GUIDE

The Predictive Trend Spotting Guide

How do you know when a crisis is about to kick off? Or how much demand there will be for your new product? Our guide to predictive trend spotting can help you answer these questions and more

We recently reached out to our customers to find out what topics they were really interested in hearing about. The resounding answer was trend spotting, so we rolled up our sleeves and got writing.

Trend spotting is, essentially, predicting the future. It’s a tough job, but using online data we can gather all sorts of information that can indicate what might happen next.

In this guide, we’ll show you how to keep track of some of those indicators, from predicting a rise in demand for a product to identifying the key groups with the power to start big shifts in your industry, with plenty of real life examples.

Want to know the answers to the following?

- How much demand will there be for our product?

- Where do trends that affect my industry actually start?

- How do I know when a crisis is about to start?

- When do tech trends go from buzzwords to game changers?

- What’s the role of influencers in generating trends?

Then read on.

How much demand will there be for our product?

Predicting how much demand there will be for a product is a difficult task, and getting it wrong can be an expensive mistake. No one wants a bunch of complaints that things are out of stock, and no one wants a whole lot of spare inventory sitting around doing nothing.

Here are a couple of ways we’ve seen savvy data experts use different sources to track demand for particular products.

Predicting demand from hype

Hype around video games can fluctuate all over the place, but we’ve seen two clients in the industry find success in predicting demand from monitoring online conversation.

This begins with thorough categorization of different products, so you can break down conversations around specific game titles or gaming accessories.

With that data in hand, by looking at positive sentiment and mentions that suggest an intent to purchase you can benchmark each game against other titles and see which are generating the most demand (both historically and in real time).

Using alternative data sources

Our friends at Pi Datametrics are specialists in search data, and they’ve noticed that all kinds of factors affect consumer behavior – especially when they’re shopping for clothes.

The company’s Organic Value Score combines visibility, popularity, and value (a golden combination for the best results from search), and can help map out the times that a particular search term delivers the most for the brands ranking for it.

They found that in the summer of 2017, the score for ‘Dresses and Jumpsuits’ (traditionally the most valuable category in womens’ wear) went through the roof in the UK.

Why was this the case? The team mapped the data against the temperature in the UK, and found that the searches were very much linked to how warm it was outside.

With weather forecasts available in advance, teams can prepare for an increase in demand for particular products by looking at previous patterns in temperature changes and spikes in searches, and preparing stock accordingly. If there’s a hot summer coming, it’s important to get those dresses and jumpsuits ready to ship.

In Pi’s weather and retail demand report, they write:

“It’s best to be aware of external weather factors to use them as both your shield and your weapon.”

When it isn’t possible to accurately predict the weather in advance, all is not lost. Aligning historical weather anomalies and search trend data can enable you to devise eventuality models, so that you’re better prepared for any similar demand anomalies in future.

Where do trends that affect my industry actually start?

Broad trend prediction is always a challenge, since so many things can affect what the next ‘big thing’ will be. Your approach should depend on your own industry and business, and the many factors that affect it. To get you thinking, here are some tips for looking at where trends start, both in physical and digital spaces.

Going beyond US data

While the largest populations of people online aren’t based in the US, many social listening products claiming to provide global coverage (Brandwatch included, for a long time before recently) drastically under-served other regions.

When we announced improvements to our AsiaPac social data coverage, Phill Agnew wrote about the benefits of looking beyond data from the US or Europe.

Communities that drive trends

Every industry has its own set of communities, and these communities are often broken down into a whole bunch of different subsections, based on interests, location, demographics or more.

Just think about marketing and the many groups, big and small, that make up the industry. To name a few, you’ve got:

- Marketers in specific fields (like content or influencer marketing)

- Marketers in specific kinds of industries (like fast food or automotive),

- Marketers in different locations (like marketers in Brighton, England),

- Marketers from particular demographics (like “women in content marketing”

- Marketers with specific job titles (like CMOs)

It goes on and on.

