REPORT

Consumer Trends in the Media and Entertainment Industry

We analyzed millions of online conversations to identify the latest consumer trends in the media and entertainment industry.

Get started with Brandwatch“It’s a show? It’s a lifestyle. It’s a religion.” – Gilmore Girls.

People love entertainment and media. As the famous Gilmore Girls quote goes, it's about more than just consuming content. From movies to music and video games, these forms of entertainment enrich our daily experiences and provide insights into the complexities of our world.

So, it's no wonder that the entertainment and media industry is a huge market, growing by more than 10% a year. And people love to talk about it online. These online conversations offer a huge pool of consumer data that can help brands understand consumers better and ultimately be more successful.

We looked at online consumer conversations about the media and entertainment industry to see what's changed, what consumer trends are emerging, and how consumers feel about the latest developments in the industry.

This report will cover the following:

How online consumer conversations about the media and entertainment industry have changed

Consumer insights on streaming services and the movie industry

- Streaming services and the rise of streaming advertising

- How Barbie might have saved the movie business

- Consumer conversations around the movie experience

Online conversations about the media and entertainment industry have decreased

The media and entertainment industry is a widely discussed topic online. People like to post about their favorite artist's latest album, the last movie they saw in the theater, or a video game they enjoy, which means there are lots of mentions to dive into to identify the latest consumer trends.

From February 1, 2023 to January 31, 2024, over 64 million individuals posted 325 million times about media and entertainment. While these are still huge numbers, they are down from the previous 12 months, with total mentions down 8% and the number of individuals posting down 5%. Consumers are posting less about media and entertainment.

Let's take a closer look at how the contents of those consumer conversations have evolved.

The most popular brands in the media and entertainment industry

Consumers love to talk about brands. Whether they are praising their favorite brand, sharing their content, or discussing newcomers, these conversations provide valuable insights into how consumers perceive a brand and what content they enjoy most.

In online consumer conversations about media and entertainment, these brands are mentioned most positively:

- Sony

- Apple

- BBC

They're all big players in the industry, so it's no wonder they're popular with consumers. What makes these brands stand out? With Benchmark, we analyzed their Instagram channels to find out more about their social media performance over the last 365 days (from February 27, 2023 to February 26, 2024) and what their most popular posts are.

A look at their social media performance shows that brands have different approaches to what and how they post. While the BBC posted over 1.66k times, Apple only posted 145 times. Apple also focuses on a different content format than the other two brands. They used mainly carousel posts on Instagram, while Sony and the BBC mainly posted videos.

What are these three brands posting? We looked at the top-performing posts by total engagements from February 27, 2023 to February 26, 2024. Our analysis shows a mix of celebrity collaborations, user-generated content, product announcements, and entertaining short clips about their content. In particular, posts about collaborations with K-pop bands such as BTS or NewJeans received many engagements.

What can marketers learn from these brands?

Engaging content is key to capturing the attention of your target audience. Apple, BBC, and Sony all engage their followers by collaborating with popular celebrities, posting short, fun videos, and teasing upcoming content and products.

Keeping an eye on your social media performance is key to seeing what posts are resonating and what content formats you should stick to. Expand your analysis to include your competitors to see what they are doing well and identify areas where you can improve.

Hashtag insights

One way consumers mention a topic is by using hashtags. On social platforms like Instagram, Tumblr, and X, hashtags are a great way for others interested in the topic to find relevant conversations.

These are the 10 most used hashtags in media and entertainment-related conversations:

- #music – 1,2m mentions

- #ps4share – 891k mentions

- #ps4live – 621k mentions

- #podcast – 532k mentions

- #nintendoswitch – 328k mentions

- #youtube – 326k mentions

- #art – 320k mentions

- #movies – 292k mentions

- #travel – 281k mentions

- #nowplaying – 257k mentions

In online consumer conversations about media and entertainment, #music is the most used hashtag. Notably, music also stands out as the most popular topic, with more than an impressive 130 million mentions within our timeframe. Delving into the top 10 hashtags, it’s clear that the majority revolved around music, podcasts, and games. Interestingly, the PlayStation 4 and Nintendo Switch clinch the spotlight as the most frequently mentioned gaming consoles through hashtags.

Examining the online gaming discourse, it appears that consumers love to post about their gaming experiences, with hashtags like #ps4share or #ps4live serving as a way for gamers to share their gameplay within their communities. This exemplifies a fundamental human need for connection, with niche communities gaining prominence. Marketers who recognize this trend and use communities to foster connections with customers can deepen brand loyalty.

