REPORT

Buying Habits and Trends for the Consumer Packaged Goods Industry

How is the online conversation about the CPG industry changing? Find out in our new report.

Get startedFrom cosmetics to fashion to food and beverages, the Consumer Packaged Goods (CPG) industry touches consumers' lives every day. How do consumers talk about CPG brands and products online?

Consumer behavior is constantly changing, and as inflation continues to influence consumer purchasing decisions, it has never been more important for CPG brands to understand consumers. CPG brands that analyze online consumer conversations can gain valuable insights into shifting sentiment, common pain points, and emerging trends.

In this report, we cover the following:

Online conversations around shopping are on the decline

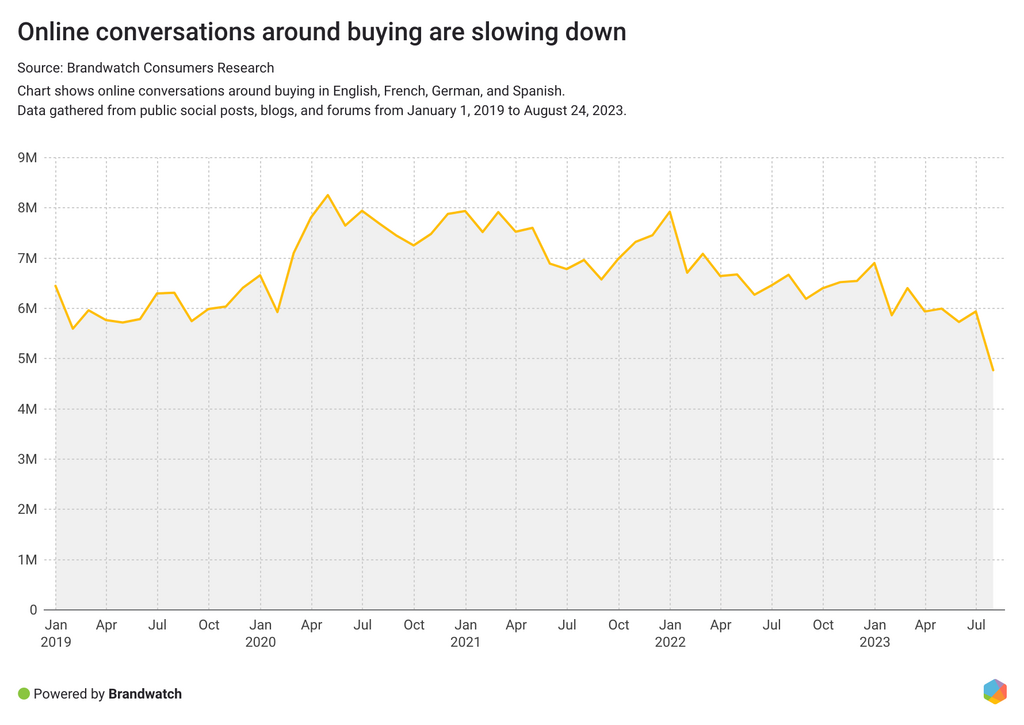

Consumers are talking less about buying or purchasing products than in recent years. From August 25, 2022 to August 24, 2023, online conversations are down 10% compared to the previous twelve months.

Not only are consumers talking less about buying, but they are also less positive about it. Positive mentions are down 18%. Money and prices are one of the main topics of these buying conversations. With the rising cost of living, inflation, and higher prices, it's no surprise that consumers are talking more about money and prices in purchasing conversations. Consumers have less money to spend and have become more price-sensitive.

Money, in particular, is talked about negatively, and while buying conversations have slowed, consumers are talking more about buying in relation to inflation. In fact, the number of people mentioning inflation increased by 7%. People’s wages not keeping up with inflation, the cost of living going nowhere but up, and indispensable products becoming more and more expensive are some of the main topics of the conversations online. Sharing thoughts and asking for advice on cheaper options is another big theme in them.

Consumer conversations are shifting

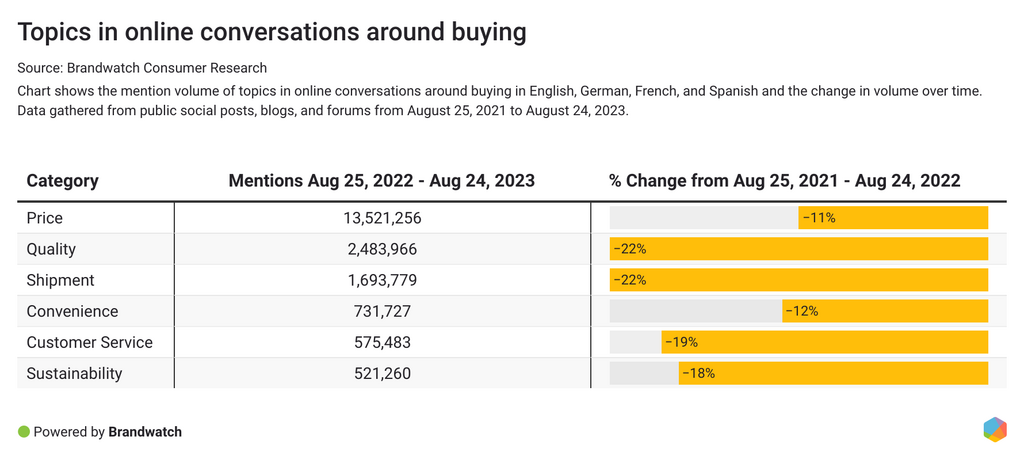

A closer look at the different topics of purchase conversations reveals a shift in consumer conversations.

While overall purchase conversations have slowed down, the conversations around shipping, quality, and customer service have all decreased the most; by 21%, 20%, and 17%, respectively. Conversations around convenience and price decreased at a lower rate than other topics analyzed, indicating that convenience and cost are still among the key concerns for consumers.

Convenience, in particular, seems to remain an important topic in online consumer conversations. Consumers talk about a positive shopping experience, with products readily available, whether in a nearby store or through an easy online ordering process. Time is the most frequently mentioned word in conversations about convenience and shopping. Customers don't want to spend a lot of time buying an item, and when they do invest their time, they expect a smooth customer experience.

Barriers to purchase in the shopping process can leave consumers frustrated, and ultimately, brands risk losing their customers. Brands need to ensure that they are removing all customer pain points and, if a problem does arise, that they are providing excellent and easily accessible customer service.

Looking at online conversations about shopping in different languages reveals some interesting differences:

- French consumers talk more about sustainability than other regions analyzed

- German consumers talk more about shipping and less about convenience

- US and UK consumers talk less about sustainability

- Spanish consumers' online conversations around shopping and price decreased by only 6% compared to an average of 11%.