With so many different communities that make up a broader group of people, identifying which ones are most influential in driving trends can be a real challenge. Numbers alone can help (e.g. measuring the share of voice of each group within conversations around your topic of interest, or the number of subscribers or followers each group has), but to truly get a feel for these communities it helps to get involved on a more personal level.

How do I know when a crisis is about to start?

The big brand crises of today often have small beginnings. A single tweet could be the cause of a mega crisis that defines a company’s whole year.

Let’s see how it can work:

How a small spark can lead to a big fire

April 10 2017 was a fateful day for the airline industry. What we now call ‘the United incident’ is a brand crisis that’ll be used as an example for years to come.

The crisis started with a series of tweets and Facebook posts from several passengers about the treatment of Kentucky Doctor David Dao while on United Express Flight 3411. Many of the posts included videos shot on mobile phones, which showed Dr Dao being violently removed from his seat and dragged from the plane.

The first tweets about the incident starting appearing online between 7-8PM EST on Sunday, April 9.

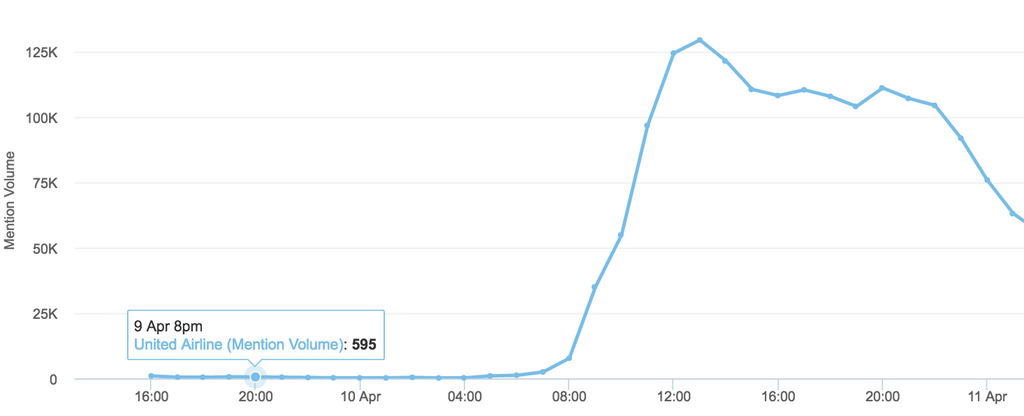

The following chart plots the volume of tweets about United during the first 48 hours. As you can see, there wasn’t any initial spike in conversation in the immediate hours following the incident.

In just a few hours United would go from under 1,000 mentions an hour to nearly a quarter of a million mentions between 12-1 pm EST. The brand was on the front page of Reddit. The response to the growing crisis came too late, and didn’t do much to quell the growing negativity.

What went wrong? We can only speculate, but the example shows the need for user defined sentiment analysis. Automatic alerts for mention volume jumps wouldn’t have alerted the brand until way too late. But if key stakeholders were immediately alerted to reports of violence or overbooking, crisis protocols could have been set in motion almost immediately after those first tweets were posted.

As Kristian Bannister wrote in his summary of the incident:

“Using Brandwatch Analytics, United would have been able to create a rule that ensured every incoming mention containing ‘overbook’, ‘overbooked’ or ‘overbooking’ was automatically categorized as negative. This user-defined approach to sentiment analysis might well have helped trigger an alert that would have notified United the second the story started to take hold.”

Identifying a crisis

A crisis can be hard to catch, but buying time between it being a small fire and a raging blaze can help a brand to address the problem and put things right fast.

As we’ve seen above, having the correct set up is what’s important for being alerted to a crisis that’s only just taking off. These early indicators, like custom alerts from social media, can tell a brand that something is out of the ordinary and that action may be required a long time before an issue becomes a full blown crisis.

The kind of set up needed depends on the brand and industry – as Kristian said, an alert set up for “overbooking”, “overbooked”, or “overbook” could have alerted the airline company to the problems on social much earlier.