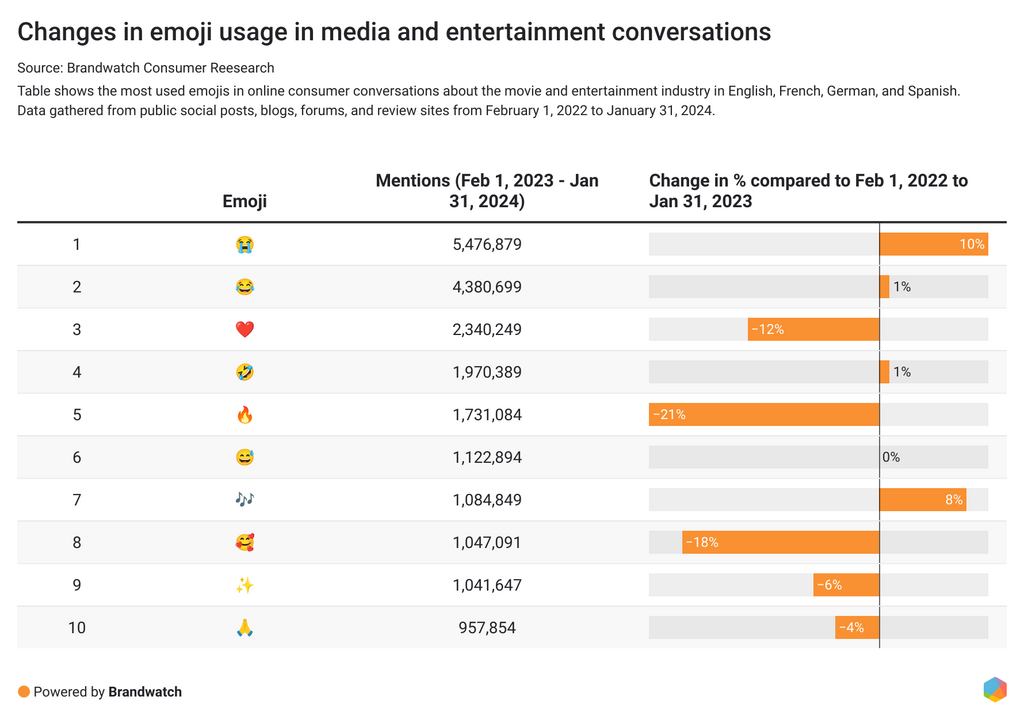

Emoji insights

Another way to communicate online is through emojis. As with everything, trends influence how we use emojis, and their meaning is subject to constant evolution – often with different meanings across cultures and generations.

People also like to hijack emojis to show that they belong to a community. Take, for instance, the purple heart emoji 💜, which has been adopted by BTS fans as a symbol of their love for their band. The emoji is also used in other conversations, but BTS fans use it so frequently that when looking at the most discussed topics featuring the purple heart emoji, BTS and the BTS ARMY (the name of their fanbase) emerge as the most dominant topic

Brands can use insights like these to inform their own marketing strategies. Using the right emojis in brand communications can be an important tactic to resonate with your target audience. As a bonus, emojis often make you seem more approachable and human.

In media and entertainment conversations, the ‘loudly crying face’ emoji 😭 takes the lead among the top 10 most used emojis, even surpassing the popular ‘face with tears’ 😂. However, this shift doesn't mean that conversations are getting sadder. Rather, it shows that emoji usage is evolving. While boomers and Gen X might use this emoji to express extreme sadness, millennials use the emoji to express strong emotions, like when they’re feeling loved or when something is beautiful or pure. Finally, Gen Z is more likely to use the emoji to express if something is funny but isn’t meant to be.

Post with the loudly crying face emoji 😭 from Gen Z:

Post with the loudly crying face emoji 😭 from a millennial:

Post with the loudly crying face emoji 😭 from Gen X:

Post with the loudly crying face emoji 😭 from a baby boomer:

Emoji usage can vary (quite a lot) across generations. Being aware of these nuances is important so you don't risk alienating your audience by appearing out of touch.

Even between younger generations like Gen Z and millennials, there are monumental differences in which emojis they use and for what purposes. In 2022, for instance, news spread that Gen Z had canceled the ‘thumbs up’ 👍 emoji because they found it to be passive-aggressive.

The same goes for locations. Consumers in different countries use emoji in different ways. Looking at the emoji usage in different regions, there are some interesting nuances:

- In the US, people use the ‘eyes’ emoji 👀 more often than in other regions.

- In the UK, the ‘thumbs up’ emoji 👍 is more popular than in other regions.

- In the APAC region and Spain, the ‘pleading face’ emoji 🥺 and smiling face with ‘heart eyes’ emoji 😍 are more popular than in other regions.

- In France, the ‘winking face’ emoji 😉 is more popular than in other regions.

- In Germany, the ‘smiling face with the smiling eyes’ 😊 emoji is more popular than in other regions.

This exemplifies why brands need to know how their target audiences are expressing themselves online. With social listening platforms like Brandwatch Consumer Research, brands can analyze online consumer conversations and discover such trends and patterns.