Consumers are less excited about Christmas

Christmas may be a while away, but CPG brands are already gearing up for the holiday season. But what are consumers thinking? Are they excited about holiday shopping? According to our data, they may be a little less excited than previously.

People talk less positively about Christmas shopping. Looking at sentiment over time, we can see that positive mentions decreased at a higher rate than negative mentions. In December 2018, mentions with positive sentiment were at 65%. By December 2022, positive mentions had dropped to 59%. Meanwhile, negative mentions increased from 35% to 41% in the same period.

Gen Z consumers express a more critical perspective on holiday shopping than other generations. Half of all sentiment-categorized mentions from Gen Z consumers between October 1, 2022 and February 28, 2023 are negative. Baby Boomers, on the other hand, stand out as the most optimistic generation, with a noteworthy 61% of mentions being positive.

Looking at online conversations around Christmas shopping from this year (January 1 - August 24, 2023), the increase in negative mentions continues. Compared to online conversations from the same time last year (January 1 - August 24, 2022), negative mentions increased from 46% to 54%.

Money is one of the main topics in negative mentions around Christmas shopping. With the ongoing cost of living crisis and inflation, consumers are more cautious about how they spend their money, which obviously impacts the holiday season. Deals and discounts will likely play a bigger role in consumers' purchasing decisions this holiday season.

According to a Google survey, 21% of respondents say they finish their holiday shopping by mid-October. Consumers looking for a good deal are starting their Christmas shopping earlier. Brands that start their promotions early have a chance to attract new customers.

Cosmetics and skincare

In 2023, the global beauty and personal care market will reach $579 billion in revenue and is expected to grow to nearly $689 billion by 2028.

Not only does the industry boast big revenues, but it also generates a lot of conversations online. In the last 12 months, from August 25, 2022 to August 24, 2023, more than 7.5 million people started more than 49 million online conversations about cosmetics and skin care.

These online discussions serve as a pool of valuable insights for beauty brands to improve their products, meet customer needs, stay ahead of the competition, and ultimately drive sales.

Let's take a look at some of the latest beauty trends and most common consumer pain points

Demand for anti-hair loss products is on the rise

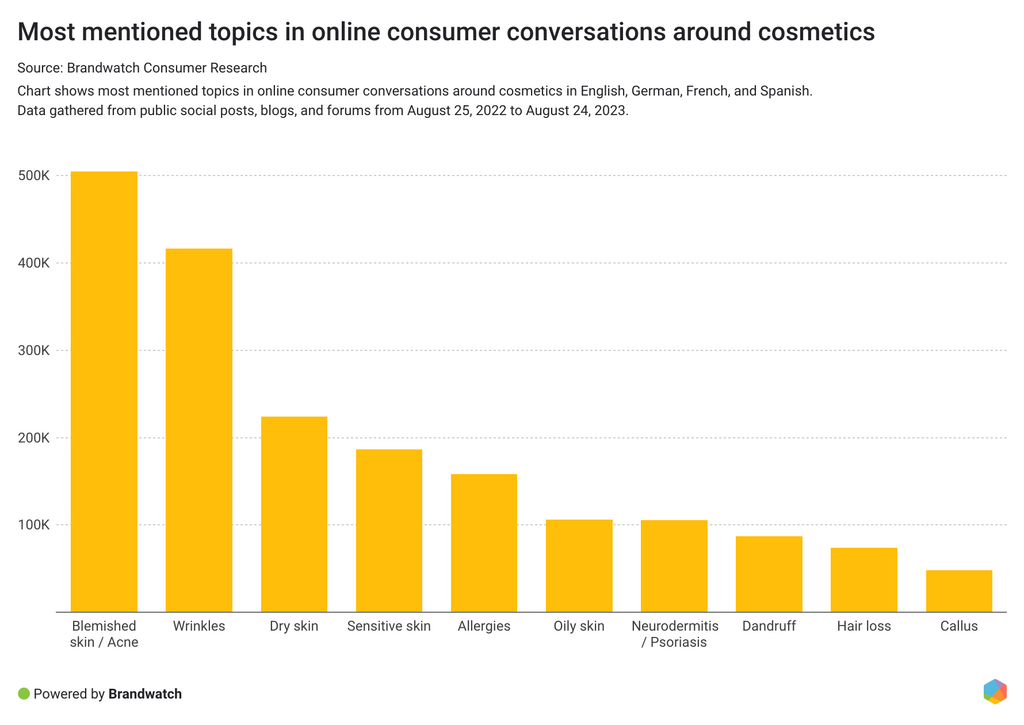

Consumers look to beauty products to solve their problems. From face creams that promise to smooth out wrinkles, to cleansers for blemished skin, to shampoos for thinning hair – there is a product for every problem.

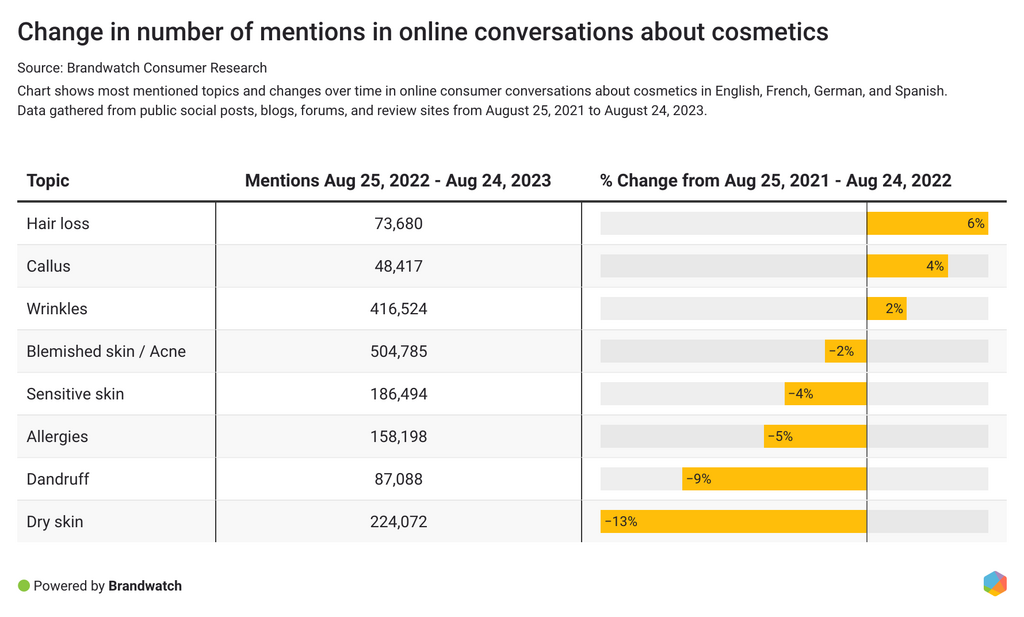

Looking at online consumer conversations, we identified the most common topics mentioned in discussions about beauty and cosmetics. At the top of the list are blemishes and acne, wrinkles, and dry skin. There are also many mentions of sensitive skin, allergies, and conditions such as neurodermatitis and psoriasis.

