Report

The Best Brands and Industries for Customer Experience 2020

We analyzed over 200 million online conversations and surveyed thousands of people worldwide to find out which brands and industries offer best-in-class customer experiences

You wouldn’t rush into a second date if your first meet up was chock full of terrible experiences. In fact, you might even lose their number.

This same logic applies to customer experience.

The major difference? When your customer has one bad encounter, there are hundreds of other suitors (competitors) already lined up at the door waiting for their shot.

The modern consumer doesn’t reward passable experiences – they want to be dazzled every time they interact with a brand. When it comes down to it, we’re all in the business of wooing our customers with a stellar experience, and in this report we’re going to be delving into the data around that.

We’ll be covering:

- Which industries are generating the most positive customer experiences?

- What are customer expectations around specific industries?

- What do we know about customer expectations across industries?

- Which brands are generating the most positive customer experiences?

- What can we learn from the top brands in the rankings?

(As well as summarizing the key takeaways we can draw from our CX research).

Note: You may be familiar with previous reports on CX we have produced. Please note we have not used the same methodology – it is not advised to compare brand performance in this report vs the previous one.

Industry analysis

Which industries generate the most positive customer experiences?

Industries with leisure products, like hotels, fashion, alcohol, and TV tend to be discussed far more positively than industries like pharma, healthcare, and energy.

This isn’t too much of a surprise. Especially when you consider how high-stakes the latter categories are. When something goes wrong in healthcare, pharmaceuticals or energy, the consequences are much more critical. At the same token, people expect things to go right in these sectors. So when they do, there is not much public praise.

What are customer expectations around specific industries?

Our idea of what’s acceptable tends to shift depending on what industry we’re talking about, and who we are.

We surveyed 9,000 people across 9 countries to better understand expectations across certain industries. Here are the standout stats:

Household goods

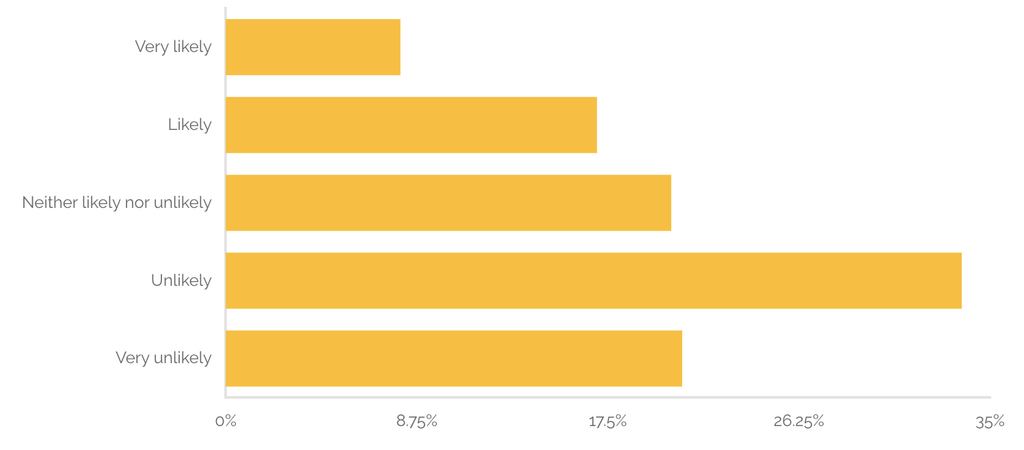

Compared to the other industries we studied in our survey, global consumers were most unforgiving when it came to the household goods industry – 55% said that after a bad experience they were either unlikely or very unlikely to give a brand a second chance.

When things do go wrong, consumers are most likely to go to a physical store or to call – they want to speak to someone directly. Consumers are also more likely to use an online form to complain about brands in the household goods industry than those in the other industries we studied.

To find out how to improve customer experience, CPG brands can take the unstructured data from online forms, call logs, and social media mentions they receive to identify the most common complaints. With the right tool, they can do it in real time and fix problems before more consumers turn away.

Beauty

The beauty industry is just behind household goods when it comes to unforgiving consumer reactions to issues, with 51.3% of our beauty customer respondents saying they would be either unlikely or very unlikely to buy from a brand again if there was a problem.

And women are far less likely than men to give beauty brands a second chance – 54% said they were either unlikely or highly unlikely to do so after a bad experience.

