REPORT

Consumer Trends for 2023

Discover the latest trends in health and wellness, the cost of living crisis, consumer shopping behavior, and much more.

Book a meetingWhat are the latest consumer trends for 2023?

Consumer trends are undeniably changing during a looming cost of living crisis in a post-pandemic world. We used social data from Brandwatch Consumer Research and several other digital data sources, to discover how brands can navigate a changing consumer landscape.

In this report, you’ll learn about:

Trends in finance, for example:

- The impact of the cost of living crisis

- Consumer attitudes towards buy now, pay later

Trends in consumer tech, such as:

- Concerns about consumer privacy

- How users are utilizing social media as a news source

Trends in sustainability, like:

- How consumers are finding it harder to prioritize

- Which industries are struggling to keep up with consumer demand for ethical practice

Trends in representation and inclusivity, including:

- How inclusivity impacts brand loyalty

- Implementing better representation strategies

Trends in consumer work-life, like:

- The value of a work-life balance

- The rise of the four-day workweek

Trends in health and wellness, including:

- Consumer concerns about mental health

- New methods to treat anxiety

The financial landscape is changing

From the cost of living crisis to changes in shopping behaviors, the post-pandemic era has dramatically changed the financial landscape.

Let’s find out how.

The cost of living crisis

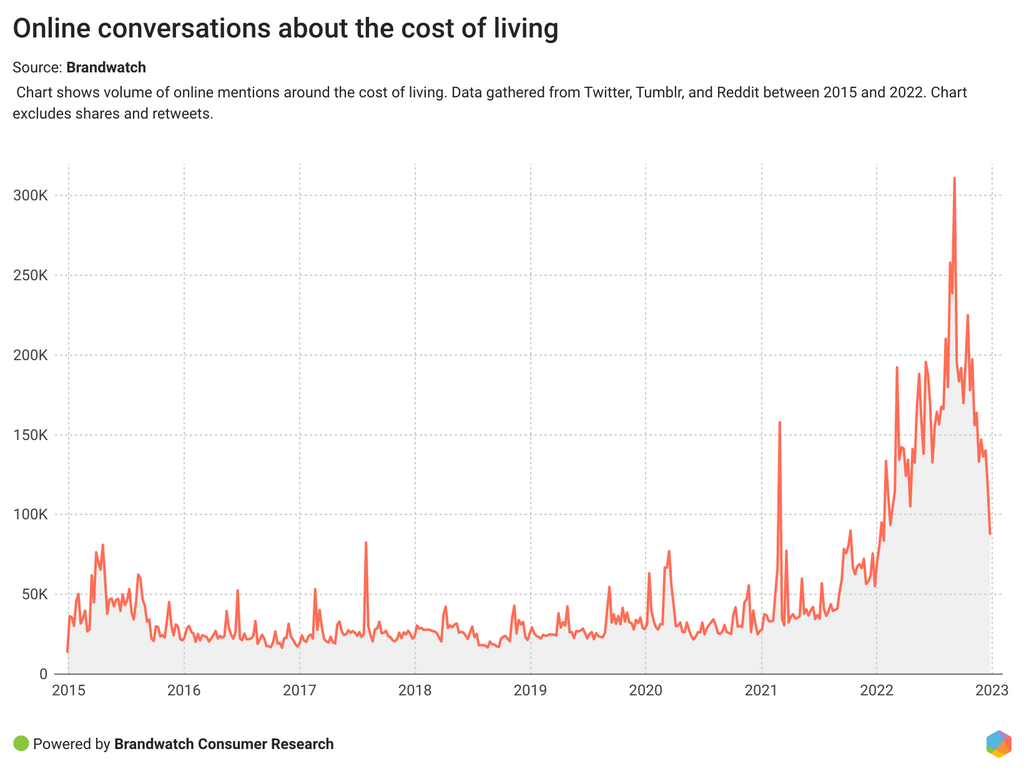

It was a stormy year in 2022 for consumer finances. An international cost of living crisis caused prices to skyrocket, and consumers had to adjust their spending habits to deal with a rise in the cost of living. Online conversations on the topic exploded in 2022, with millions of individuals taking to the internet to express their concerns, difficulties, and apprehension.

According to Google Trends, search interest in the cost of living reached a 5-year high at the end of September 2022. And according to Brandwatch Consumer Research, there was a 97% increase in conversations about the cost of living compared to the previous year.

Needless to say, the cost of living crisis was one of the most discussed topics in online conversations in 2022. But what about 2023?

Online conversations about the cost of living have declined towards the end of 2022, but that doesn’t mean the conversation isn’t relevant. It looks like consumers have accepted a looming recession and are dealing with it in their own ways in their day-to-day lives. Rather than taking to social media to express concerns, they’re adjusting their spending habits to account for rising prices.

The cost of living crisis will continue to play a major role in consumers' purchasing decisions in 2023. Our research found that the main topics heading up these conversations include rent, salary, expenses, and increased gas prices. Food is also a noticeable topic of conversation, with consumers discussing rising food prices at grocery stores and restaurants.

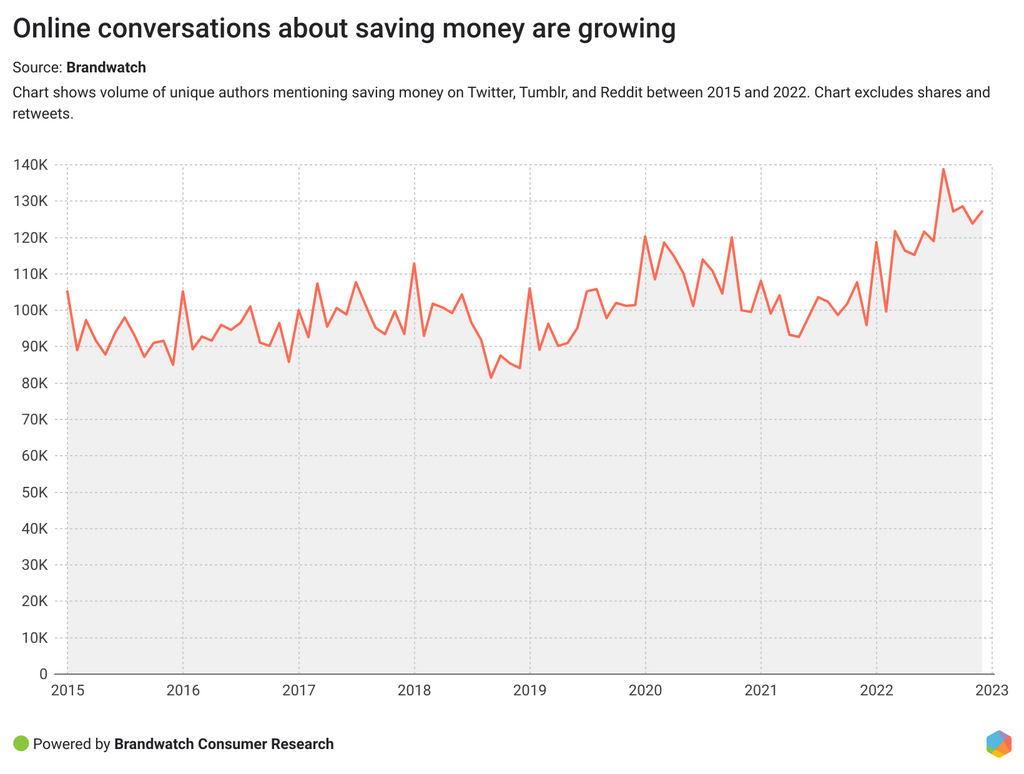

To counteract inflation, consumers are looking for ways to save money. Online conversations saw a 12% increase in those discussing saving money in 2022 compared to 2021, and the conversations aren't slowing down.