Consumer insights on streaming services and the movie industry

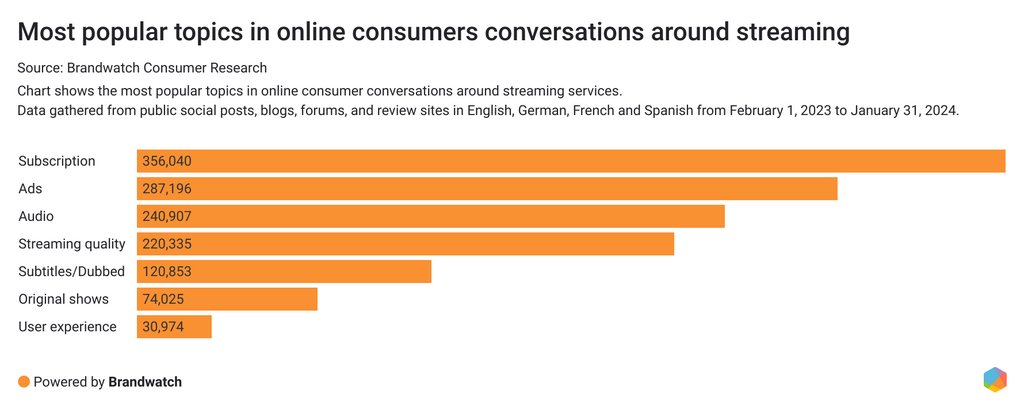

Streaming services and the rise of streaming advertising

The streaming industry had a tumultuous 2023. Tactics such as limiting account sharing or introducing cheaper ad-supported subscription models to cut costs and attract new customers made headlines worldwide. Against a backdrop of numerous streaming options, consumers are weighing the pros and cons of spending their money in the ever-expanding streaming market.

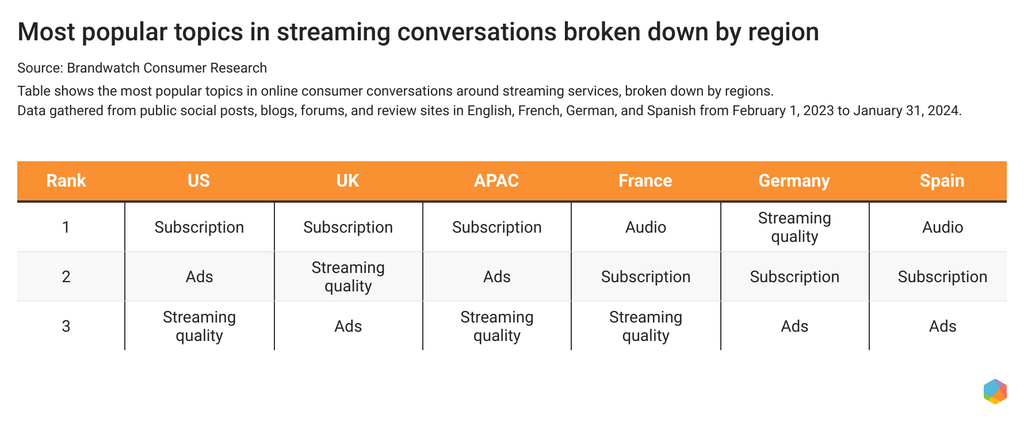

In consumer discussions about streaming, subscriptions and ads are the most talked about topics, surpassing other important themes like streaming or audio quality. From February 1, 2023 to January 31, 2024, discussions on original shows, subscriptions, and ads experienced a surge, marking an increase compared to the previous 12 months. In the same period, mentions of audio and streaming quality, subtitles, and user experience in general saw a decline.

In particular, consumers in the US, the UK, and the APAC region are talking about streaming subscriptions, while consumers in France, Germany, and Spain are more preoccupied with audio and streaming quality.

When consumers talk about streaming subscriptions, it is usually in a negative way. With 88% of sentiment-categorized mentions marked as negative, subscriptions appear to be frustrating for many consumers. Consumers in the US and Spain are particularly negative about streaming subscriptions, with 90% of mentions categorized as negative. Consumers in Germany exhibit a relatively lower level of negativity, with only 77% of mentions carrying a negative tone.

They discuss different subscription models, criticize the soaring prices, and vent about paying more to continue an ad-free streaming experience. The inability to share an account with family members is also a pain point, especially if family members do not all live in the same house.

Another pain point is shows and movies that are removed or made exclusive to the streaming provider. While this exclusivity makes sense from a business perspective, it creates frustration for users who want to purchase the content to re-watch it without paying a monthly subscription.

As streaming services remove exclusive content from their platforms and content is not released on physical media, consumers worry that shows and movies will disappear, forcing them to turn to piracy.

It’s clear that the streaming wars are entering a new phase with the introduction of advertising into the streaming market. Consumers have escaped cable TV and its commercial breaks by switching to streaming providers, and now they are back to watching ad-supported shows and movies.

And consumers are not happy.

The main emotion expressed in consumer conversations about ads and streaming is anger. Consumers complain about being forced to pay more to continue an ad-free streaming experience. They say they hate ads, that they are annoying, and that they have canceled their streaming subscriptions because of ads. Others say they are frustrated by the lack of variety in the ads they see.

