CONSUMER INTELLIGENCE IN PRACTICE

Competitor Analysis

Learn how consumer intelligence can power up your competitor analysis, from measuring share of voice meaningfully through to reviewing the competitive landscape

Book a meetingCompetitive intelligence is about more than knowing what your competitors are doing. It’s about getting to know the landscape in which your organization, products, and services exist, defining the metrics your business will use to measure success, and using that information to make better strategic decisions.

In this guide, we’ll introduce how to approach competitive intelligence by asking the right questions. We’ll also provide step-by-step tutorials for using Brandwatch to:

- Perform a competitive landscape analysis

- Measure share of voice

- Set up competitor benchmarking

- Analyze competing product reviews

Throughout, we’ll share insights from Brandwatch Solution Strategist, Evelyn Castillo. Evelyn works with some of our biggest clients to help them find answers to their big strategic questions. She has worked in research for seven years.

"What I talk to our clients about a lot is highlighting the intelligence aspect of competitor intelligence – it’s not just about knowing what’s out there, tracking volumes, and comparing yourself. What’s important is what you learn from it, how that informs action, and how those actions fit with the objectives of your organization."

How to approach competitive intelligence

The truth is that many teams are obsessed with looking at what their competitors are up to, but not for the right reasons.

“One thing I learned really early in my career that I found super-surprising is that people would spend a lot of time tracking their competitors,” says Evelyn. The problem she saw was that the information gained from looking at what competitors were doing wasn’t used properly. Teams were tempted to copy competitors, even if those actions made little sense for their own businesses.

Successful competitive intelligence initiatives don’t start with tactical questions. They start with the objectives of the company, around which research questions can be built.

“The easy questions are ‘What’s our share of voice? What are our competitors doing?’. The more sophisticated questions we get are ‘When we look at competitors, when we look at perceptions, what is it that people love about those brands? What is it that makes those brands competitors? What makes them top of mind?”

If an organization’s goal is to be seen as sustainable, comparing marketing efforts with those of unsustainable competitors might not be the best place to start.

One of Evelyn’s favorite clients to work with is a large luxury fashion brand which she says has mastered its competitive intelligence strategy. By starting with its business objectives, the team she works with can define the values and metrics they want to use to measure their success.

“I feel like the biggest advantage for this brand is that they’re very strategic in terms of how they do their competitor analysis. It isn’t, again, about the share of voice,” says Evelyn. “It’s a very in-depth analysis where they say ‘these are our business objectives, this is where we sit, and this is where we want to be.’ Then they can begin understanding where their competitors are winning, and where they fall on the same criteria the brand is measuring themselves against.”

This is not just beneficial to a single team. By going beyond vanity metrics like likes and mention volumes, the team can demonstrate how different initiatives helped shift consumer perception, or how the brand has moved up in a specific category that is important to the wider business. These insights can be relayed to executives and acted upon across the business.

In practice: How-to guides for common use cases

How to perform a competitive landscape analysis

“Something that not enough clients do when looking at the competitive landscape is analysis within the category that’s unbranded, especially in order to discover new brands. I feel like people really underestimate new entrants to the market,” says Evelyn.

“A good example is in the feminine care category – if you’re losing market share in feminine products you might think ‘Oh, have people moved to tampons? What’s happening?’. The reality is there have been these new entrants to the market with products like sustainable cups, but if you were just looking at your competitors you’d be making assumptions about what was driving that decline in consumption. You’ve got to take a step back when doing a landscape report to get that discovery aspect.”

How might that look in practice using Brandwatch Consumer Research?

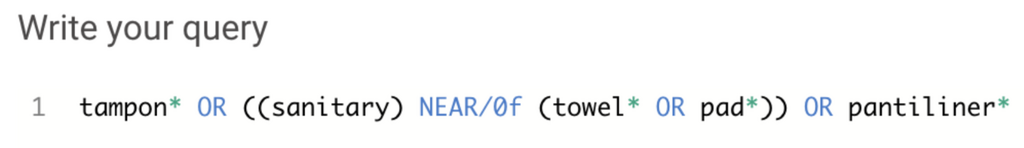

Let’s take Evelyn’s above example on feminine care products. A very simple non-branded query might initially look something like this. It’s designed to pick up public conversations related to known products.

Your query is basically a search and will determine everything you see once you begin analyzing the data. It can be edited and backdated at any time (all the way back to 2010 if you want to look at the data historically), which is particularly helpful when you want to continuously add new trends to a non-branded query.

Below, you can see key topics in original posts relating to the keywords we searched for in July 2020. Each element is clickable, so you can see what’s being discussed within each topic.