Where are consumers trying to save money?

Breaking down the money-saving conversation by sector, consumers most often mention food, cars, technology products, and travel. People are keen to find the best deals or discounts, and many opt to make their own food instead of eating out. Some buy off-brand products more often, and others look for the best tips on avoiding food waste.

I'm not emptying my grey bin as much anymore. It is because when it comes to food, I'm either recycling it, eating it or composting it. Brilliant, another way I'm saving money. I'm a vegan. Vegan food can be very expensive! Saving on waste helps though 😃

— Sarah D epilepsy warrior (@prinsorc) October 24, 2022

The cost of living crisis will continue to be a concern for consumers in 2023, influencing shopping behavior – and, thus, how brands approach internal strategies. Brands can target price-sensitive consumers with special offers, especially related to the food industry. Consumers actively look for deals and discounts to buy their favorite products without overspending, so offering cheaper alternatives will appease consumer concerns.

Changes to ‘buy now, pay later’ cause consumer worries

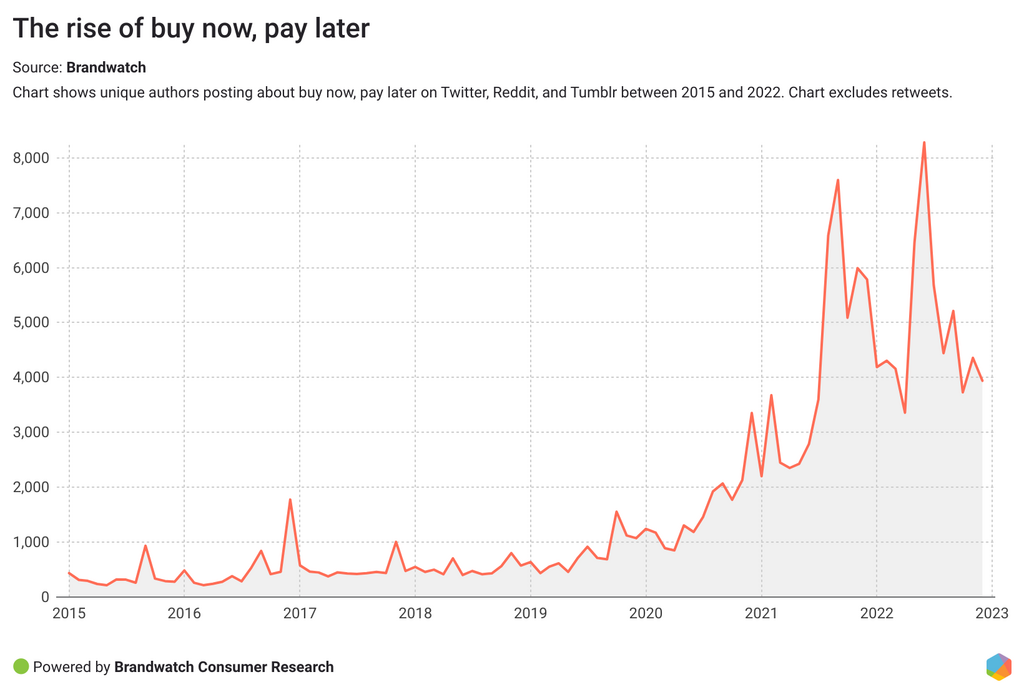

Buy now, pay later (or BNPL) offers consumers the opportunity to purchase goods on credit and pay for them at a later date. Between 2019 and 2021, the value of BNPL loans that originated in the United States grew more than 1,000%, from $2 billion to $24.2 billion.

More and more customers are using this up-and-coming method of purchasing to buy products they otherwise might have to go without. And in the cost of living crisis, it’s become a necessary form of payment for some consumers.

The online conversation about BNPL has skyrocketed alongside this value increase. 2022 saw the biggest spike in this conversation, with even the lowest mentions numbers remaining higher than any peak in the conversation before 2021.

Alongside this, the risks that come with buy now, pay later are also gaining traction. People are concerned about the repercussions of delaying payments and the impact increased reliance might have on vulnerable people.

YOU SHOULD NOT BE FINANCING A PIZZA OR A PAIR OF JEANS!!!!!! https://t.co/uw7elKSGj3

— Fetterman/Cortez 2024 (@Glutton4Pnshmnt) September 15, 2022

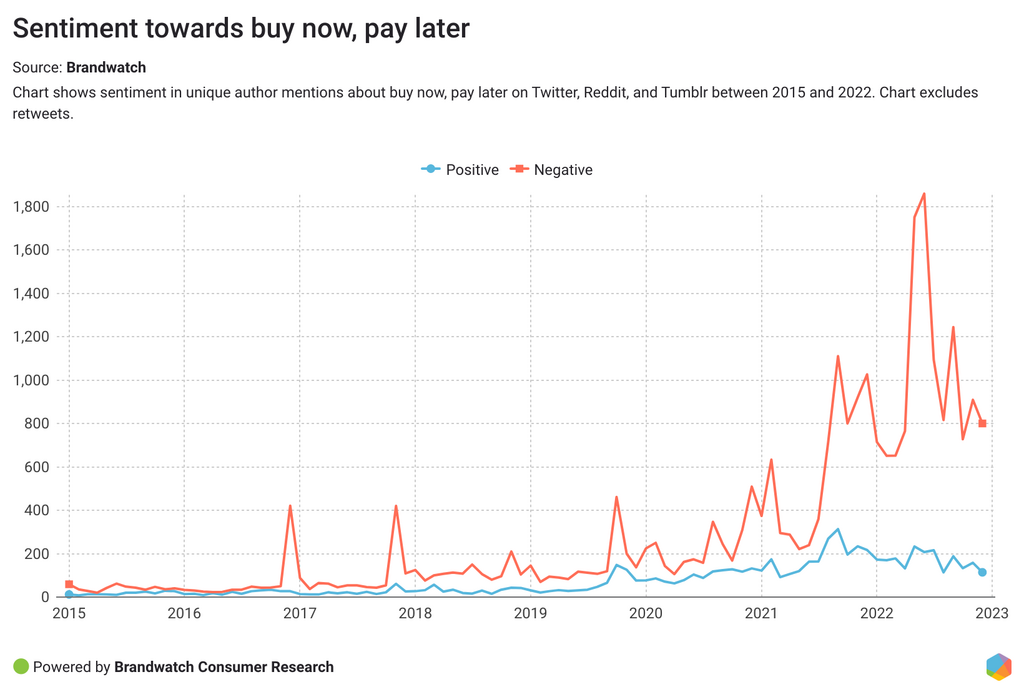

BNPL’s popularity growth has resulted in a slew of negative sentiment in online conversations. In June 2022, negative sentiments towards buy now, pay later schemes were at their highest.