But not all conversations around ads are negative. As many as 25% of all sentiment-categorized mentions about streaming and ads are positive. In these conversations, consumers praise ad-supported streaming services, especially FAST services (Free Ad-supported Streaming Television) that offer content for free. Budget-conscious consumers are turning to these streaming platforms to watch content.

The streaming industry is changing and looking for new revenue streams. While consumers generally don't view the addition of advertising to streaming as positive, they are more receptive if it comes with a lower price tag. Streaming services that charge consumers extra to continue streaming without ads cause the most frustration, as consumers don't want to pay more for the same exact streaming experience.

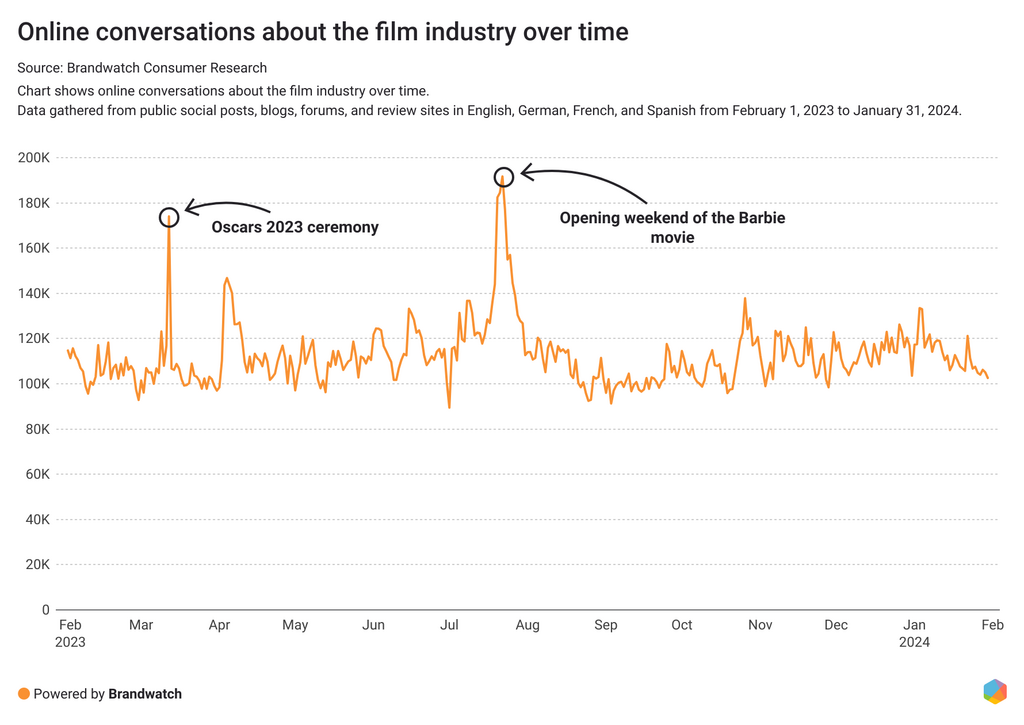

How Barbie might have saved the movie business

The movie industry has struggled in recent years as the pandemic and subsequent restrictions have slowed production and left theaters empty. The popularity of streaming services has also led to more consumers opting to watch movies at home instead of going to the theater.

Box office has since rebounded, but not to pre-pandemic levels. According to Statista, the box office in the United States and Canada grossed $8.91 billion in 2023, compared to $11.32 billion in 2019. And there's one movie, in particular, that helped boost those numbers: the Barbie movie.

In online conversations about movies and theaters, the release of the Barbie movie caused the highest peak in mentions. It was even higher than the conversations about the Oscars.

It was by far the most mentioned movie in online consumer conversations, with an impressive 1.4 million mentions online. The Barbie movie was also the number one movie mentioned in positive conversations.

It's safe to say that this was the year of Barbie. People all over the world went to the movies to see Greta Gerwig's pink production, and, not surprisingly, it was the highest-grossing movie of 2023. This is not only reflected in ticket sales, but also in online conversations. Barbie is the most mentioned movie in positive conversations about movies. In particular, Gen Z loved talking about it. Generational data shows that 40% of Barbie mentions came from Gen Z, the demographic that, on average, only makes up 28% of general movie conversations.

Barbie fans went to the movies not only to see the movie, but to dress up in their favorite pink clothes.

People online liked to point out that they not only enjoyed the movie and dressing up, but that their movie going experience in itself was special. Experiencing watching a movie with other excited fans made the screening of a memorable experience.

Movie brands can add to the excitement by offering special screening nights, merchandise, or a photo booth to encourage people to dress up. 2023 showed that consumers can still get excited about going to the movies, and theaters that can make it a special event might have a better chance of luring consumers back.

Consumer conversations around the movie experience

The movie-going experience is a major talking point in online consumer discussions related to movie theaters. It’s also the topic consumers talk the most happily about, with 40% of emotion-categorized mentions being joyful. This underlines that a positive experience is a driving factor for why consumers go to the movies.

In these happy conversations, consumers say they love to see movies on the big screen, an experience they can’t replicate at home. Others enjoy the social aspect of going to the movies with friends and family and being surrounded by like-minded movie fans.