Geographically, there are differences in online conversations about skin and haircare-related topics:

- Wrinkles are the main topic for US and UK consumers.

- German consumers talk more about dry skin.

- French and Spanish consumers are more likely to mention under-eye circles than consumers from other countries.

- UK and APAC consumers are more likely to talk about sensitive skin.

Online conversations about hair loss products increased by 6% from August 25, 2022 to August 24, 2023 compared to the previous period. Hair loss is also the topic with the highest percentage of sadness in online conversations compared to the other skin and hair problems analyzed. 20% of all emotionally categorized mentions around hair loss express sadness.

Consumers search for hair loss treatment products, ask the community for their experiences and treatment results, and mention that they experienced hair loss after illnesses or stress.

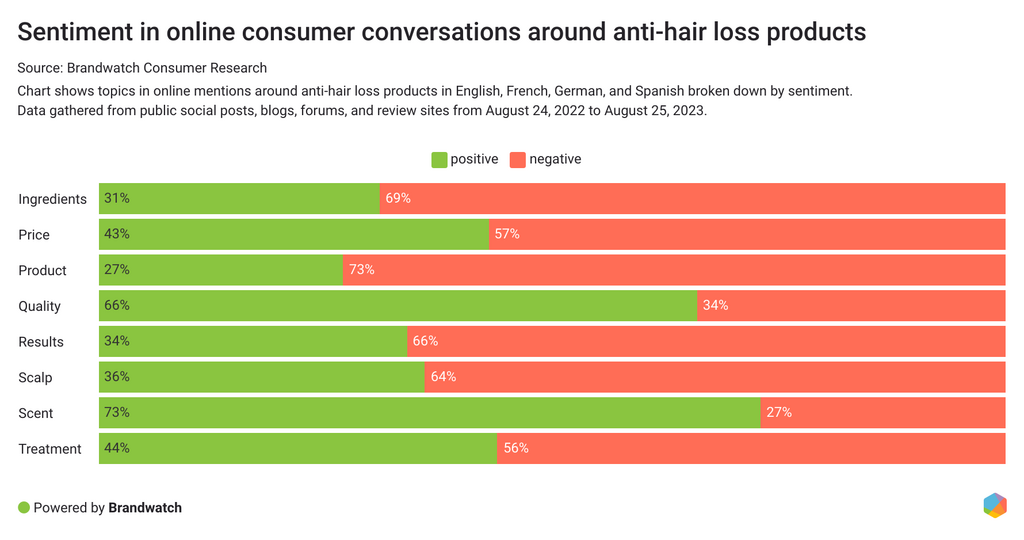

By breaking down online conversations about anti-hair loss products into different topics, we can see how consumers talk about these products and what their pain points are. Consumers most often mention the products in general, the effects on their scalp, and their experience using the product.

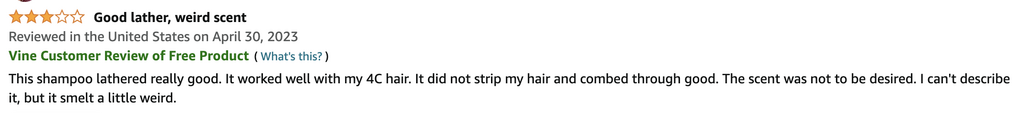

In terms of sentiment, online conversations about scent and product quality had by far the highest percentage of positive mentions compared to other topics analyzed. 73% of mentions about product scent and 66% of mentions about quality are positive. But these are also two factors that can quickly turn consumers off, as the following review shows. A pleasant scent is crucial for consumers to recommend and repurchase a product.

The most negative comments are about the product in general, the ingredients, and the results from continuous use. Consumers share their experiences and say they can't recommend the product. When discussing ingredients, consumers are looking for natural ingredients or products that contain specific ingredients believed to help improve hair growth, such as keratin. Consumers complain when their expectations aren't met, and they don't get the results they were hoping for because the product either has no effect or perhaps even a negative effect, like oily hair or itchy scalp.

While it's obvious that certain product attributes, such as scent and texture, are subjective and can't universally satisfy everybody, it remains crucial for cosmetics brands to actively engage in monitoring online conversations to pinpoint the most prevalent customer pain points among the masses. These insights should then be used to inform product development and empower brands in the beauty and cosmetics industry to maintain a competitive edge and, ultimately, drive sales.

Hyaluronic acid, vitamin C, and retinol are popular product ingredients

Let’s dive into the product ingredient conversation. Ingredients target different skin and hair concerns, and popular ingredients have changed over the years.

Which ingredients are popular?