The conversation spiked due to a number of factors, including the UK government announcing they were planning to regulate BNPL in 2023. Many were frustrated with this delay, taking to social media to encourage regulations to be introduced sooner.

The Treasury is today announcing plans to regulate buy now, pay later (BNPL) products after a consultation, yet that won't be brought forward to mid-2023, and not in place until likely 2024.

— Martin Lewis (@MartinSLewis) June 20, 2022

That is painfully, and far too, slow... My official statement... pic.twitter.com/pGizGVrjIz

With this in mind, brands utilizing the buy now, pay later methods might need to obey future regulations to better protect vulnerable consumers. This could hugely impact brands' relationships with their consumers in 2023. Equally, brands should be especially aware of how BNPL offers can impact susceptible consumers. Exploring alternative payment options, or offering critical advice on BNPL schemes, might be in the cards to keep ethics front-and-center.

Consumer changes in the tech space

Worldwide technology spending is projected to total $4.5 trillion in 2023. That’s a lot. Here are the latest trends in the tech space, so that you can make the most of consumer interest.

Consumers are more concerned about privacy

Sharing personal information is a standard part of the online experience. Whether inputting login details, accepting cookies to browse a website, or entering credit card information to make a purchase, we’re repeatedly asked to share our details. Yet, consumers are growing increasingly cautious of giving this information away.

In 2023, consumers are looking for more ways to protect their own data. According to Forrester, 89% of US adults use at least one privacy or security tool to help protect their data. And in a 2022 Ipsos survey, 50% of respondents say they feel their online security is adequate.

This growing concern is also reflected in search and social media data. According to Google Trends, search interest for "privacy" was at a five-year high at the end of October 2022 . Plus, online conversations about personal data and privacy were up 17% in 2022 compared to the previous year.

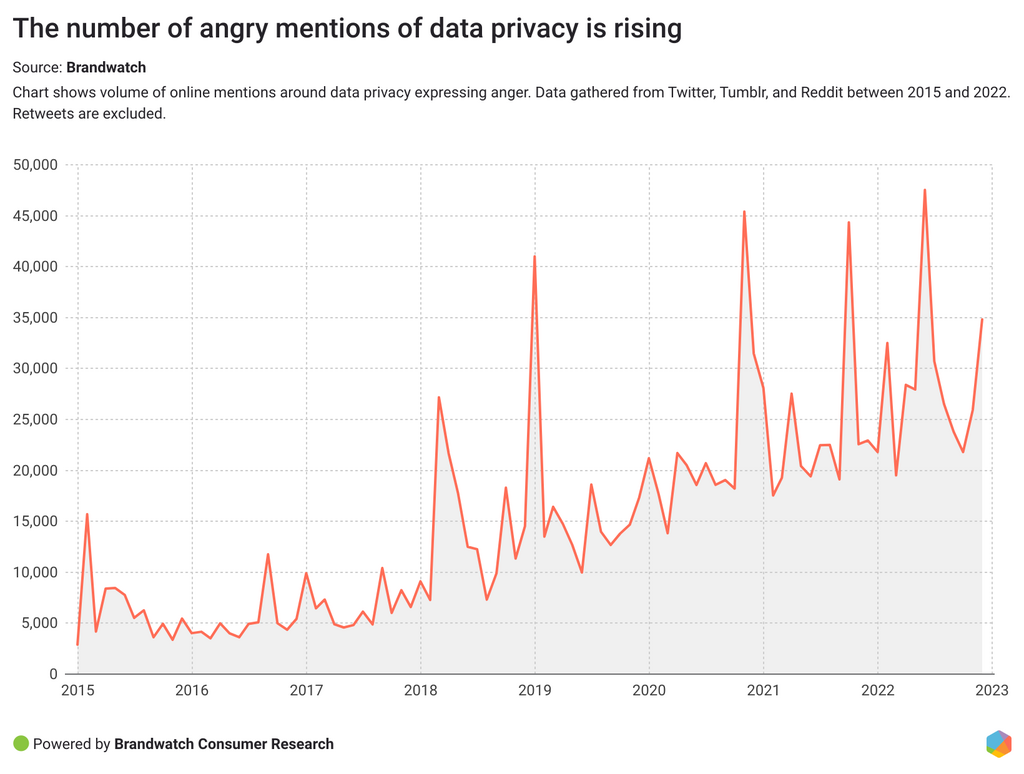

Using Brandwatch Consumer Research to explore sentiment, the conversations became increasingly negative in 2023 – hitting an all-time high. In fact, negative mentions increased by 33% in 2022 compared to 2021, with anger being the most expressed emotion.

Consumers worry about data leaks from their social media profiles and other online accounts and about companies selling their data to third parties. This distress leads to plenty of angry mentions when a data leak happens, and users ultimately lose trust in the associated companies. Data leaks or breaches are a significant concern for consumers. According to BuzzSumo, in 2022, over 22k articles were published about "data leaks" or "data breaches," receiving over 1.3 million engagements.

Another hot topic of discussion is password management. With more accounts comes more credentials, and consumers complain about not remembering their passwords, having problems with password resets, or even expressing frustration that they have to set up an account to access a site or use a service.

i hate logging into things. i hate emails and usernames and passwords. are you a robot? no im seething with rage let me access this shitty website

— phi (@phiguy_) October 6, 2022

Problems resetting passwords were one of the top issues in the angry mentions around passwords. Providing a smooth password reset process and excellent customer service is key to preventing this frustration.

Consumers are becoming more aware of how their personal information can be misused, and a data breach can lead to profound mistrust between consumers and companies involved in the violation. It’s hard for brands to regain that trust, so companies need to ensure that user information is as secure as possible.

Will there be a future without passwords? Will the stressful experience of proving you’re not a robot ever dissipate? Who knows. But having proper cybersecurity measures in place is vital for online brands.

Social media’s function is evolving

News consumption is changing. More and more people rely on social media to stay up-to-date on the news instead of following traditional news sources like TV or radio. Younger generations, in particular, are subject to this change. In a survey by Ofcom, 79% of 16-24-year-olds in the UK say they use social media as their primary source of news.

Social sites are not only used to find news, but also to find their next purchase. According to DataReportal, 75% of internet users use social media to research brands and products. Consumers are using social media to get inspiration on what to buy next, to get more information on relevant brands, or to buy directly through social media platforms.

“2023 represents an opportunity for marketers to recognize the effect social media has on buying choices and embrace social media as an even bigger part of the marketing mix. Growth opportunities continue to abound as most modern consumers carry their purchasing power in their pockets. And even when they’re not buying, they turn to social media for inspiration on their choices as consumers.”

Online conversations about social media usage reveal some interesting differences across platforms. Instagram, Pinterest, and TikTok have the highest percentage of mentions around shopping usage than on the other platforms. For news consumption, Twitter is relied on the most.

As with any shopping experience, consumers are eager to express themselves online about whether or not they had a positive experience.

I bought that Amazon pack of lip liners I saw on TikTok and they are amazing and black girl friendly 👍🏽 would buy again

— ukiyo ˘͈ᵕ˘͈ (@kkukiyo) January 11, 2023

Consumers praise products they are happy with and are often excited to share which social media platform they discovered the product on. However, they also complain if the product they wanted and saw on social media turned out to be disappointing in real life.