But not all conversations are positive. Consumers reinforce in their discussions that increased prices are a real pain point. Ticket prices, online fees, and the cost of snacks like popcorn have gone up, resulting in money becoming a more dominant topic in conversations about going to the movies. From February 1, 2023 to January 31, 2024, mentions of money and prices increased by 9% compared to the previous 12 months, with negative mentions rising by 22%. This heightened sensitivity towards prices is particularly visible in the APAC region, the UK, and Spain where online conversations on the topic have surged by 13% to 16%.

Another pain point for consumers is the behavior of others that can negatively impact the experience. Whether it's people talking during the movie or using their phones, consumers are not happy with disruptive behavior. From February 1, 2023 to January 31, 2024, the number of mentions around movie theaters and phone usage increased by 17% compared to the previous 12 months. People on their phones during the movie seem to have become a bigger issue in 2023, with more people complaining online that it's affecting their viewing experience.

Brands in the movie industry need to monitor these consumer conversations to learn the most common pain points and make changes to improve the experience. Consumers expect an outstanding experience for the increased prices and if these are not met, there is a risk that they will turn away.

The music industry and changing consumer behavior

The year of the Swifties

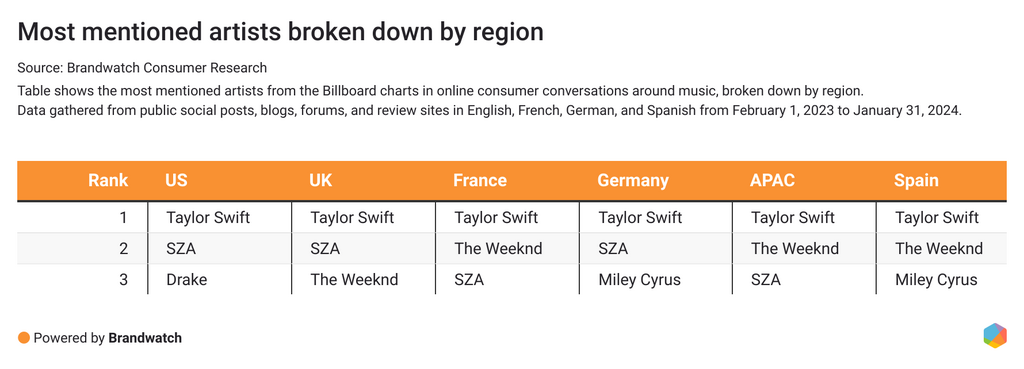

2023 was the year of the Swifties. Taylor Swift was everywhere, and not only did she top the Billboard charts, she was also – undoubtedly – the most talked-about artist online.

Consumers mentioned her more than 1 million times in online conversations. That's 3.5 times more than the runner-up, Drake. And no wonder because this has been a record-breaking year for Taylor Swift.

Her world tour sold out in seconds, with millions of fans still on waiting lists, and is the highest-grossing music tour in history with $1 billion in revenue. The concert film is also breaking records as the highest-grossing concert film of all time.

According to a Bloomberg analysis, she now has a net worth of $1.1 billion. Her appearance at the 2024 Super Bowl fueled online conversations even more, with fans mentioning her five times more than star player Travis Kelce – who also happens to be Swift’s boyfriend. Search interest for her reached a 5-year-high in early February 2024. Her popularity shows no signs of slowing down, and more and more brands are looking for ways to capitalize on the Taylor Swift effect.

One of Taylor Swift's defining characteristics is that she is loved worldwide. With the Eras Tour still ongoing, we will likely continue to see Taylor Swift setting trends.

For example, Swifties like to buy friendship bracelets that they can exchange with others at her live shows. This trend was influenced by a Taylor Swift song with the lyrics: "So, make the friendship bracelets, take the moment and taste it." Notably, between April and August 2023, Etsy witnessed a substantial $3 million in sales attributed to these friendship bracelets. It's no secret that Taylor Swift is a trendsetter, and more and more brands are seeing an opportunity to leverage her popularity to reach their target audience.

Swifties all over the world go out of their way to see their favorite artist live, traveling to other cities and countries for her shows. They are setting another trend by turning concerts into vacation experiences.

Concerts becoming a vacation experience

Concerts have made a comeback, but there's a noticeable shift in how consumers approach them. More people now view concerts as a vacation experience, willing to travel for the event. According to Expedia Group, 70% of respondents say they are more likely to travel to a different location for a concert, and 40% say they travel to a concert to have an excuse to go to a new location.

This is also reflected in online conversations. The number of people talking about concerts and travel increased by 20% between February 1, 2023 and January 31, 2024 compared to the previous 12 months.

In online conversations, people share their experiences at concerts, traveling, and visiting friends and family. The most frequently mentioned artists are Taylor Swift, Beyoncé, and Harry Styles. Popular cities mentioned in online conversations include London, New York, Paris, and Chicago.