Applied to a trending topic like veganism, our above findings could spell trouble for beauty brands that have slacked on creating quality vegan products.

Brandwatch Project Manager Camille Gerbaud has been studying vegan trends in the cosmetics industry, finding a vocal online community discussing the pros and cons of vegan beauty products:

"The vegan cosmetics market has matured. People aren't satisfied just to have a vegan mascara – they want a vegan mascara from their favorite brand that delivers on volume, length, and durability. It's not enough for brands to release cruelty free items that don't live up to the standard of quality in the rest of their product lines."

If brands are to release cruelty-free products, especially in the beauty industry, they’d better make sure they’re up to scratch. If not, consumers may not come back even when improvements are made.

Media & entertainment

Of all the industries we studied, media and entertainment brands are most likely to get messages on social media (publicly or privately) when consumers aren’t happy about something.

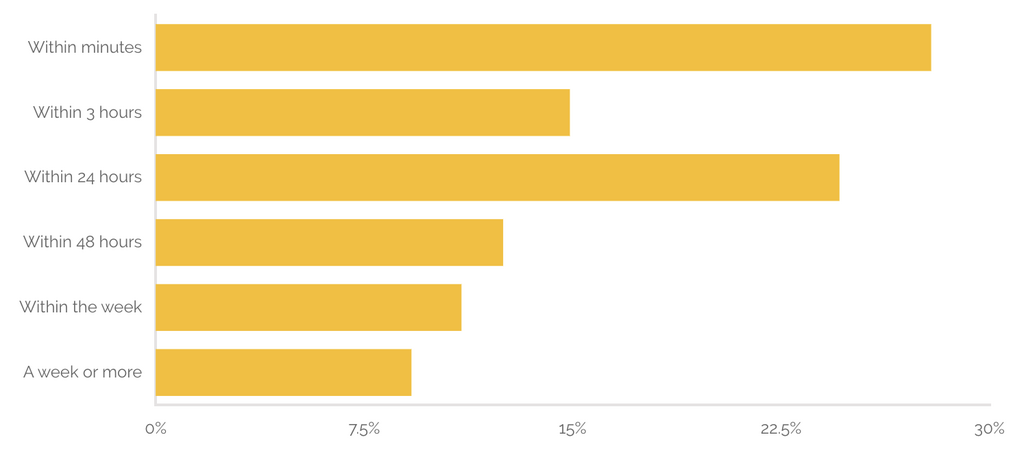

And those that said they’d reach out via social media to a media or entertainment brand were most likely to say they expect a reply within minutes (when compared to other ways of reaching out to media/entertainment companies).

Looking at the gender split for how people interact with media and entertainment brands when there’s an issue, we found that men were more likely to go to these brands in public (either in person in a store, or publicly on social media), while women were more likely to call or email.

Consumer technology

When it comes to problems with our tech, our survey suggests that consumers are very anxious to get answers fast – of all the industries we studied, consumers were most likely to expect an answer within minutes if they reported a problem.

That said, when it comes to who’s complaining, it can depend on demographics – women were twice as likely to say they wouldn’t interact with a consumer tech brand if there was a problem than men were.

This is a good time to point out that if brands are experiencing a fall in custom, they should look both to what is being said to them and what’s not being said to them. If consumers are dropping off without leaving feedback, further investigation is needed into potential feedback channels that aren’t currently being monitored, and new ways to find out what customers are dissatisfied with.

What do we know about customer expectations across industries?

Looking at consumer expectations in our survey of consumer tech, beauty, entertainment, and CPG customers, we spotted a few trends across all the industries studied.

For example:

- 18-34-year-olds are less likely to go into a physical store when something goes wrong than those aged 35+

- Women are more likely to contact brands via email when something goes wrong than men

- Those that said their first port of call was on social media (publicly or privately) when something went wrong were most likely to expect an answer within minutes

- Regardless of the way the consumer would ideally like to get in touch with a company when things go wrong, most said they wanted a response within 24 hours

Brand analysis

Which brands are creating the most positive customer experiences?

When we drill down a bit deeper using social data, there are some real standouts in terms of customer experience.

Here are the top 10 brands for customer experience according to social media. We ranked over 600 brands based on the positive mentions they’re getting that include personal pronouns like “I” or “I’m”. Brands here had to have a high percentage of positive mentions compared to the rest and to have at least 100k positive mentions.