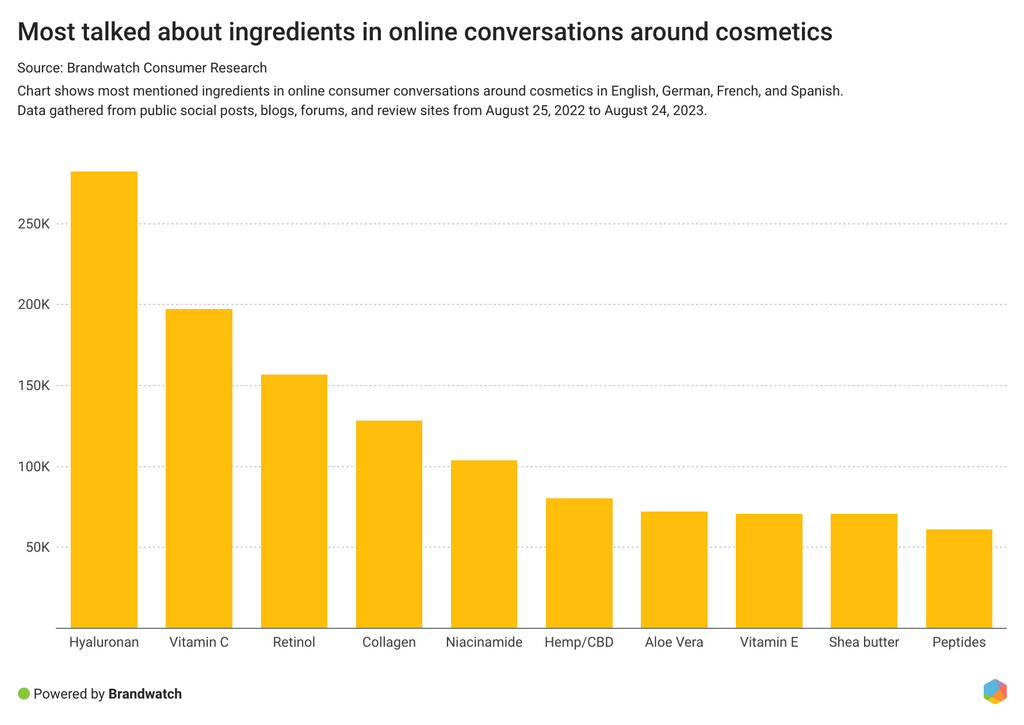

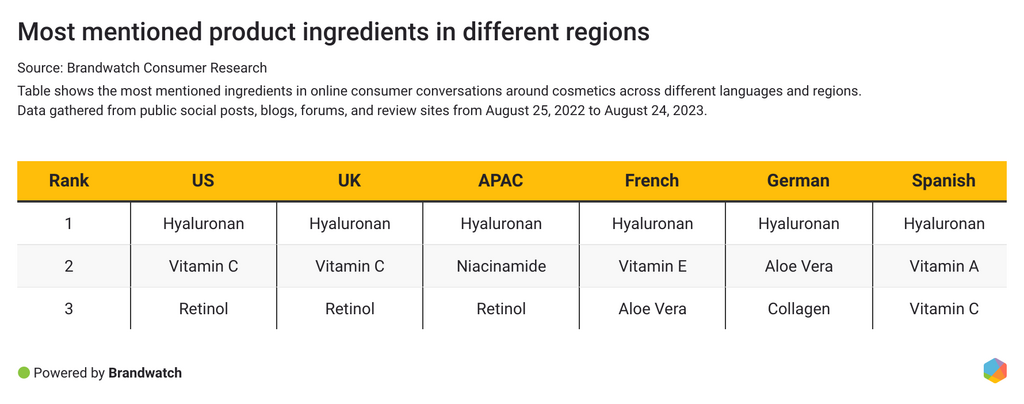

Ingredients such as hyaluronic acid, vitamin C, and retinol are often mentioned in online consumer conversations. Collagen and niacinamide are also popular. While hyaluronic acid is the most discussed ingredient in all countries analyzed, there are some interesting regional differences.

- French consumers talk more about products with vitamin E, while Spanish consumers are more likely to talk about products with vitamin A.

- German- and French-speaking consumers are more interested in products with aloe vera.

- Products with niacinamide rank second in online consumer conversations from the APAC region.

- German consumers are more likely to discuss collagen than other consumers.

In terms of trending ingredients, we identified online conversations that increased the most from August 25, 2022 to August 24, 2023 compared to the previous 12 months:

- Ceramide: Mentions increased by 46%

- Niacinamide: Mentions increased by 33%

- Cica: Mentions increased by 32%

- Retinol: Mentions increased by 27%

- Glycolic acid: Mentions increased by 20%

What product ingredients do consumers prefer? According to online consumer conversations, here are the most popular ingredients for various conditions:

- Argan oil for dry hair

- Ceramide for dry skin and redness

- Collagen for wrinkles and cellulite

- Hyaluronic acid for dry skin and dark circles

- Retinol for wrinkles and blemished skin

- Shea Butter for neurodermatitis and psoriasis

- Urea for calluses

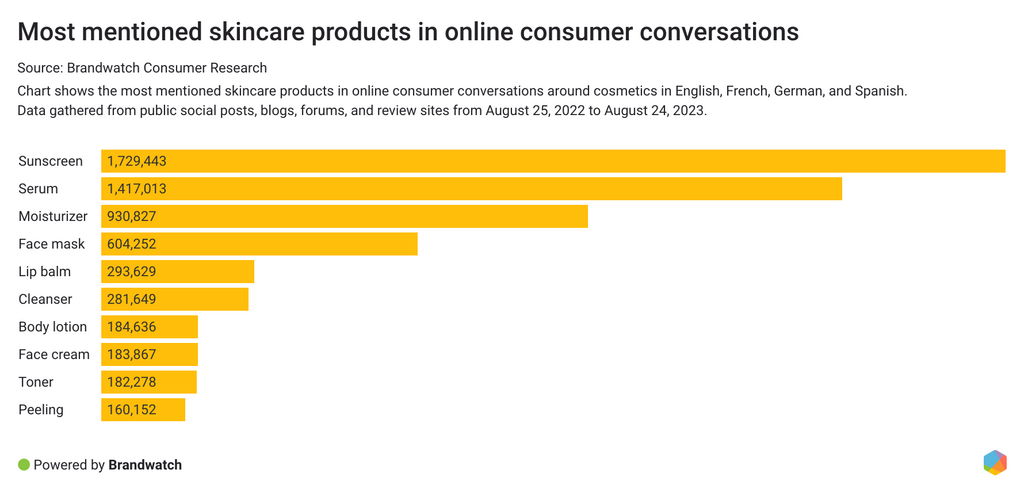

The rising demand for sun protection

Sunscreen and sun protection products are the most mentioned skincare products in online consumer conversations about cosmetics. Of all the skincare products analyzed, sunscreen mentions increased the most, with 11% more mentions from August 25, 2022 to August 24, 2023 compared to the previous twelve months.