Tickets and money are one of the main topics in online conversations around concerts. Increased prices and sold-out tickets are also the biggest pain point for consumers, being the key topic in sad conversations.

Consumers complain that tickets are becoming more expensive and sometimes outright unaffordable. Music fans that are willing to pay higher prices expect good entertainment in return. If the venue isn't right, or they’re not thrilled with the performance, they don't think the higher prices are justified.

Consumers are becoming more selective about which concerts they attend and whether the experience is worth the money. This includes festivals, which are more expensive than a single concert because of their length. When ticket sales began for this year's Coachella, the festival faced its slowest ticket sales in a decade.

To thrive in this evolving landscape, music brands might benefit from making the concert going experience a once-in-a-lifetime experience. If music brands see this as a special occasion for fans and are willing to go the extra mile, they might win over consumers. This might be an opportunity to partner with hotels or airlines to offer special deals or packages to attract customers.

How consumers feel about AI in the music industry

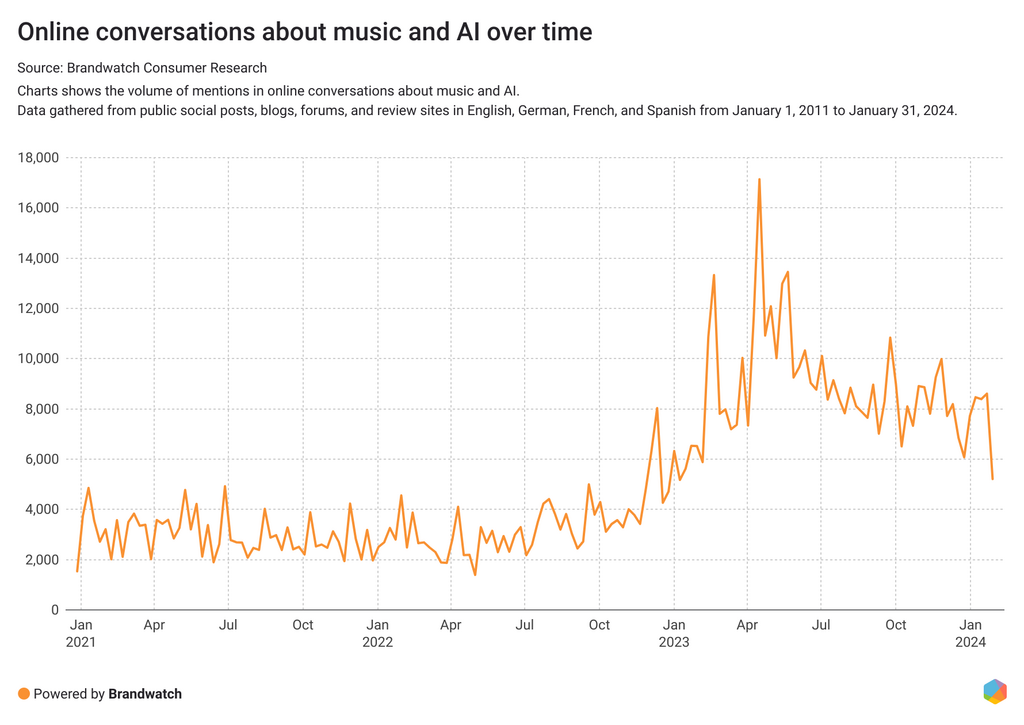

There's hardly an industry that AI isn't disrupting right now, and the music industry is no exception. Almost every day, there are new articles about music and AI, about new tools, new songs, or concerns about copyright. Major artists have begun to experiment with AI. The Beatles, for example, recently used an AI tool to release an unfinished song, and artist Grimes released an AI platform that allows artists to record songs with her voice.

And consumers are paying attention. According to Google Trends, search interest in "music and AI" reached a five-year high in January 2023, and online conversations increased more than 150% from February 1, 2023, to January 31, 2024, compared to the previous 12 months.

The negative AI consumer conversations

Consumers are more negative than positive about the topic overall, with 63% of sentiment-categorized mentions being negative. US consumers are more negative than UK consumers, with 67% negative vs. 54% positive.

What are the consumer concerns driving these conversations? First of all, consumers are concerned about the recognition of artists. With AI, anyone can create songs that use an artist's voice without their permission and go viral. In 2023, an AI song that used the voice of artists Drake and The Weeknd without their approval went viral, causing a lot of controversy. Consumers are concerned that this could disrupt the music industry in a negative way and harm the careers of many artists.

Second of all, they're worried they won't be able to tell the difference between human made and AI-generated songs. Consumers want to know what they are listening to. They also criticize AI-generated music for lacking creative depth and a human touch, and debate whether it can be considered art.

The positive AI consumer conversations

And while many online consumer conversations about this are negative, there are also positive discussions. Consumers see an opportunity for AI to help finish or restore old music, like when the Beatles used AI to finish an old song.

Others are excited about tools that help them get creative and make music without the equipment or knowhow. Social platforms like TikTok and YouTube are testing AI features that allow users to create their own music and exercise their songwriting skills.