Have you ever bought a good product after seeing a YouTube review that usually has this line: "[insert name of company] reached out to me to review [insert product]"? I bought something recently and it was a pile of crap. Yay!

— Mr J in the UK (@mrjintheuk) September 21, 2022

Social media can be one of the first places consumers find a new product or learn more about a brand. Companies should ensure that consumers can easily find more information about their brand and products with relevant captions and links. But first, they need to get consumers' attention.

Looking for inspiration? Here are seven brand examples of engaging content on TikTok.

Consumers find sustainability harder to prioritize

Sustainable living has been growing in popularity for years, and it’s at the forefront of many consumers’ minds in 2023. With the ever-growing increase in climate change awareness, individuals are looking towards brands to make a difference. A 2022 survey by IBM found that 51% of consumers said that sustainability is more important to them than it was 12 months ago.

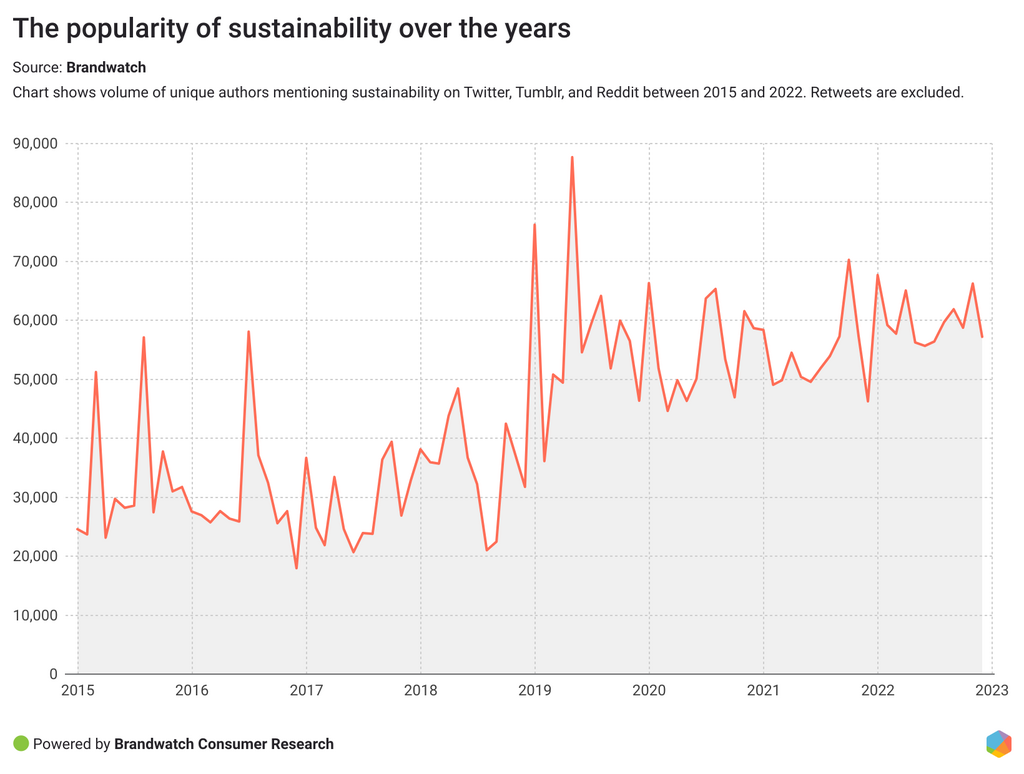

We looked at online conversations to see how the sustainability conversation is changing online. In 2022, there was a 12% increase in individuals discussing the topic compared to the previous year.

One of the most frequently mentioned topics in the sustainability conversation; the future. When looking at the sentiment, users are equally split on whether the future will look bright or whether it’s all doom and gloom.

In the positive conversations, consumers praise projects and initiatives they like from brands making a difference. Consumers who mention sustainability and the future in a negative way are concerned about the state of the climate in a few years’ time.

Money is also a big topic of conversation – for example, consumers discuss how they can't afford to live more sustainably, especially when it comes to food.

With the cost of living crisis raging, more people could face the problem of not being able to afford a sustainable lifestyle. In a Deloitte survey, 52% of UK consumers said it was too expensive to buy sustainable products.

Plus, according to a survey by GWI last year, consumers said they have less bandwidth to care about the environment. Financial challenges have made it harder for customers to prioritize sustainability, and this concern has boosted online mentions about the topic.

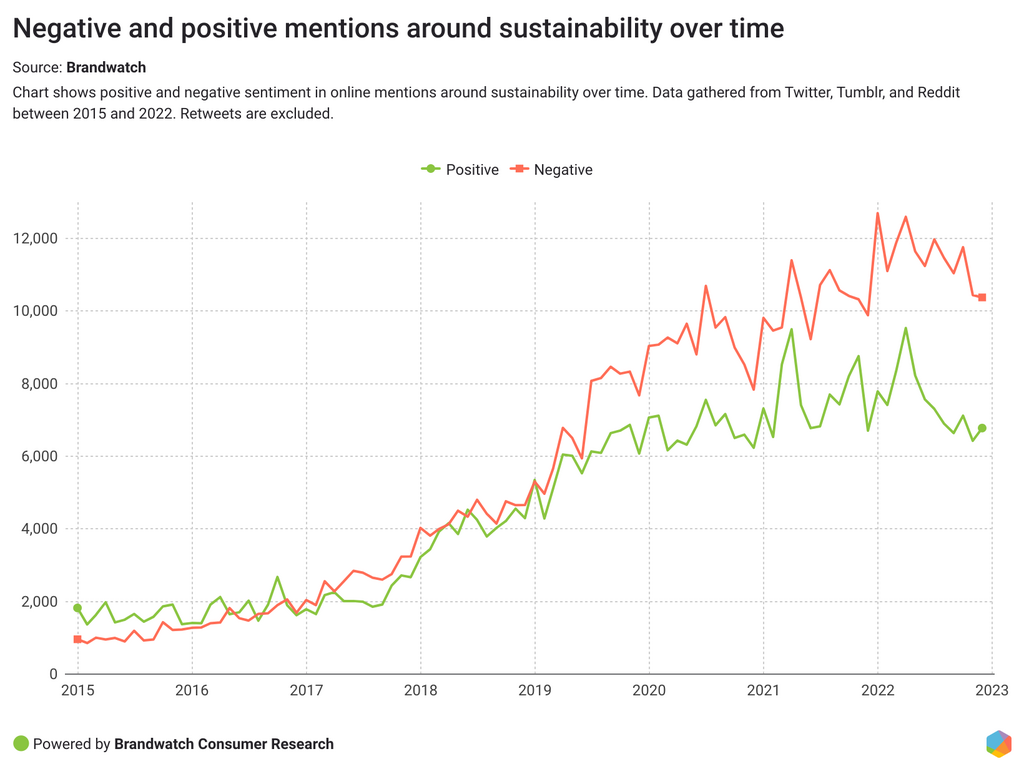

This trend can also be seen in how consumers talk about sustainability online. A breakdown of sustainability conversations into negative and positive sentiment shows that the gap between the two has widened over the years, with negative mentions increasing at a higher level than positive discussions.