The top brands for CX 2020

| Rank | Brand |

|---|---|

| 1 | Etsy |

| 2 | MTV |

| 3 | Sephora |

| 4 | Four Seasons Hotels |

| 5 | Dior |

| 6 | GameStop |

| 7 | Kia |

| 8 | Wendy's |

| 9 | Chanel |

| 10 | Dove |

Let’s zoom in on those frontrunners:

1) Etsy

Etsy claims the top spot for CX, with the most positive set of mentions out of the 600 brands we studied.

Looking within those conversations, we found that Christmas played a huge part, with people sharing the gifts they were buying and receiving.

Some of the biggest discussion points were around custom pieces and descriptors like “beautiful”, and lots of people were tagging Etsy in positive Instagram posts about creations and things they’d bought.

Baby-related items were also a bit topic, which makes sense – parenting, books, and fine arts were the top interests for authors talking positively about the brand.

Women were more likely than men to be sharing their positive Etsy experiences (65% of gender-categorized authors in the conversation were women).

Arguably, you could say that the positivity around Etsy is more down to creators on the platform than the platform itself. But, by bringing this community together on one site, Etsy has built a trusted place where people can access custom products that they love.

2) MTV

MTV also got a lot of positive mentions (over 500k).

We saw mentions spike when good songs are featured on the channel, and up and coming bands/artists are very vocal when their music is played.

Notably, a lot of the positive mentions across social around MTV were nostalgic. Looking back on the old days of MTV seems to tug at everyone’s heartstrings.

This definitely bodes well for the entertainment giant as they are planning on reviving Daria and have been whispering about bringing back other classics like MADE and Real World since 2018.

Revivals are a common trend for the entertainment industry, with rumors around a Friends revival spreading and with the popularity of the recent Gilmore Girls reboot.

Generally speaking, people don’t speak directly to MTV when they have issues because cable providers are responsible for general functionality. However, when it does come to negative sentiment being shared around the brand it tends to be about the quality of current shows.

3) Sephora

Sephora has managed to cultivate an extremely loyal following since it opened in the 1970s, and the hard work has paid off.

Online mentions are full of brand advocates showing off their purchases, talking about their typical spend and showing off their makeup skills in useful tutorials using Sephora products.

Recently, Sephora has also been praised for a new in-store shopping tactic. Users can pick a red shopping bag if they want to be approached for assistance or a black bag if they want to shop alone.

Somewhat unsurprisingly, the conversation was generated predominantly by females (76% of gender-categorized authors).

The negative mentions that did come up in our research mainly centered around the high price tags on some items.

Other comments are from (or about) men who seem to be very confused about the store in general – which is arguably more humorous than harmful.

Overall, this beauty brand has done a commendable job of building a loyal fan base that genuinely loves their products. While price can be a pain point, we know that most people are willing to spend the money when the quality is right.

Summary

What can we learn from all these CX trends?

1) Consumer expectations aren’t uniform

As we can see from the social and survey data above, consumer expectations differ across industries as well as across different groups.

For example, younger consumers tend not to go into physical stores to complain as much as those over 35. And in some industries, men and women have differing opinions on whether brands should get second chances.

These are differences that businesses should take note of when it comes to catering to the needs of different audiences.

2) Community is key

Looking at our best brands for customer experience, those that get the most positivity tend to have built out a large community with deep ties to the brands.

Etsy has created a fantastic community of passionate creators and fans of custom, handmade items. Meanwhile, MTV’s fans have remained loyal for a long time and speak of the brand like an old friend.

These long-standing (sometimes emotional) ties can be good for building a strong network of brand advocates.

3) Don’t leave gaps

To ensure you’re creating the best customer experiences, it’s important to understand how consumers feel about your industry and to ensure that all possible sources of feedback are covered.

Whether that involves analyzing previously archived call logs to find the most common complaints, opening new avenues through which consumers can get in contact, or benchmarking your brand against others in the industry to find shortfalls and opportunities to improve, there is plenty to do to make sure your brand’s CX is on point.

Methodology

Industry and brand sentiment analysis was done by monitoring social conversations about around 600+ brands from July-December 2019, using Brandwatch Consumer Research.

Survey analysis was done using Brandwatch Qriously. We surveyed 9,000 people across 9 countries in January 2020.