This group of consumers see a positive opportunity in the use of AI to create music, as long as it's done within copyright laws and with the consent of artists. Music brands and social platforms will need to prioritize consumer education on copyright laws to instill confidence in using AI-generated music. As more AI tools enter the market in 2024, it's likely that regulations will be put in place to prevent misuse and fraud.

The latest trends in the gaming industry

Consumers and the gaming conversation

The gaming market is a huge industry. According to Statista, the market revenue of the gaming industry will reach $455.30 billion in 2024. Video games are becoming increasingly popular, and the days of the main target audience being male and young are over. As many as 46% of gamers in the US are female, and more and more consumers over 50 are joining the gaming community. As game companies prioritize adding more accessibility features to games, such as customizable subtitles and colorblindness settings, and develop adaptive controllers, games are becoming more inclusive and reaching a wider audience.

More than 33 million people discussed gaming online, totaling 118 million mentions from February 1, 2023 to January 31, 2024. While the volume of mentions stayed the same, the number of individuals increased by 4% compared to the previous 12 months.

One of the biggest topics of conversation in gaming are the games itself. Whether posting about what they are currently playing, sharing their excitement about an upcoming game, or discussing newly released games with their community, consumers have a lot to say. Gaming brands can dive into these conversations and gather valuable feedback that can inform their product development and go-to-market strategy.

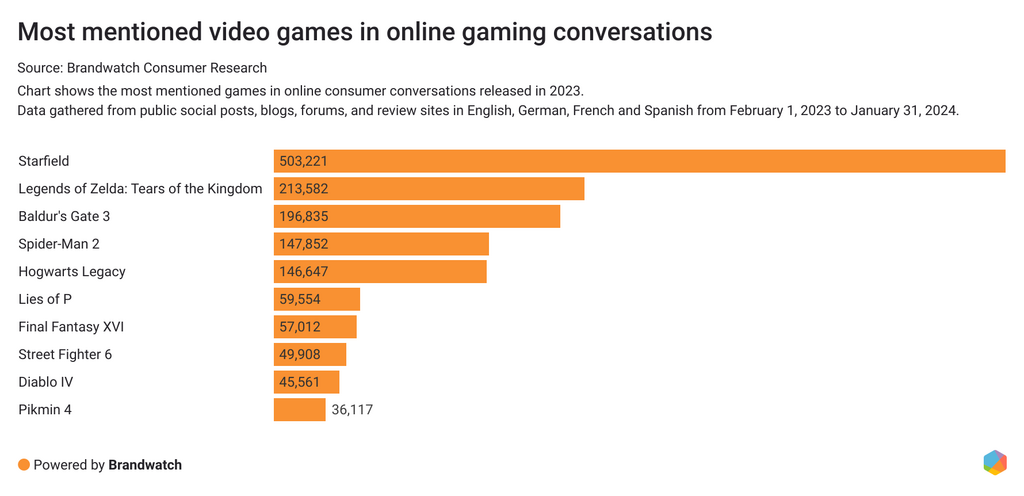

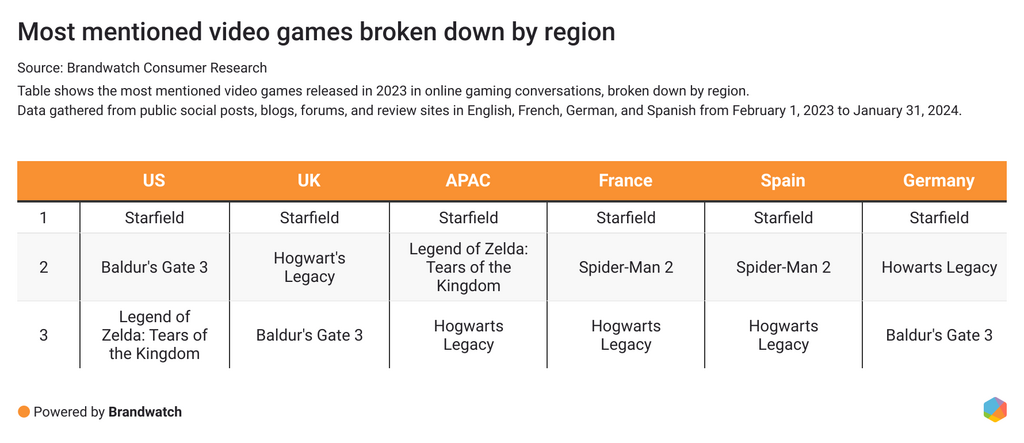

As we see on the chart, Starfield, Legend of Zelda: Tears of the Kingdom, and Baldur's Gate 3 are the most discussed video games released in 2023.

Looking at the regional data, apart from Starfield being in first place, there are some differences when it comes to the most discussed games:

- In the US, Baldur's Gate 3 is the second most popular game in consumer conversations.

- In the UK and Germany, consumers talk more likely about Hogwarts Legacy.

- Within the APAC region, the new Legend of Zelda game is more discussed than in other regions.