Recently, money has become a greater topic of discussion in the sustainability conversation. Negative mentions of money and sustainability increased by nearly 150% from 2020 to 2022, compared to 2017 to 2019. People are frustrated with the climate crisis, and in 2023 they’re set to be even more frustrated about not being able to make as much personal impact.

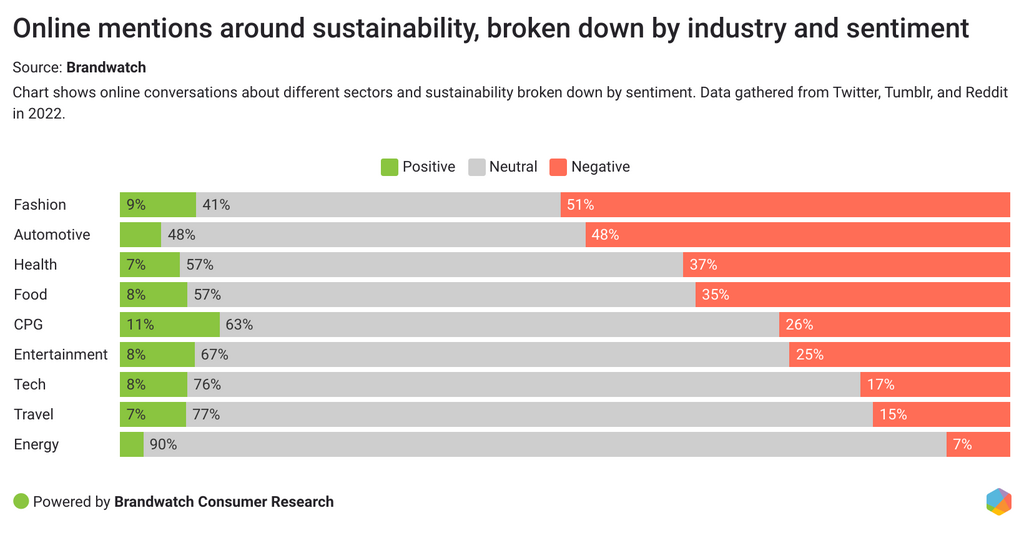

Looking towards the industries mentioned in the sustainability topic, food, fashion, and technology were the most discussed. Unsurprisingly, conversations mentioning energy increased massively due to the energy crisis. Now, let’s look at the sentiment toward each industry.

The fashion and automotive industries saw the highest percentage of negative mentions in 2022. The fashion industry is particularly criticized for its "fast fashion" culture and negative impact on the environment, which should be a key agenda point in fashion brands’ strategies in 2023.

On the other hand, CPG was the most positively mentioned industry. Consumers are quick to praise environmentally friendly products, such as shampoo bars, and share their wins on social media.

Consumers are looking for ways to be more sustainable in an affordable way. Enter: buying secondhand. This trend has been around for a while, but online mentions saw a 21% increase in 2022 compared to 2021.

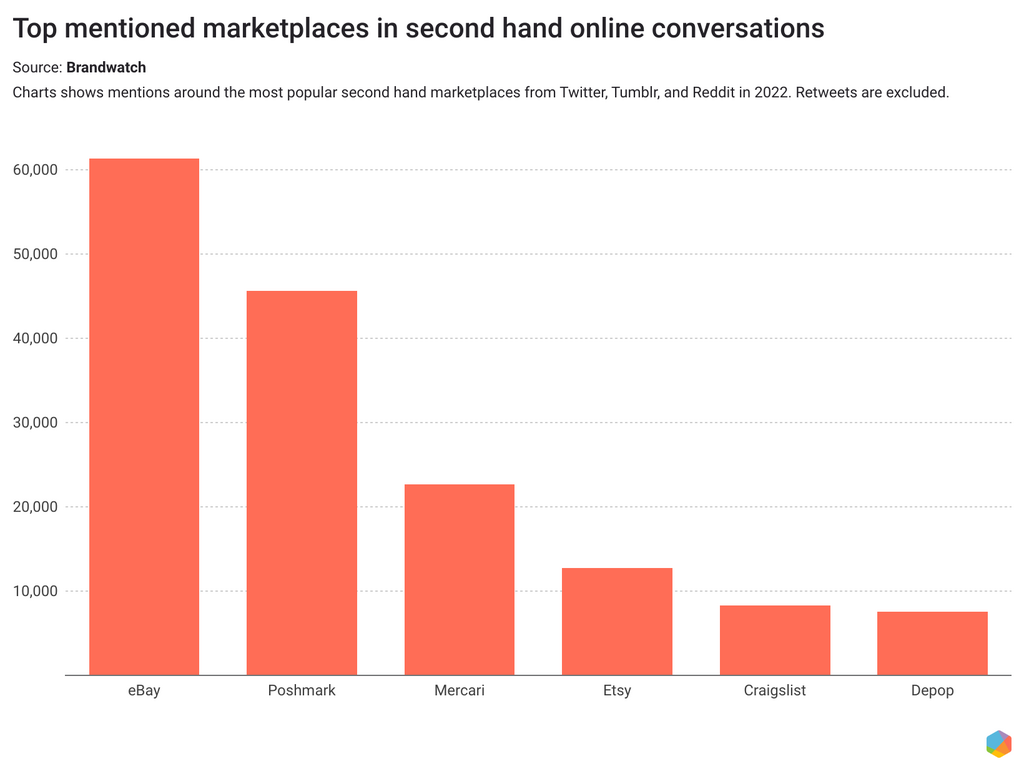

Where do consumers prefer to buy or sell used? A breakdown of online conversations in English by popular second hand marketplaces shows that eBay, Poshmark, and Mercari are the top platforms.

Books are the most mentioned product in second hand conversations, followed by clothing and electronics. Demand for apparel and technology increased in 2022, and online discussions showed a 23% increase compared to the previous year.

So, why do consumers like to buy pre-loved items? Well, who doesn’t love a good deal? People are quick to share their happiness online when they get a good deal. They’re glad to have saved money or found a rare and unique item. Essentially, thrift shopping is more exciting.

I love finding gems at second hand stores

— MELANINANDMELONS (@rronnilynn) December 28, 2022

Consumers face a dilemma in 2023: how can we make sustainable choices on a budget? According to a survey by Capgemini, 46% of consumers said they would choose sustainability over affordability. Brands should be aware that sustainability is still a high priority for many consumers, which can influence whether a consumer becomes loyal.

More than a third of UK adults said that brands with a transparent, socially, and environmentally responsible supply chain positively impact their trust in that brand. In 2023, companies need to consider their sustainability to appeal to the climate-conscious consumer.

Trends in inclusivity, diversity, and representation

Inclusivity has become an increasingly important driver of brand loyalty. So brands are taking action. Whether it's inclusive clothing, diversity in hiring, or making devices more accessible, companies are responding to customers' desire to be represented, not excluded.