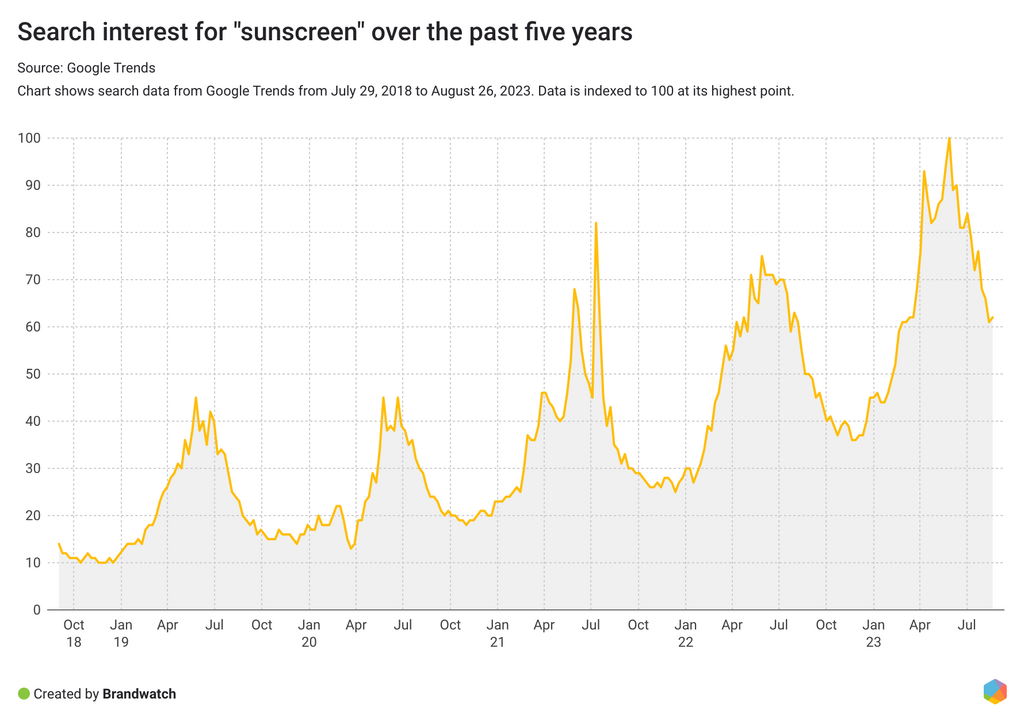

Demand for sunscreen products is on the rise. According to Google Trends, search interest for "sunscreen" has increased over the past few years, reaching a 5-year high at the end of May 2023. And no wonder as July 2023 broke several global heat records. As temperatures rise, consumers will be looking for ways to protect their skin.

In online conversations, mentions of high-SPF products increased, while discussions of products with an SPF of 20 or less decreased. Mentions of products with an SPF of 50 or higher increased by 31%.

Consumers are discussing sun care products as part of their daily skincare routine. They are looking for facial washes and cleansers that remove sunscreen at the end of the day. A pain point for consumers is finding sunscreen products that address their specific skincare needs, such as sunscreen suitable for sensitive, dry, or oily skin.

A closer look at the emotions expressed in sunscreen conversations reveals that of all the emotions, fear has increased the most. From August 24, 2022 to August 24, 2023, fearful mentions increased by over 16% compared to the previous twelve months. Consumers are worried about UV exposure, sunburn, or skin cancer. Some are unsure how much and how often they should apply sunscreen to be safe, especially when they are in the water.

It seems consumers have a growing need for safe sun protection products. With July 2023 being the hottest month on record worldwide, this need is unlikely to diminish any time soon. Cosmetic brands would be well-advised to offer various sunscreen products for different skin types and educate their consumers on how to use these products properly.

The fashion industry

The quiet luxury trend

Quiet luxury is luxury fashion that combines classic, practical basics that are high-quality but understated, often without the logo of the designer brand. It's basically a minimalist way of dressing in luxury clothing, and celebrities like Kendall Jenner and Gwyneth Paltrow as well as the TV show Succession fuel this "stealth wealth" trend.

According to BuzzSumo, in the last 12 months, there have been over 1.8k articles published about quiet luxury, generating over 180k total engagements.

Top 5 articles with the highest engagement:

- Newshub: Quiet luxury is one of 2023’s biggest trends, and Rihanna just shared her take on it - 11.1k total Engagements

- Vogue: Is Rich-Mom-Energy the New Quiet Luxury? Here’s How to Get the Look - 10k total engagements

- Vogue: If You Pay Attention to One Trend This Season, Make It “Quiet Luxury” - 8.1k total engagements

- Manilatimes: ‘Quiet luxury’: No flash, no logos, but big-time style - 7.7k total engagements

- Harper’s Bazaar: The 10 Best Quiet Luxury Brands Are Beyond Any Trend - 5.4k total engagements

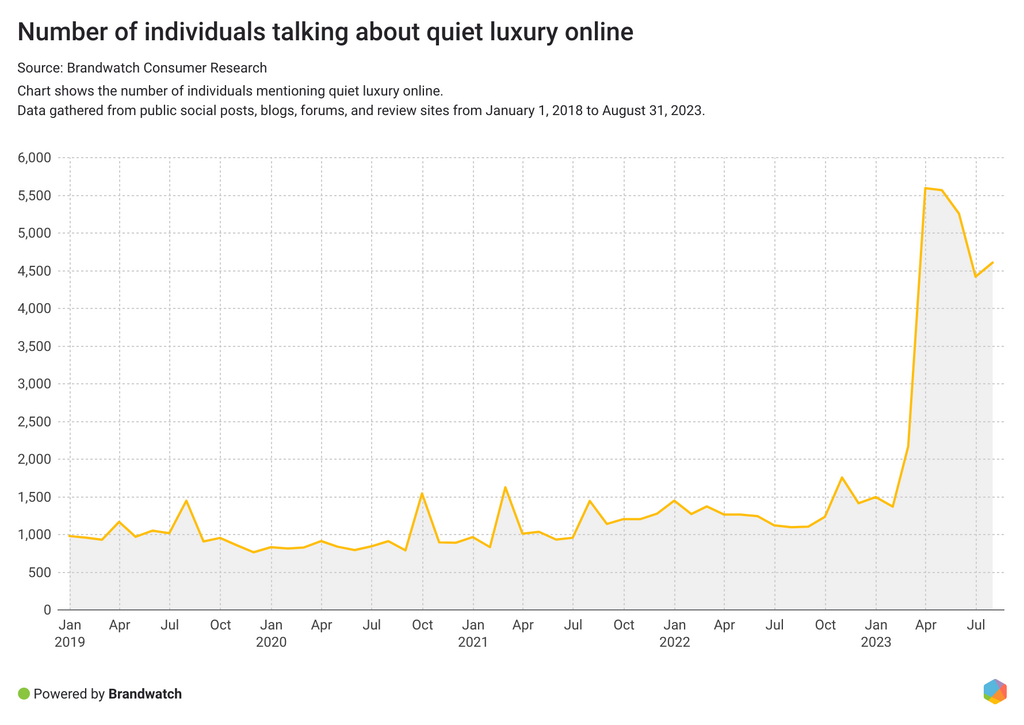

Over 30k individuals discussed quiet luxury online from August 25, 2022 to August 24, 2023. That’s an increase of 135% compared to the previous 12 months.

In online conversations about quiet luxury, consumers talk about the aesthetic and style of these fashion choices, favorite brands, and inspiration from celebrities like Sofia Richie, Kylie Jenner, and Hailey Bieber. The most discussed quiet luxury items are bags, dresses, and watches, and the most mentioned fashion brands are Chanel, Gucci, and Zara.

