CMO Guide

Creating a Culture of Competitive Excellence

How CMOs can drive an informed, agile and effective strategy across their organization

14 Minute Read

Get started with competitive excellenceWhen it comes to competitive intelligence, the playing field has completely changed. Companies cannot afford to rely on traditional methods to drive intelligence strategies forward. Company-wide mindsets need to be shifted.

It can quite easily be said that the role of the CMO has changed in recent years. The focus no longer lies in brand management and campaign effectiveness, but in translating the changes in the market place into business objectives.

Many of these changes are rooted in the role the customer plays in business operations. Understanding the voice of the customer and its effect on market and strategic initiatives has to be a priority for all CMOs and senior leadership teams.

But what does this have to do with competitive intelligence? The methods of old simply won’t cut it. Brands must be reactive. Market research still plays a role but there is now an imperative to take an always-on approach to competitive intelligence.

“We must start to think differently about how business, management, and strategic intelligence works. What companies today need isn’t meticulous plans, but to constantly reassess the business and its markets and competitors. In other words, the goal for strategic intelligence is not to collect market information to make plans, but to use that information to generate insights that in turn support ever-changing perspectives.”

On one hand, the data to make this happen has never been more readily available, but on the other structuring this data in a way that is valuable for the entire organization requires time and investment.

In this guide we look at the factors that need to be in place to achieve this, while also taking a practical look at the data that will accelerate this strategy and the challenges you can expect to see.

The role of the CMO

When it comes to customers, the balance of power has completely changed. No longer do customers have to come to the brand to gather information, it is freely available and often less biased elsewhere. Brands have less and less control over the information that customers gather in relation to products, services and, most importantly, experiences.

When you think of the the typical customer journey (if there is such a thing), it becomes obvious that brand owned content and activities take a back seat to social media, review sites and customer forums.

This means that companies are focusing less on what the competition are doing and saying, and focusing more on the voice of the market. This isn’t to say that keeping track of competitive activities isn’t extremely important but more of a call to action to broaden the scope of considering what’s important when it comes to competitive intelligence.

Moving away from the customer, to be truly competitive you need to be agile and aware of the area you are operating in. These two go hand-in-hand because without one you cannot effectively do the other.

What we mean by this is understanding what your core competencies are and keeping your finger on the pulse of these. This will naturally enable a more informed and reactive mindset.

The final stage in the role of the CMO in driving a competitive mindset is ensuring the insights gathered are distributed and acted on effectively. We all know that data is useless in a silo however, it often falls between stools as to whose job it is to share insights with the necessary teams. Not everyone will need to know everything but how can you ensure the right teams have the right information?

We will explore the role of Vizia, our data visualization tool, in aiding the visualization and effective distribution of critical insights.

Stage 1: Understanding core competencies

While this may seem like an obvious starting point, it can’t be stressed enough how important it is to understand where the company is coming from. The idea of being able to be competitive without knowing your own strengths and weaknesses is simply foolish.

One way to kick this work off is to carry out a SWOT analysis of your organization and offering. The important thing to remember when it comes to this type of analysis is that strengths and weaknesses are generally specific to internal operations. In order to ensure you are not losing sight of external factors, it’s often useful to incorporate a PEST analysis in tandem.

This analysis will not only give an overview of where and how your brand is operating but will also create a framework for the strands that need to be monitored going forward. Ensuring that strengths are leveraged as effectively as possible can make or break your competitive intelligence strategy. This coupled with an agile mindset will create further areas of strength.

In their paper, “The Core Competence of the Corporation“, C.K.Prahalad and Gary Hamel set out three qualifications for measuring your company’s core competencies:

“An area of specialized expertise that is the result of harmonizing complex streams of technology and work activity.”

- It must provide potential access to a wide variety of markets.

- It should make a significant contribution to the perceived customer benefits of the end product.

- It should be difficult for competitors to imitate.

There is a counter to the core competency model that companies like Nike and Netflix are spearheading. This is rooted in the level of disruption we are now seeing in the markets and which companies, in order to succeed, must adapt to. This argument is more than valid, however, no matter how effective your business model is, there is always a starting point and that can, more often than not, be brought back to core competencies.