If you’d like an example of this kind of tracking done right, check this out:

When do tech trends go from buzzwords to game changers?

There is a litany of tech buzzwords, and they can be overwhelming. We are constantly inundated with a stream of new words that hint at exciting technologies, but while some are straightforward, some are jargony, and others are downright confusing.

Of these buzzwords, some are fleeting, with not much lasting power. Others enjoy a life beyond a mere buzzword, proving their value to create meaningful change. What makes some buzzwords stick and others fade? When does a buzzword go from a passing trend to a ubiquitous foundation in tech?

Example: Artificial intelligence

Artificial intelligence gives us an idea of how the evolution of a buzzword into a game changer looks. Today, AI is in virtually everything. Once a sparkling new buzzword that generated plenty of hype, it is now a tech mainstay. Brands big and small have incorporated AI into their products. It is in everything, from Amazon’s recommendation engine to mobile banking apps’ bill pay reminders. How did AI come to be?

People really started talking about AI in 2015. The conversation kept rising until it reached a peak in January 2018. Then, the conversation started dwindling. But the fact that people are not discussing AI at volumes of January 2018 doesn’t mean it has faded into obscurity. In fact, it’s the opposite.

The conversation is no longer so much about exciting tech of the future. Now, people are using terms for products and features that are powered by AI and already exist, like home assistants. Amazon Echo, for example, is powered by AI. Another example is Spotify – recommended artists and playlists are generated from AI.

AI has reached an inflection point where it is so seamlessly integrated into our lives that the ‘buzzword’ is no longer skyrocketing. Instead, we’ve acknowledged AI’s presence in so much of our lives that the conversation has settled into day-to-day chatter.

As Uber’s Director of Product Jairam Ranganathan said at AI conference VB Transform: “We don’t even think about it [AI] anymore… It’s kinda like not thinking about computers.”

When do tech trends go from buzzwords to game changers? It’s when the conversation around it dips from the peak of excitement, but doesn’t fade into the abyss.

What’s the role of influencers in generating trends?

Influencers are famed for their ability to change people’s opinions and behaviors, but can they drive large scale trends?

Example: Food trends on Instagram

The food world is full of influencers who post dreamy shots of delectable doughnuts, chic cheeses, healthier versions of beloved foods, controversial avocado toast, and more.

By sharing content about foods and partnering with the hottest restaurants, cafés, and dessert shops, influencers are enticing their followers and elevating the trend. They do so by influencing followers to try out new foods and share photos of their food experiences to their own followers.

Here are some of those trendy food types, and how they’ve rocketed in popularity within the popular #foodporn conversation on Instagram.

How have influencers pushed this conversation forward?

Take matcha fan and influencer @kaleandkardigans, who’s posing with a glass of iced matcha from Crazy Cups. With more people expressing interest in healthy foods, matcha (which has antioxidant properties) is a prime candidate to rocket up the trend list, and @kaleandkardigans is helping it along.

@Kaleandkardigans touts matcha’s benefits and its timeliness (perfect for the summer). They also incorporate a call to action, beckoning followers to search for Crazy Cups matcha on Amazon. In this case, influencers and brands are collaborating to take advantage of a trend, and to push that trend forward.

Here’s an example of another influencer pushing a new trend – increasingly popular beverage choice hard seltzer.

Hard seltzer brand White Claw is in the spotlight right now, and other brands in the industry are looking for a slice of the attention. With the help of influencers and popular hashtags, brands in the field can start to build out trends within the competitive Instagram landscape.

Predicting trends on platforms like Instagram, especially when consumer taste changes so quickly, is difficult. But keeping an eye on the products key influencers are touting is one way to get an idea. After all, Instagram is a place to discover trends and those with the most followers can be experts in getting them started.

All that said, don’t take your eye off the general conversation coming from those who don’t have thousands of followers – trends can grow from the most unexpected of places, as we discovered above.