As you can see above, clicking through the different elements will quickly get you to the verbatim mentions themselves.

By looking at mentions of period products above, we’ve found people talking both generally and specifically about different brands and products, and comparing them on their different merits. We’ve also picked up conversation that compares ‘known’ products (those that appear in our query) with new products, like menstrual cups.

The unbranded query can then be added, to ensure new product conversations like these are picked up in the general landscape analysis. Competitive landscape analysis should be an ongoing process, since new trends are emerging all the time. The earlier you pick them up, the sooner you can act on the associated insights.

How to measure share of voice

Part of Evelyn’s work is taking a look at clients’ set ups and advising on how they can do better. A common problem she’s found when looking at share of voice is around differing levels of quality between queries relating to an owned brand and queries relating to competitor brands.

“You know your brand in a way that no one else does. And you think you know your competitors, but you really don’t know your competitors in the same depth. So what I’ll often find when checking over client queries is a very robust search for their own brand, including hashtags for every campaign that ever existed,” Evelyn says.

This is not helpful if you’re trying to get a good idea of how much conversation your brand is generating compared to your rivals.

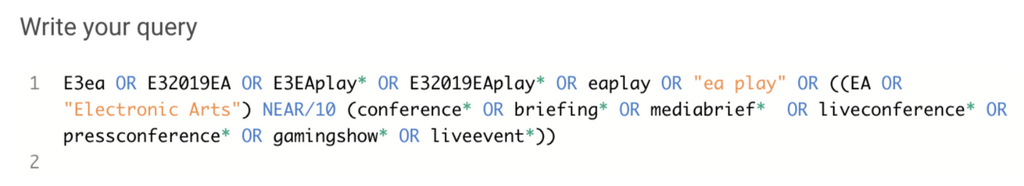

Here’s an example of how this might look. A gaming brand looking to measure their share of voice at gaming expo E3 might write the following comprehensive query for their own brand:

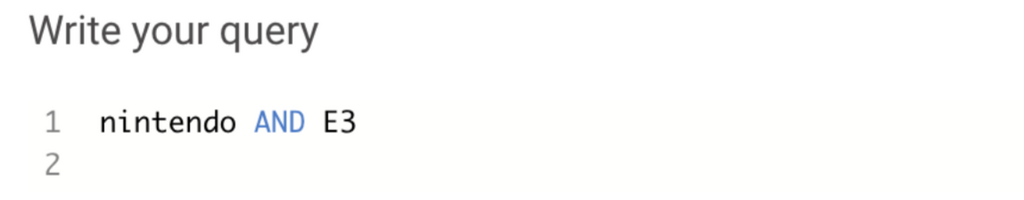

And a much more basic one for a competitor:

“Trying to keep it as apples to apples as possible is really important when analyzing share of voice. Otherwise, you’re just going to inflate how much your brand is talked about.”

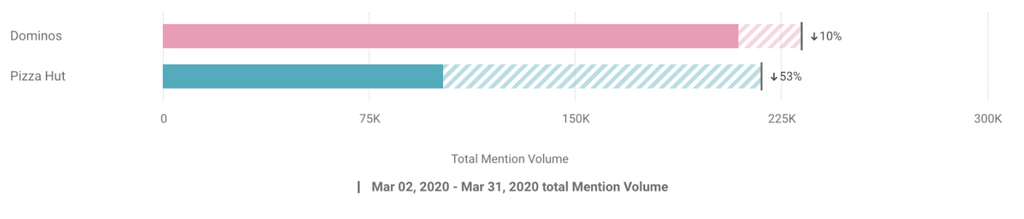

Once your queries are ready, you can begin analyzing share of voice in various ways. Here, we’ll compare Pizza Hut and Dominos.

An analyst could look at conversation over time or as a whole.

They could also look at key conversation drivers, like conversation around dessert, sides, or kinds of pizza. This analysis is done by searching for keywords relating to different menu items and then assigning mentions containing those words specific categories.

It’s important to remember what Evelyn said above about using share of voice wisely. Is it actually helpful to know that one of your competitors is generating more mentions than your brand, or that they have more followers?

A better way to approach share of voice might be to compare your brand with direct competitors in terms of the conversation relating to sustainability or price or the makeup of your audience if you’re trying to capture the attention of a specific group. It should all relate back to your overall goals.

If the goal is to be top-of-mind for consumers who are looking for great tasting pizza, or for pizza that’s value for money, it’s pretty simple to monitor how you compare to the competition.

In Brandwatch Consumer Research, that can be done in one of two ways.