So what do you do once you’re identified your strengths weaknesses and core competencies?

Get to know the perception of your customers.

This may be easier said than done but there are so many options in terms of gathering this information.

First, look internally. The collective intelligence of your employees is massive. By tapping into the right teams, you can learn more about your customers than any kind of market research can uncover.

Start with your customer facing teams like sales, customer success, and customer support. Then move onto wider teams like product and research. Gaining perspectives on what your employees think of the wider brand and how it’s serving customer can be just as valuable as getting insight on your customers.

To drive a truly effective competitive mindset you need to ensure your employees are committed too, so understanding where they stand is a key starting point. Once this is done, it’s just as important to follow up at regular intervals to see how perceptions are changing and if your efforts are having the desired effect.

Another effective way of gathering customer sentiment is through social data. Generally speaking, people are more unbiased on social compared to when they are speaking to a company rep or survey, this means there is a wealth of information to be gleaned.

Stage 2: Monitoring

You identified your core competencies. You’ve gathered customer perceptions. Now what?

We live in an always-on world which means you need to take an always on approach to staying on top of the information that will help your brand succeed, but also steer it clear of any danger.

The main issue here is that there are countless different sources you need to maintain a hold over. From web analytics to share of voice. Intent to purchase to news.

| Data Source | Purpose |

|---|---|

| Owned Social n | Monitoring brand activity |

| Organic Social | Intent to purchase and share of voice |

| Web Analytics | Website performance and activity |

| Content | Industry news and trends |

| Offline Data | TV broadcast and unstructured data |

| CRM Data | Customer feedback |

With Brandwatch Vizia, it’s easy to keep track of all of these data sources in one place. With the world’s leading social data from Brandwatch Analytics and out-of the box data integrations, you can maintain a 360 degree view of your strategic intelligence.

The ability to seamlessly integrate different data sources allows us to blend social with any other data source. We already have data such as consumer contact centre and Google Analytics data blended with social data. The screens are in all our global offices and in our senior exec offices so they can see consumer trends in real time. The control hub means we can control the messaging all over the company.

Depending on your brand, market and competition, the range of data points will change. However, we have put together some high-level examples of the data you should be using as a base point.