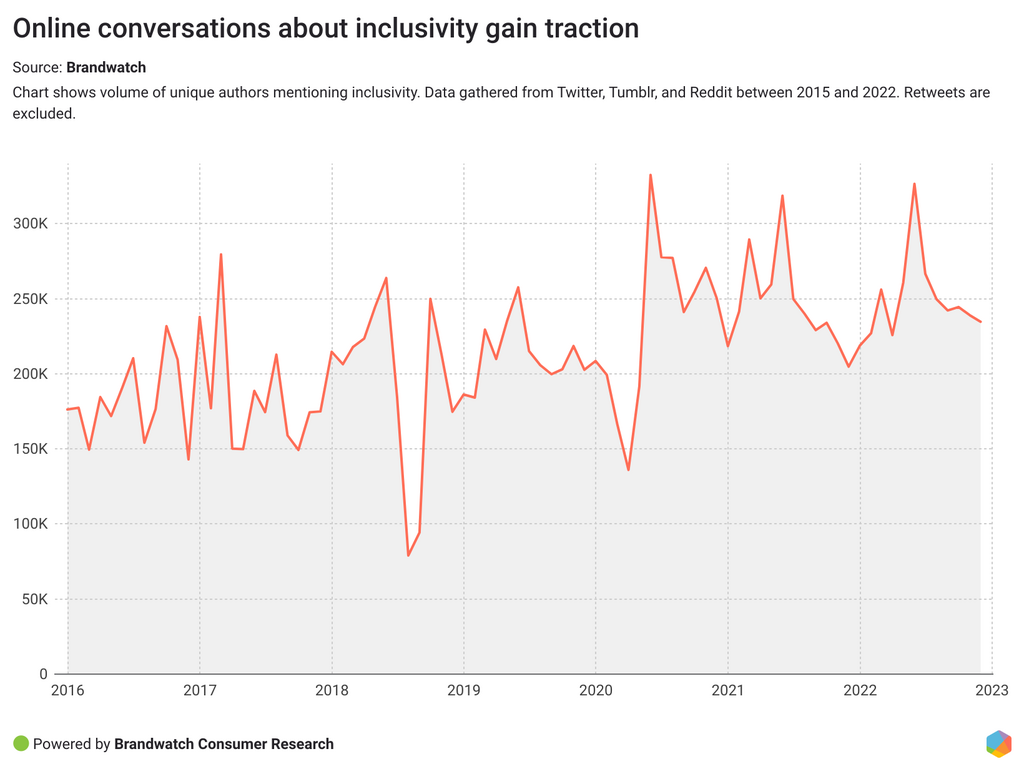

What will drive inclusivity in 2023? Looking at the data, it's safe to say that inclusivity is here to stay. It will continue to drive conversations in 2023 as consumers seek wider representation.

Inclusivity is an important issue, as it fights for the rights of minorities and oppressed groups. A look at the most frequently expressed emotions shows that the overall mood is positive. Joy is the top emotion with 38% of mentions categorized by emotion. So what drives these conversations?

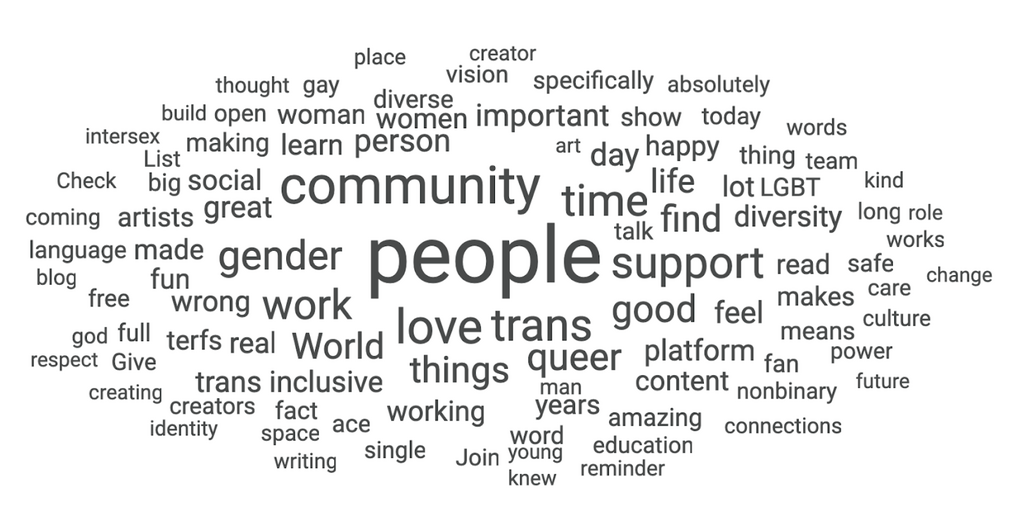

Social media users are primarily expressing their love and support for their community. They praise inspiring content and projects that raise awareness of inclusivity and diversity.

The queer community, trans rights, and gender roles are major topics in the online space. Work is also an important topic of conversation, as consumers are happy to share positive experiences with companies that prioritize diversity in the workplace.

When talking about companies, consumers are more vocal about certain industries than others. Consumers who mention inclusivity are most likely to talk about the fashion, technology, and entertainment industries. The high volume of discussion around fashion and inclusivity makes a lot of sense, as fashion is an important part of expressing your identity and personality.

In particular, Gen Z is more likely than older generations to consider gender-neutral fashion. 85% of Gen Z think about buying more gender-neutral clothing.