1. Using keywords

Taking the example of value for money, you might search for phrases like “great value” or “lots for your money” etc, and instruct Brandwatch to categorize mentions including these words over time across your competitor set.

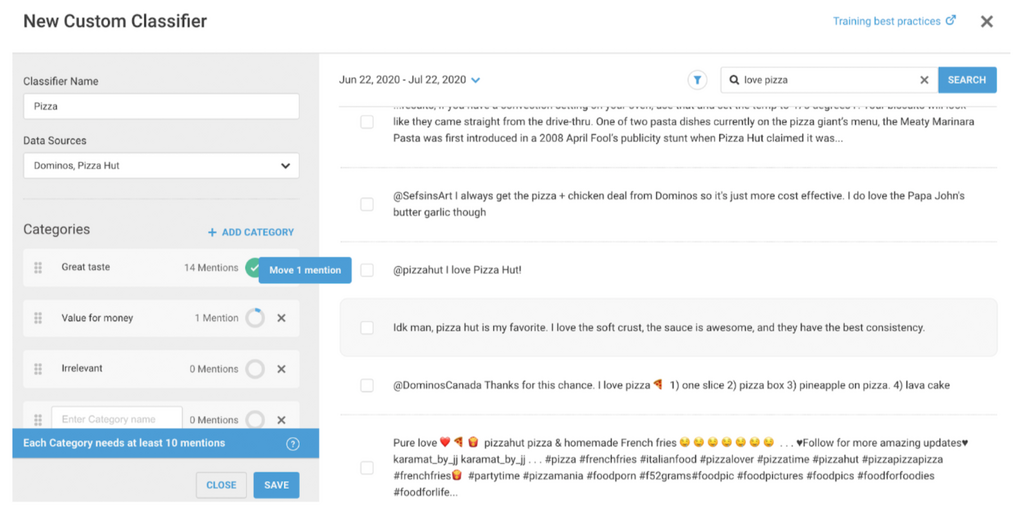

2. Using Custom Classifiers

Alternatively, you can train Brandwatch to recognize mentions that relate to value for money or great taste. All you’ve got to do is drag and drop ten or more mentions into a category, and Brandwatch will recognize mentions like them in future.

Custom Classifiers are especially good to use when the topic or value you want to categorize data by is hard to come up with specific keywords. Value for money or intent to purchase are good examples of this.

Once the data is categorized, you can compare your brand to the competition in a dashboard, just like we did above with mentions of different menu items. You don’t have to set up different Classifiers for different competitors – it’s all done at once.

How to set up competitor benchmarking

Competitor benchmarking is closely related to share of voice. There are a couple of things to consider when thinking about it.

Historical data and competitor benchmarking

For Evelyn, historical data is key to any kind of benchmarking a brand undertakes.

“Historical data is the best way to track shifts in behavior and assumptions. And whether you’re comparing yourself to your competitors, or whether you’re comparing yourself from now to some time in the past, or both, benchmarking is a big advantage. Being able to say Brand A was owning this space once upon a time and now they’ve shifted, that inspires curiosity. Why are they shifting? Why have perceptions changed? What have they done to make that happen?”

Evelyn also talks about the importance of looking to brands that aren’t necessarily direct competitors but that have achieved things your brand is aiming for.

“Something we’ve done with clients before is to look at aspirational brands. If you want to make a change, instead of looking at competitors let’s look at those who have done what you want to do successfully. Let’s look back in time and see what can we replicate to our advantage,” she says.

With Brandwatch Consumer Research, you can track public conversations about your brand, competitors, and landscape all the way back to 2010.

Benchmarking and visualization

Benchmarking is such a common use case for Brandwatch customers that we created visualizations specifically for the job.

For example, however you want to break the data down, you can see how it’s changed over time.