Share of voice

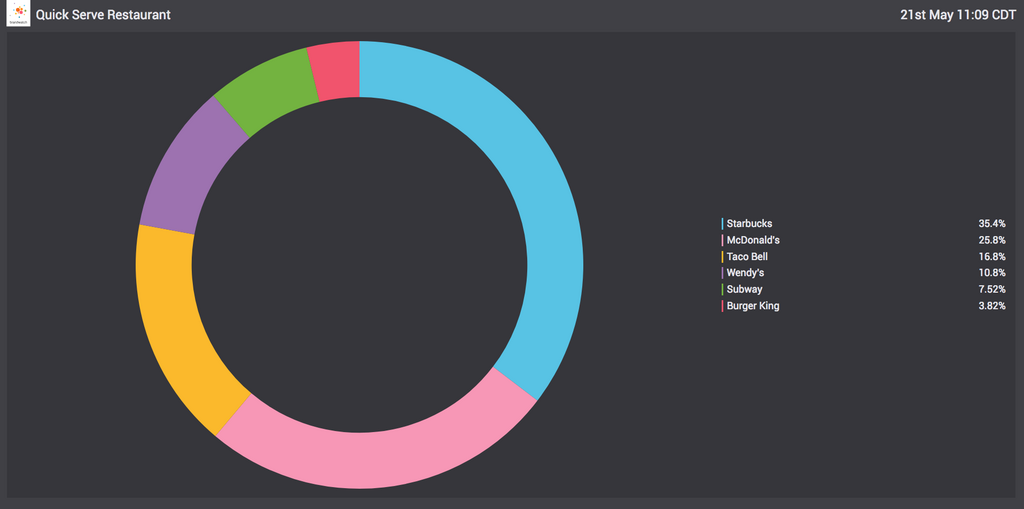

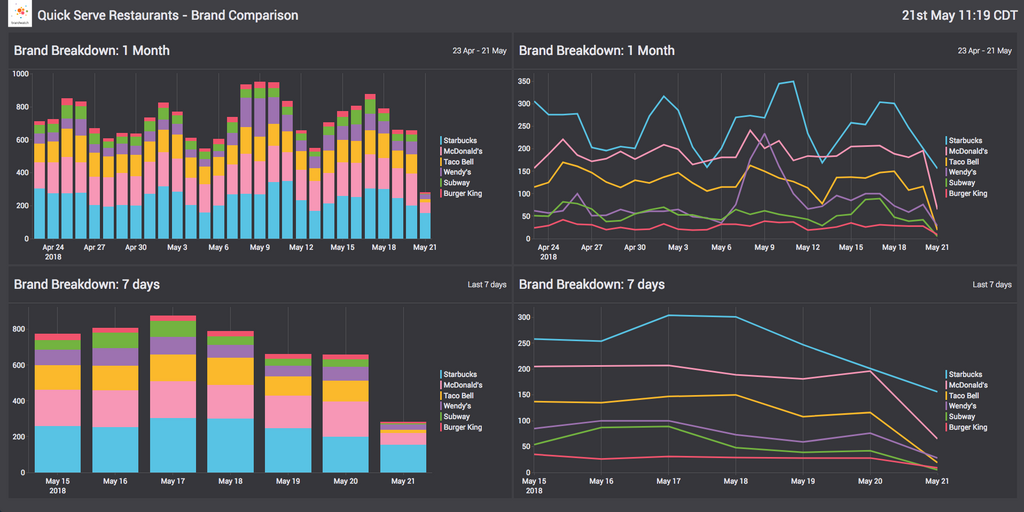

This is one of the most straightforward ways of assessing your position compared to competitors. It clearly shows how many people are talking about your brand versus the competition. This information is always useful for social and marketing teams and can allow them to be more agile and reactive in their activities. This should also be done with product categories.

Intent to purchase

Following on from the previous example of quick serve restaurants, while it’s useful to have a high-level awareness of where you stand, that data needs to be interrogated to gain truly valuable insights.

Tip: Be mindful of the teams that will benefit from this data.

Intent to purchase data gives you insight into how your offering stacks up against your competition. The more you and your team acclimatize yourself with this data the easier it will be to identify strategic opportunities.

An interesting perspective, when it comes to intent to purchase, is to compare this data across a group of competitors. From the above example, we can see that conversation volume for Starbucks increases during the week and tapers off at the weekend. If I was McDonald’s I would be thinking, what activities can we push to capitalize on this increased share of voice?

It would also be good to identify if there are any correlations between competitive intent to purchase and mentions specific to your products.

Social Benchmarking

Industry benchmarks are an excellent way to gather perceptions on your brand from an outside-in perspective. In the following example, we look at the social benchmarks for the Quick Service Restaurant industry.

Leaderboards allow you to identify your competitors’ areas of weakness while also looking at your own areas for improvement. By tracking this data over time your teams can get a gauge of whether or not their efforts are having an effect.

By visualizing this social analytics data alongside other sources, it starts to reveal the bigger picture of your performance.

Sentiment

So people may be talking about you and your competitors, but is what they’re saying positive? It’s an important data point to establish. There’s a few ways of doing this:

Web Analytics

While you have limited insight on what’s happening on your competitors’ website, it’s important to understand if any owned or non-owned activities are impacting your website. Having a view on all of your integral data will allow your teams to work smarter in terms of identifying the reasons for peaks or drops in activity.

Content

It’s imperative to keep track of industry news and activity. Knowing if your competition is involved in a crisis or acquisition is valuable information for your team and the entire business.

This information can be gathered from social but also through the knowledge base of your employees. Set up a Slack channel that allows your employees to share competitive intel from the field and beyond.