Joy is the most expressed emotion in the quiet luxury emotion, with 66% of all emotion-categorized mentions being joyful. In joyful conversations, consumers praise the style choices of celebrities, saying the fashion items are beautiful, elegant, or comfortable.

While joy is the top emotion, anger comes in second. Consumers in angry conversations say that they find the style boring, that they don't see the point of spending a lot of money on luxury items when the logo is hidden, or that quiet luxury is nothing new.

Fashion brands have a chance to win customers by showing how to style different quiet luxury items for looks that are anything but boring or by combining quiet luxury with fashion nostalgia. Lower-priced brands have the opportunity to offer classic, understated items to price-conscious consumers who want to dress elegantly but are on a budget.

Speaking of fashion nostalgia, let's dive into the 90s fashion conversation.

Most popular 90s fashion clothes

The 90s are back, with younger consumers discovering vintage items like bucket hats, cargo pants, and tie-dyed fabrics. 90s runway videos featuring supermodels like Tyra Banks and Claudia Schiffer are popular on TikTok, and at the 2023 Met Gala honoring designer Karl Lagerfeld, many celebrities brought back 90s chic.

And people are not getting tired of talking about 90s fashion. In the last six months, nearly 1.9 million people talked about it online, an increase of 3% compared to the six months before.

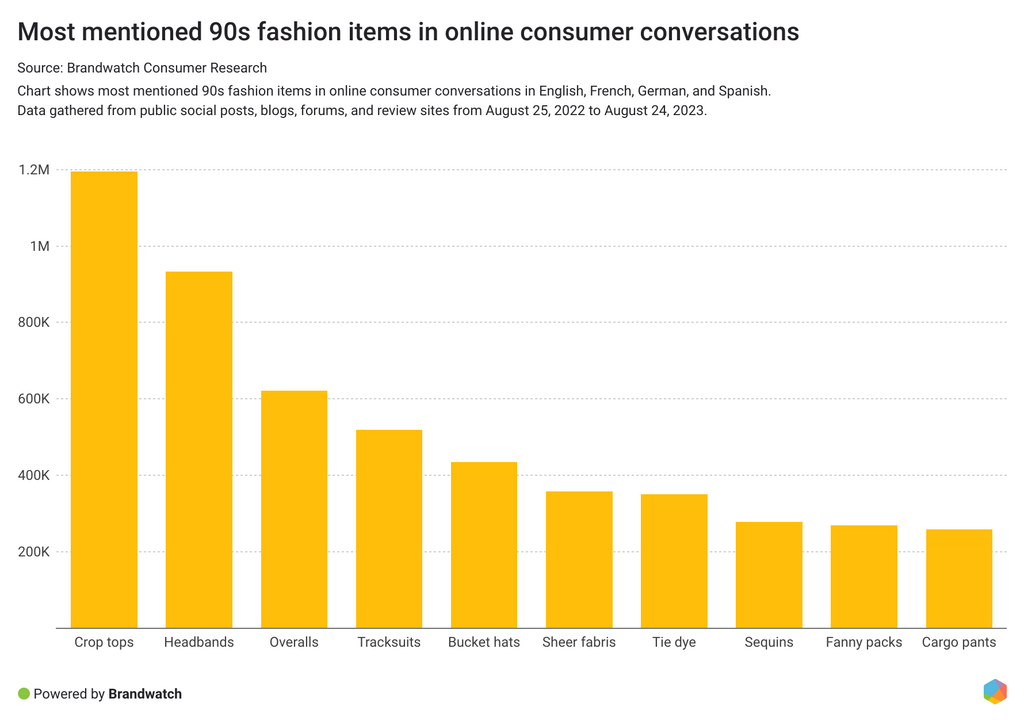

Crop tops and headbands are the top 90s fashion items consumers discuss online. Overalls, tracksuits, and bucket hats are also popular.

Breaking down the consumer conversations into different regions reveals interesting differences:

- Consumers in France talk more about sequined clothing and accessories

- Consumers in Spain and the UK talk more about tracksuits

- Consumers in Germany talk more about hoop earrings

The crop top conversation is evidently controversial, with 73% of sentiment-categorized mentions being negative. This negativity is driven not only by consumers who share the opinion that they don't like crop tops but also by consumers who like them but are not comfortable wearing them or are insecure about their body type.

There might be an opportunity for fashion brands to offer guidance on mixing crop tops with various clothing options to demonstrate that they cater to a diverse range of body types, dispelling the notion that crop tops are exclusively suited for a single body shape.

K-pop has fueled online discussions about crop tops over the past year. Male Korean singers, such as Exo member Kai, wear crop tops as part of their stage outfits, and their fans praise their fashion choices.

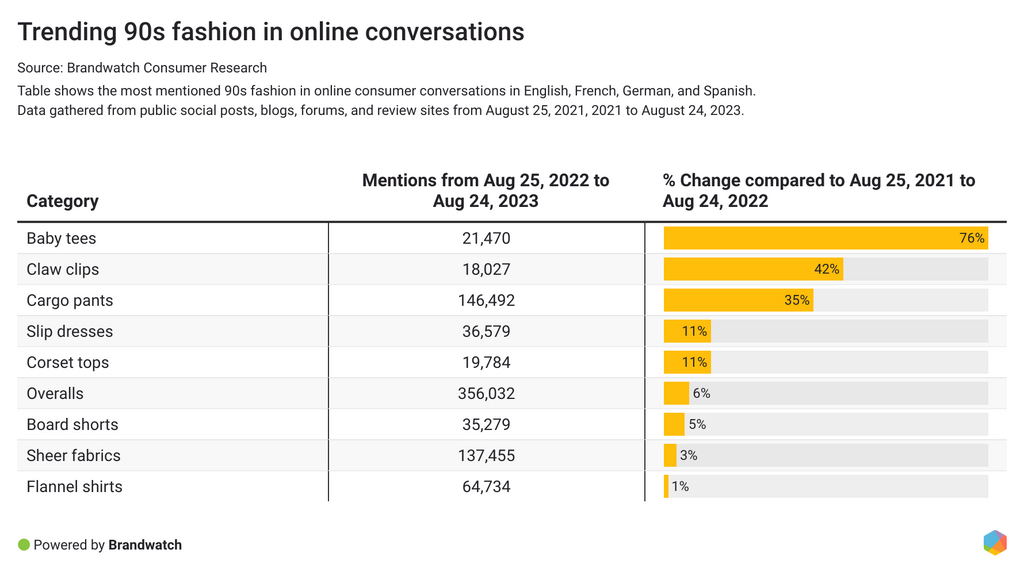

What 90s clothes are trending? Online conversations over the past twelve months have grown the most for baby tees (a shrunken version of a regular t-shirt), claw clips, and cargo pants.