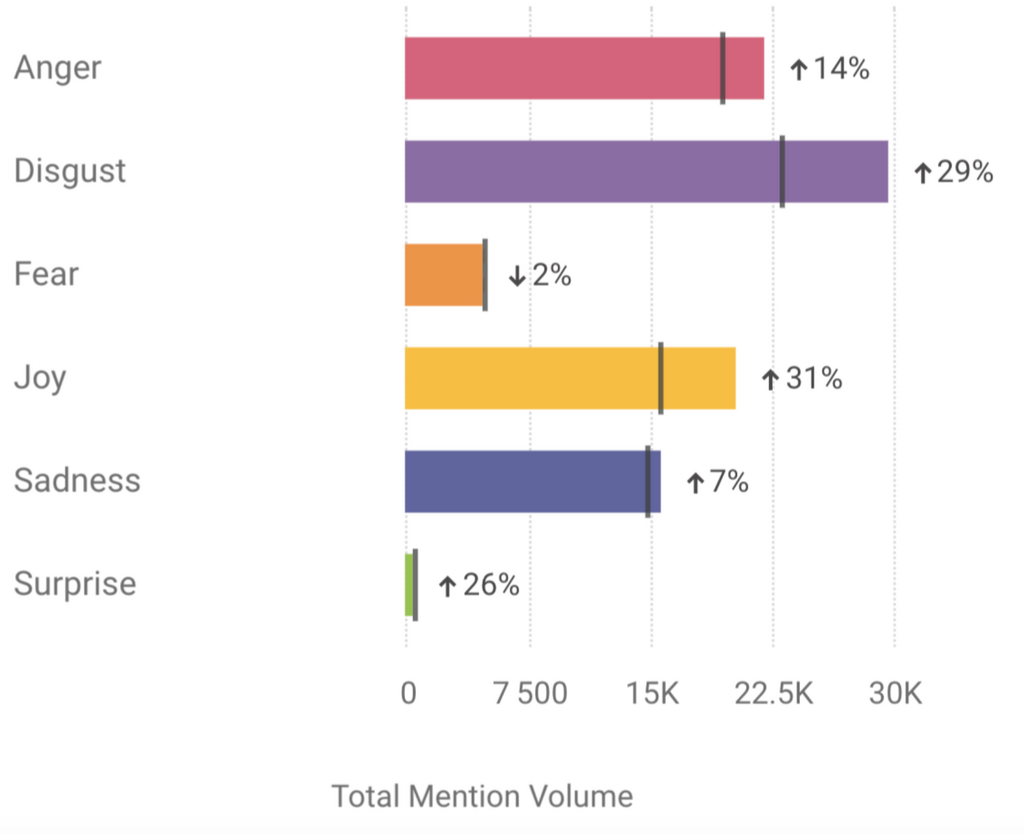

You could see how consumer emotion around one of your products has changed from one month to another.

You could also look at how much conversation your brand has generated about a particular topic compared to a key competitor over a month.

Whatever you want to measure, from your own products to your competitors’ brands, you can visualize it easily with Consumer Research’s benchmarking component.

How to analyze competing product reviews

Brandwatch Reviews allows customers to analyze product reviews, either for products belonging to the brand or to competitors.

Here’s a simple example of how it works.

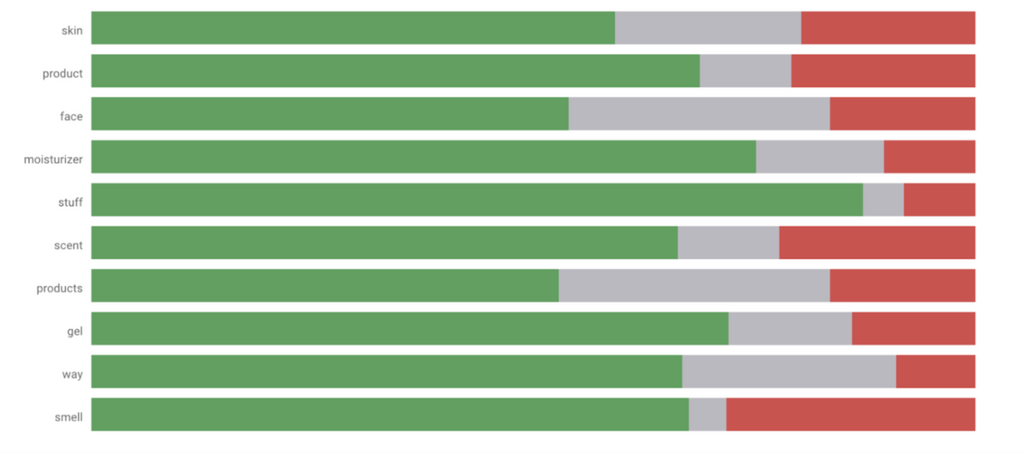

We looked at reviews around two popular moisturizer brands. One gets better reviews than the other, which means people are more likely to buy it.

One of the key reasons people love the better-rated moisturizer is the smell.

For the worst-rated moisturizer, smell is actually one of the worst rated aspects. Users claim it is “perfumey” and leads to rashes and reactions.

Improving the scent to be less potent will help the worse-rated brand’s moisturizer improve against competing products.

With Brandwatch Reviews you can single out specific product characteristics and compare them like-for-like with the competition to see how you stack up.