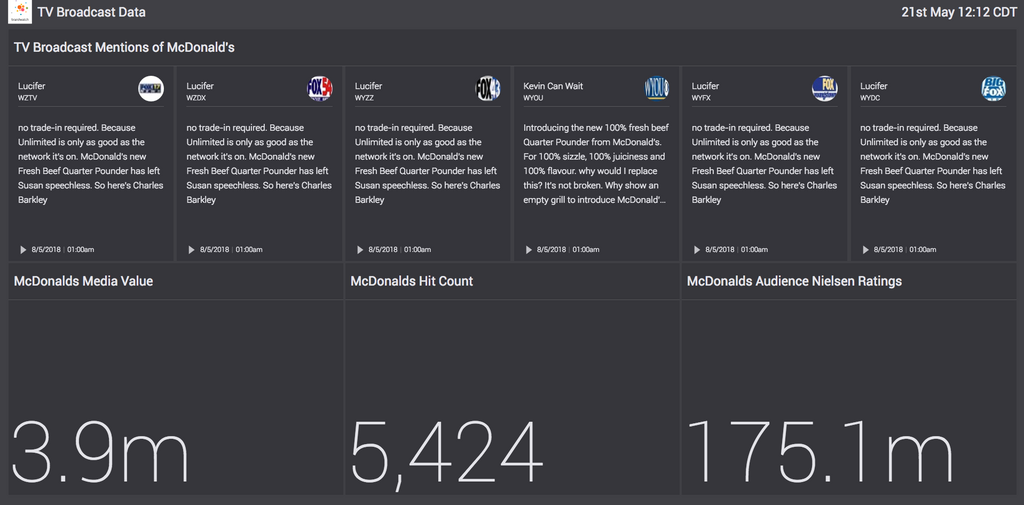

Offline opportunities

While online activity seems to be taking over from all other mediums, it’s important to keep an ear to the ground when it comes to offline activities also.

TV data is probably the most obvious example of this. How are your competitors being mentioned across earned and paid television broadcasts? Do they have a greater share of voice and sentiment? Is there an opportunity for your next marketing campaign?

The important thing to do at this point is to bring all of these disparate data sources together in a meaningful way.

The point is to create a space where you can identify opportunities more easily while also making smarter decisions faster. Having data that covers a breath of sources is crucial to this process but it’s also essential that this data is real-time and up to date.

Some of the questions an integrated approach can answer:

- Where are my competitors’ blind spots?

- What channels are worthy of investment based on volume and sentiment?

- Has a competitor’s launch lead to a decline in website traffic?

- Has our recent campaign lead to a decrease in competitors share of voice?

- Was it the recent acquisition that lead to a bump in website visits?

- Has our traffic dropped because a competitor has started bidding on our terms?

Stage 3: Distribution and the feedback loop

Possibly the most important step in the process is creating an environment where this information is shared freely and openly across the organization. One of the biggest blockers of poor decision-making is communication barriers. There should be a culture of sharing between your front line employees, senior leadership teams and everything in between.

The tricky part of this process is figuring out what teams need which information and when. For instance the product team isn’t necessarily going to need to know about website traffic but they will need to know about a new competitive offering and how that differs from what your company offers.

On the other hand, the information the product team glean from the information could be useful to all of the customer facing teams. One of the most important aspects of breeding a culture that breeds competitive and strategic excellence is fostering a feedback loop that supports decision-making.

One way to do this is to invest in an insight distribution system. With Brandwatch Vizia, you teams can seamlessly share real-time and compelling data from a variety of sources. By strategically positioning your screens within teams you can ensure that they are being served the right data.

The tactics your company decides to back based on this data will depend entirely on where you are in the market and what your objectives are. However, given the level of competition and disruption in today’s markets, it’s useful to be aware of your options.

1. Walk the path less travelled

Use customer perceptions and feedback to target blind spots in the market. Conduct an analysis of each player’s offering and isolate an area your brand can leverage. Use differentiated positioning of new products to make the first move.

2. Preempt your rivals

Between a combination of data insights and on the ground intel try to preempt your competitors’ moves. This is a highly reactive strategy so you need to be confident in the data at hand. If so, you can launch activities to distract or deter the market from the competition’s offering.

3. Do nothing

Imitation is the sincerest form of flattery. A steadfast and inimitable strategy is one of the greatest competitive advantages a brand can have, so by bowing to the pressure of competitive attacks, you expose potential weaknesses.

4. Anticipate shifts in the market

Look beyond your competitors and look to the market. The rate of change at the minute is enormous so being able to effectively foresee a change in market factors or consumer needs will drive your brand forward and give you a greater strategic standpoint.

The crucial point to remember is that in creating a culture of competitive excellence, the right decision can be made depending on the information at hand at any given time.