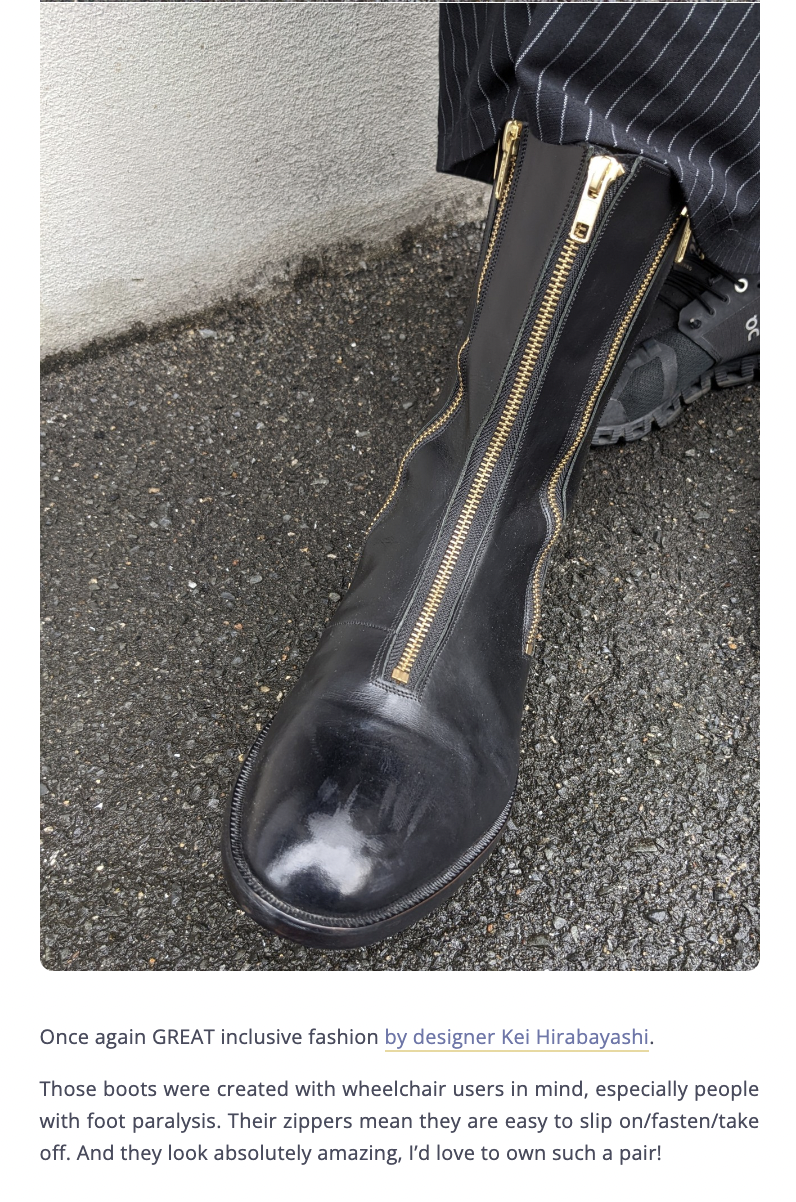

Brands that make clothing more accessible are praised online. For example, this Tumblr post saw plenty of shares in later 2022 with nearly 14.6k notes, praising designer Kei Hirabayashi's inclusive boots for people with disabilities.

The cosmetics and beauty industry is another key area where consumers demand greater representation and inclusivity. In 2022, the number of people discussing gender-inclusive cosmetics online increased by 63%.

That’s a lot.

Joy is the most expressed emotion in these conversations, and the number of authors expressing joy on the topic doubled in 2022. In these conversations, consumers ask for advice and feedback on makeup trends, or recommend LGBTQ+-friendly products and brands.

Among these online conversations, users encourage each other to wear makeup that expresses their personalities. Brands in these industries should consider this when creating forward-thinking products and marketing strategies.

Diving deeper into the conversation, nail polish was one of the most discussed products in the gender-inclusive cosmetic conversation. People celebrate the freedom to wear whatever color of nail polish they want, regardless of gender. However, some point out that they’re reluctant to go with more colorful choices.

There may be an opportunity here for beauty brands to encourage consumers to be bold about how they express themselves.

I love the fact that men are comfortable enough to paint their nails. Nail polish can be gender neutral it is okay to be curious and explore.

— AprilFoolChild (@Aprilfoolchild) May 19, 2022

For brands and consumers, small changes can make a big difference. Brands should evaluate what changes they can make in their communications and product development to become more inclusive and accessible. Consumers have become more aware of inclusivity over the years, and brands that fail to follow these trends may struggle to keep up with changing consumer trends.

Consumers and work-life balance

Work-life balance has never been a bigger topic. With the COVID-19 pandemic fast-tracking working from home, flexible working hours, and remote working, employees are demanding more from their workplace.

People Management found that two-thirds of employees would take a pay cut for a better work-life balance. In response to the study Gethin Nadin, psychologist and Chief Innovation Officer at Benefex, said: “This research and others like it continue to suggest to employers that those willing to be more flexible with their people will become the more desirable employers.” But how does this look in practice?

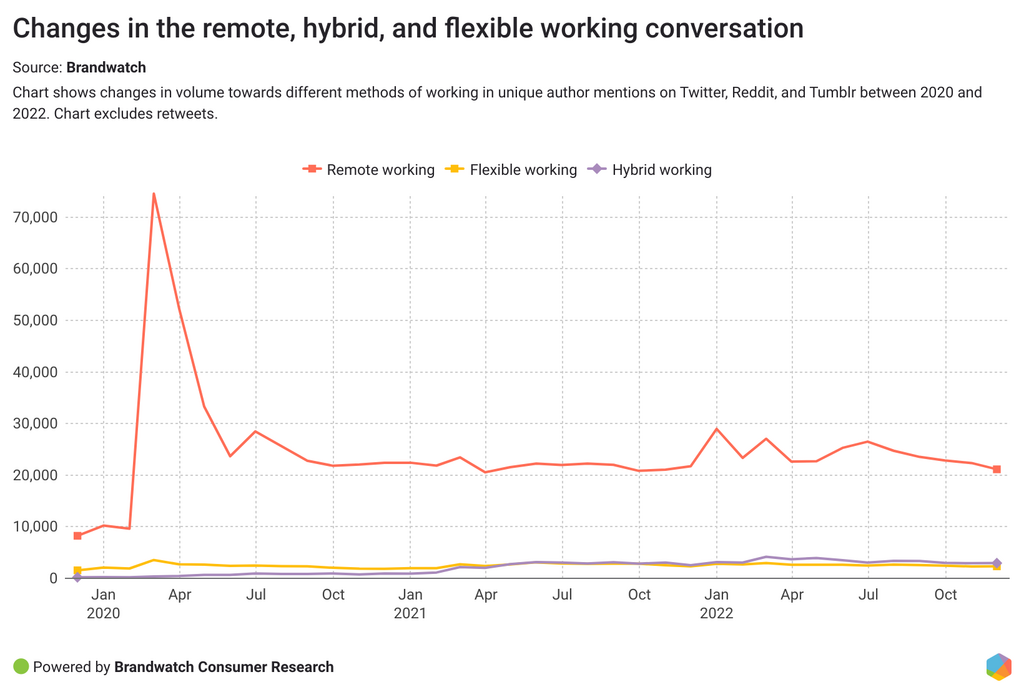

Using Brandwatch Consumer Research, we found that workers are leaning towards hybrid working, with the hybrid conversation overtaking the flexible working conversation in the second half of 2022.

A recent ongoing economic trend, dubbed the Great Resignation, has seen an influx of employees voluntarily resign from their jobs for better pay or working conditions. This trend has likely seen an increase in employers offering hybrid working situations to retain talent and increase employee satisfaction. This way, brands can attract the best talent available, whether employees live right around the corner or they’ll be working remotely.

Day 1 at the @CivoCloud office has been amazing. I love the hybrid work culture (freedom to choose remote/in-person)! 💼

— Kunal Kushwaha (@kunalstwt) September 13, 2022

Share pics of your work spaces 👇 pic.twitter.com/M3QkhLlThr

The remote working conversation also saw a slight dip in mentions towards the end of 2022, likely due to remote working now becoming a normal part of many people’s lives. We’re used to remote working now, so we’re talking less about it.

Our 2022 Consumer Trends report found that organizations must be proactive by prioritizing employees and their pain points. In 2023, we can see that employers are taking action. One example is the prevalence of a four-day workweek, in which employers reduce working hours to improve employee satisfaction and work-life balance. In November 2022, one hundred employers in the UK “signed up for a permanent four-day working week for all their employees with no loss of pay.”

