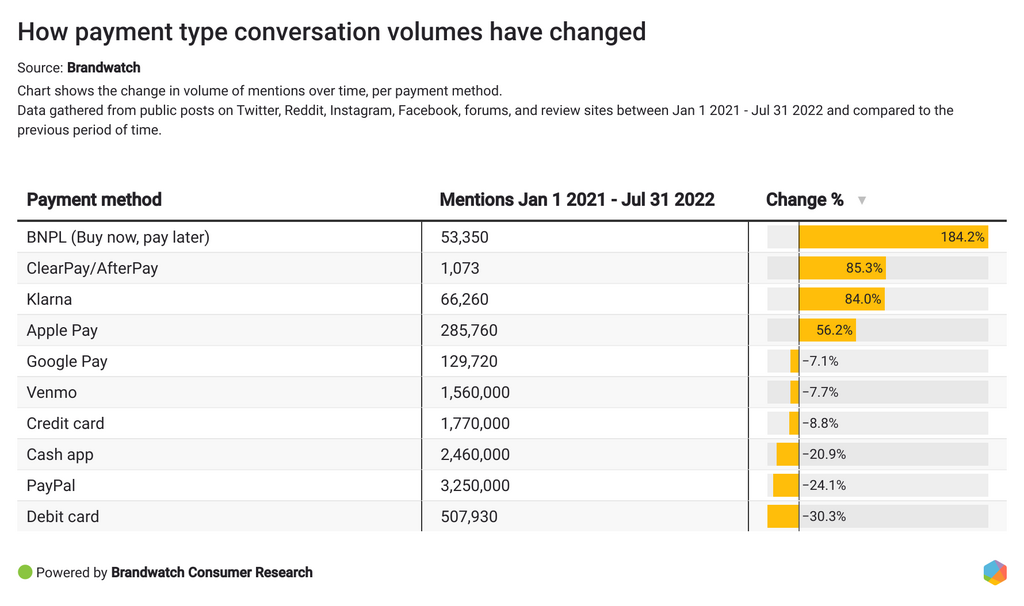

We also looked at how the volume of mentions has changed since the previous period of time (June 1 2019 - Dec 31 2020).

And similarly, the BNPL conversation saw a 184% increase in mention volume, followed by ClearPay/AfterPay, and Klarna—all of which offer consumers a way to make purchases now and pay for it later.

‘Buy now, pay later’

In one of our recent reports, looking at the impact of COVID-19 on shopping behaviors, we discussed the ‘1-click buying’ phenomena and how simplifying the checkout process has improved the consumer digital shopping experience—and also influenced consumers to spend more. While some consumers expressed they were happy with how easy shopping online has become, others implied that 1-click buying has become a major source of anxiety for them, as they felt inclined to buy something “every single day”.

We also analyzed consumer discussions about what’s important to them when it comes to online shopping. And we saw a lot of feedback around ‘placing an order’ related to payment options. If consumers can’t pay with the existing payment options on the website, the business will lose that revenue.

And this may have been one of the reasons why ‘buy now, pay later’ has seen a huge increase in popularity in recent years. This payment method allows consumers to break down large purchases over time, offering to pay in installments, thus taking the pressure off the decision-making process.

And these tweets summarize consumer attitudes towards BNPL well:

We’ve compared the general BNPL conversation to the few fastest-growing payment options, Klarna and ClearPay/AfterPay (part of the ClearPay family).

And as you can see on the chart, the general BNPL conversation as well as the brands that offer to pay in installments—all have seen steady growth in the last three years.

The growth in both mention volume and unique authors initiating discussions relating to ‘buy now, pay later’, signifies a strong consumer interest in this payment option.

And this tweet caused a massive spike in engagement, seen on the chart above.

And lastly, here’s handy feedback from a Reddit user for those businesses that are still considering whether the BNPL option is for them:

Takeaway

Many consumers may still hesitate to spend with the ongoing global pandemic and broader economic and social issues.

But one thing is clear: more consumers have been talking about alternative and, potentially, more convenient ways to make digital payments, such as BNPL, and businesses need to take note if they’re to create great customer experiences and influence purchasing behavior.