Millennials vs. Gen Z: Differences in consumer conversations

Looking at generational data shows that there are indeed differences in how the different generations talk about a topic online. By comparing millennials and Gen Z's online conversations about 90s fashion, we can see what millennials and Gen Z prefer.

Millennials are more positive about 90s fashion trends than Gen Z consumers. In Millennial online conversations, 30% of emotion-categorized mentions are joyful, while in Gen Z online conversations, only 27% of emotion-categorized mentions express joy.

Crop tops are the number one 90s fashion item for both generations. While Gen Z is more likely to talk about tracksuits and sequined clothing and accessories, Millennials are more likely to talk about overalls and tie-dye fabrics.

It's important for your brand to understand the preferences of different audiences in order to personalize your messaging. Generational insights help you better understand your customers and inform your strategy to make better business decisions.

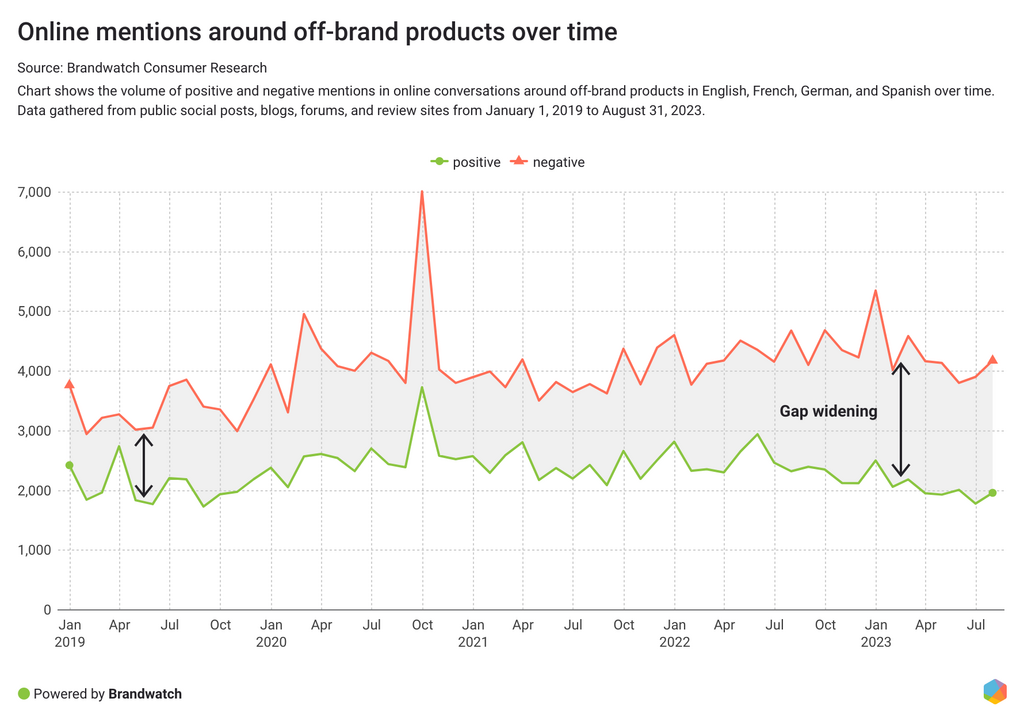

Consumers are getting more frustrated with off-brand products

Off-brand products grew in popularity as consumers switched from branded products to cheaper alternatives. Consumers became more price-conscious as inflation led to higher prices for food products, and online conversations around off-brand products have been rising. In fact, the number of individuals talking about off-brand products online increased by 3% from August 25, 2022 to August 24, 2023.

But while interest remains high, the sentiment in these conversations is shifting. The gap between negative and positive mentions is widening. Negative mentions increased by 4% over the time period analyzed, while positive mentions decreased by 14%. What is causing this shift?

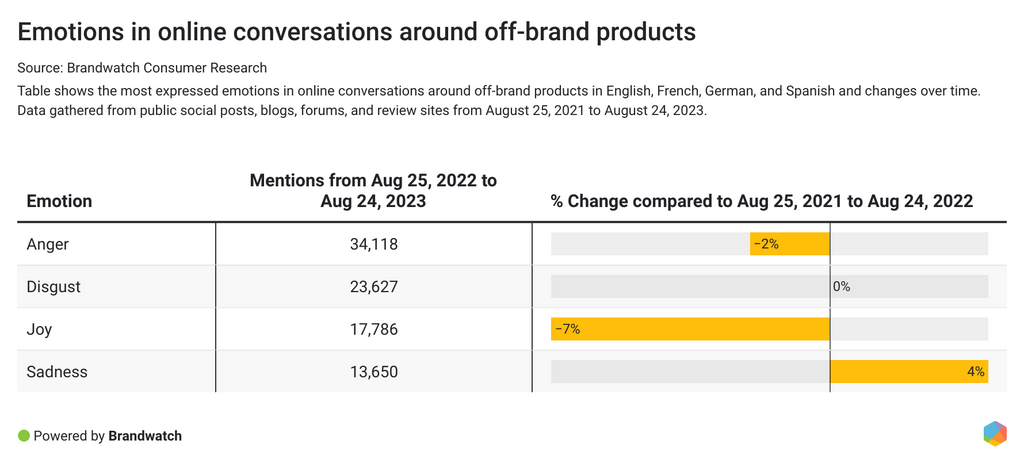

Breaking down the mentions into different emotions, we see that the most expressed emotion in conversations about off-branded products is anger, followed by disgust. Joyful mentions are only in third place. Mentions expressing joy decreased by 7%, while sad mentions increased by 4%.

Consumers seem to be getting more frustrated with buying off-brand products. On the one hand, there's a general frustration among consumers who are forced to switch from brands they preferred in the past for budgetary reasons. Others are not satisfied with the quality of the cheaper alternatives or point out that even off-brand products are becoming more expensive.

In addition to price, other reasons for dissatisfaction with off-brand products include products being out-of-stock and disappointing flavors. Consumers who replace branded products with a cheaper alternative expect a similar taste and are disappointed when their expectations are unmet.

Consumers in the UK and Germany talk more about the taste of off-brand products than consumers in other analyzed countries. However, consumers in the US, APAC, and France talk more about the packaging, while Spanish consumers talk more about the ingredients of off-brand products.

Consumers in Germany and the UK also talk more negatively about off-brand products and prices than other consumers. 78% of German consumer conversations and 73% of UK consumer conversations are negative, compared to 61% overall.