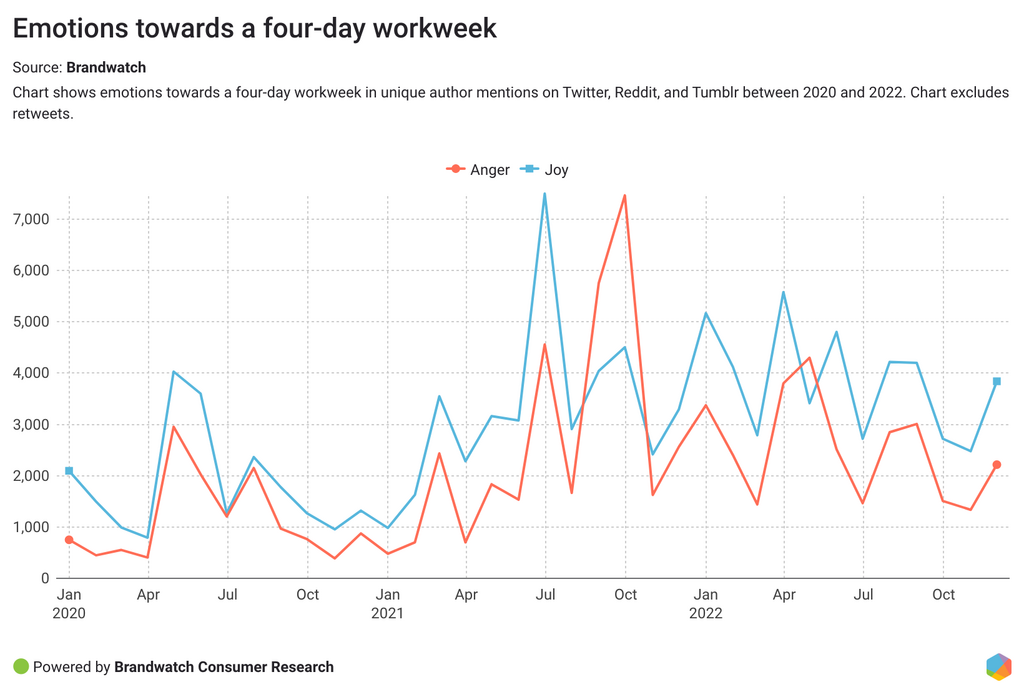

This isn’t the last we’ll see of the four-day workweek. Looking at the online conversation, we can see that – while spikes of mentions aren’t as drastic – the baseline of mentions about the four-day workweek has increased.

Perhaps this indicates that the four-day workweek has become a household term, and users use it more frequently in online conversations.

The chart above shows angry and joyful mentions about the four-day workweek in online conversations since 2020.

We can see that joyful mentions remain high, creating a larger gap when compared to angry mentions. However, it’s worth noting that many of the angry mentions are in support of the initiative. For example, users are frustrated that they cannot have a four-day workweek.

ireland has a four day workweek so why can't I?

— elly belle 🔮 (they/them) (@literElly) December 2, 2022

In 2023, employers will need to work quickly to improve employee satisfaction to retain a loyal workforce. Employees are getting savvy; they know their worth, and aren’t afraid to change roles if there’s a chance of a better work-life balance.

In fact, online conversations about getting a salary increase didn’t see a significant rise during 2022, which might indicate that better working conditions trump a salary adjustment for many employees.

Health and wellness trends

In a post-pandemic era, health is still a priority on everyone’s mind. And health doesn’t stop at the physical. Now more than ever, individuals are increasingly conscious of their mental health. In 2023, brands will need to keep this in mind when creating forward-thinking strategies.

Treating anxiety

The World Health Organization found that COVID-19 increased generalized anxiety disorders by 25% in the global population. That’s a lot. And as the general population battles a rise in anxiousness, we’re all looking for ways to calm down. Enter: microdosing.

Microdosing is the practice of taking a tiny amount of a drug in order to benefit from its physiological action while keeping any side effects to a minimum. According to Harvard, the jury’s still out on whether microdosing is beneficial. Some studies “indicate a very real and significant benefit from microdosing, whereas others are much less convincing and show little to no benefit.”

Another recent study on microdosing found "small to medium-sized improvements in mood and mental health that were generally consistent across gender, age, and presence of mental health concerns."

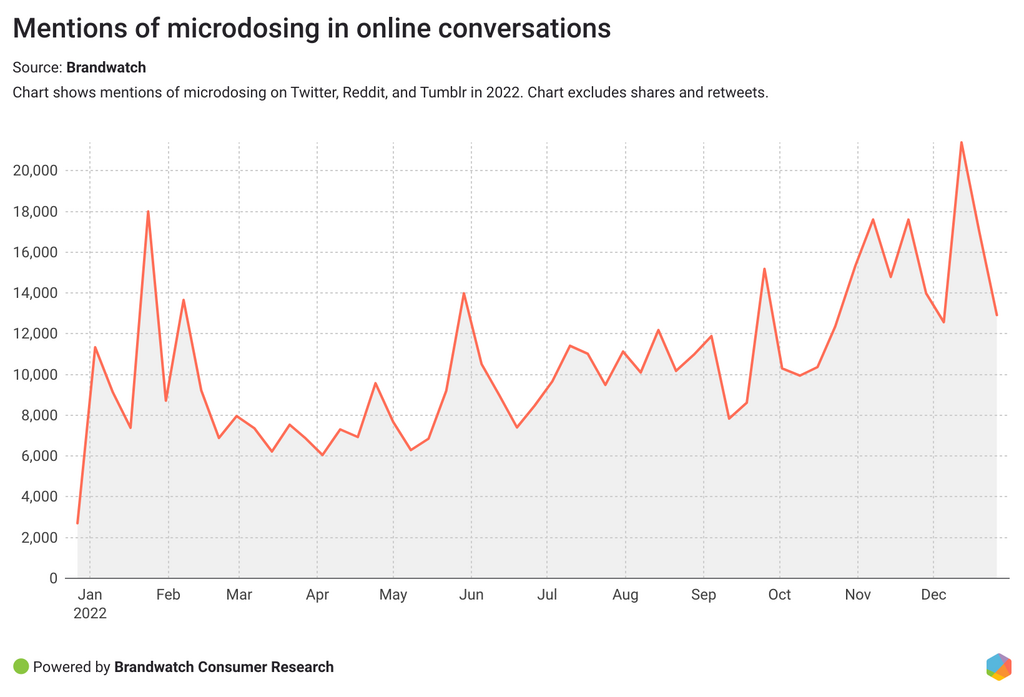

Online, people are interested in how microdosing might be used to minimize their mental health problems. And the conversation is growing.

Online mentions about microdosing saw a steady upwards tick throughout 2022, showing a noticeable peak towards the end of the year.

In 2023, we expect interest in this experimental habit to grow as more people look for ways to treat anxiety disorders. While microdosing isn’t a new concept, interest in the practice is on an uptick, slowly becoming a household term for different areas of the internet.

Those uncertain about experimenting with microdosing are turning to mindfulness. Meditation saw an impressive increase in online mentions when the pandemic hit as individuals across the globe looked for ways to cope with restrictions.

Naturally, this conversation dropped off as the world opened up again, and we were able to get back to a normal routine.

However, mentions reached a peak towards the end of 2022. While mentions aren’t as high as peak-pandemic, they’ve definitely seen a noticeable increase.

Consumers are experiencing increased anxiety and are more aware of the mainstream, and not-so-mainstream, ways to tackle it. In 2023, brands need to be sensitive to the general public’s increased anxiety and offer ways to accommodate this as much as possible.

An example of a brand putting this into practice is supermarket chain Jumbo in the Netherlands. In 2023, the brand has pledged to expand their offering of “chat checkouts” nationwide, where customers can engage in dialogue.

Areas where loneliness is a significant issue were carefully studied when selecting the stores, after a study found that 33% of individuals over 75 claim they are at least moderately lonely. This is a simple, but very effective way of ensuring customers feel safe in store.