Home gym conversations become more negative

During the COVID-19 pandemic, many consumers changed their exercise habits and started working out at home. People adopted new routines and purchased equipment to enhance their home gyms. In 2023, life is (almost) back to normal, but consumers are sticking to the workout routines they have established over the past few years.

From August 25, 2022 to August 24, 2023, the number of people talking about home gyms and working out at home increased by 7% compared to the previous 12 months. Consumers are not only talking more about the topic but also more negatively. Negative mentions increased by 12%, and anger is the emotion expressed that has increased the most in the last 12 months with an increase of 8%.

In negative conversations, consumers say they work out at home because they feel uncomfortable working out with other people at the gym or they are too tired or lazy to go to the gym. Other negative conversations are driven by people wanting to improve their home gym situation, but buying equipment is expensive and takes up a lot of space.

One of the most liked tweets of the last twelve months points out the benefits of working from home and that investing in a home gym doesn't mean you need a lot of equipment or spend a lot of money:

But when consumers invest in their home gym, which equipment is the most popular?

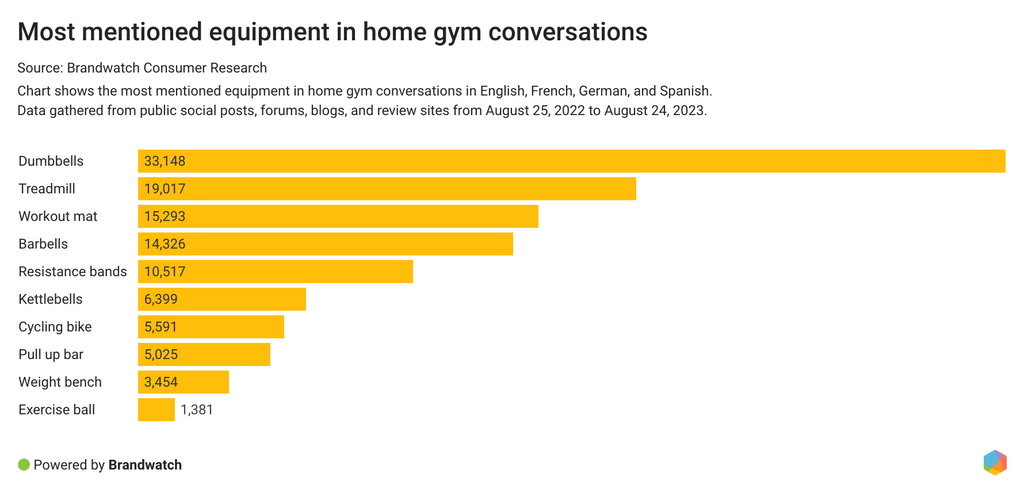

According to online conversations, dumbbells, treadmills, and workout mats are the go-to products to enhance the home workout experience. Barbells, resistance bands, and kettlebells are also popular.

While most online conversations about equipment decreased over the past twelve months, mentions of weight benches increased by 5%. There seems to be a growing need for home exercise equipment that helps build muscle and strength.

What are the most popular workouts to do at home?

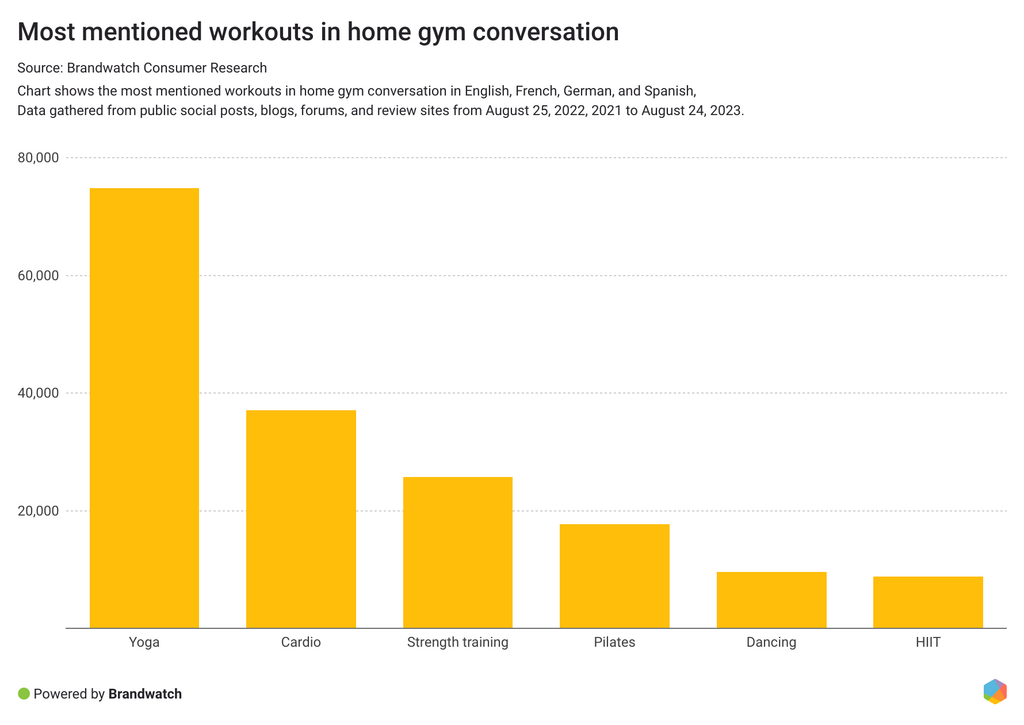

Yoga is the most popular, followed by cardio and strength training. Pilates ranks fourth and has grown in popularity over the past twelve months, with online conversations increasing by 31%.

In online conversations, people say they do Pilates to get stronger and stay healthy. They refer to Pilates as their fitness routine, with some starting their mornings with a Pilates session. Workout mats and resistance bands are the most commonly mentioned equipment, and online classes are a popular topic of conversation. Free classes on platforms like YouTube are particularly popular. With little equipment and space required to do Pilates at home and plenty of free online Pilates videos to choose from, this is a great budget-friendly workout.

Working out at home was an adjustment many people had to make during the COVID-19 pandemic, but it seems to have become a habit they're eager to continue. Fitness brands can reach more customers with equipment suitable for strength training and weight lifting. Offering additional content, such as best practices or online training courses, can help increase customer engagement and loyalty.

Final thoughts

Consumer behavior is changing all the time. CPG brands, from food and beverage to fashion and cosmetics, need to be aware of these changes as soon as possible to keep customers happy.

CPG brands that use social listening platforms can stay ahead by understanding the most common customer pain points, their performance against their competitors, and what trends are emerging in their industry. With Brandwatch, brands can make smarter, data-driven business decisions.