- In France and Spain, Spider-Man 2 is the second most popular game.

Starfield has more mentions than any other game, more than twice the mentions of second-place contender Baldur's Gate 3. A look at the sentiment shows that the game is polarizing consumers. Of all sentiment-categorized mentions, 62% are negative, making it the most negatively discussed game in the top 10. In the negative conversations, consumers criticize a poor game experience, such as bugs or a boring storyline.

On the other hand, 38% have positive things to say about the game, saying they had a great experience.

The sentiment analysis shows that consumers are divided, but the negative mentions outweigh the positive ones. As the game has been in development for eight years, the consumers had high expectations and for many, it appears they have not been met.

Gaming brands need to keep up with consumer expectations to not lose out on customers or, in extreme cases, turn into a business disaster. The Gollum game and The Day Before, for example, were so poorly received that they led to layoffs and the closure of the game studio. Both games were announced years before their release, which led to consumers getting excited, but also set the stage for significant disappointment when the games ultimately failed to meet the lofty expectations.

Looking at the subreddit with the highest upvotes in gaming conversations, consumers share their disappointment with games that have been released in 2023.

As video game prices soar, consumers are becoming increasingly price-conscious, expecting quality in return for their investment. But even though they are more conscious of how they spend their money, they are hungry for new content.

The event that caused the highest peak in online conversations was The Game Awards on December 7, 2023, proving that The Game Awards is one of the biggest award shows in the entertainment industry. The live show was watched by 118 million people around the world, which is more people than ever before. The show not only honors the best games and achievements in the industry, but it's also an important event for game brands to promote their upcoming games.

Consumers watch the show for news in the gaming industry and to get the scoop on upcoming games. With physical events like E3 shutting down, gaming companies are turning to virtual events like The Game Awards or hosting their own events to promote their upcoming content. Brands that provide informative content about upcoming projects and are transparent about the process can effectively keep their audience engaged while avoiding the creation of unrealistic expectations.

Gamers are getting cozy

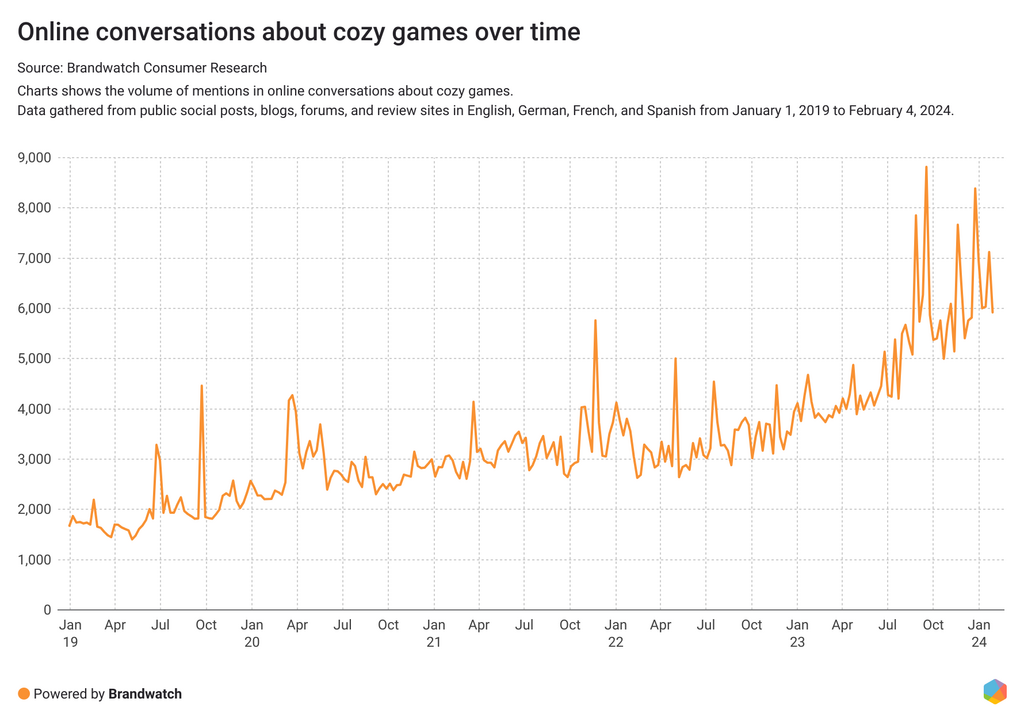

The rise of cozy games gained momentum during the pandemic with the release of Animal Crossing, which for many became a go-to source of relaxation. Since then, "cozy games" have taken off as a genre in its own right, and gamers have adopted the term to describe games that are relaxing, wholesome, and without stressful challenges.

In 2023, the trend took off, with many new cozy games hitting the market and fueling online conversations. Online mentions of cozy games increased by 57% from January 16, 2023 to January 15, 2024, and according to Google Trends, search interest in "cozy games" reached a 5-year high in December 2023.

Conversations are overwhelmingly positive, with 75% of sentiment categorized mentions being positive. Consumers say they have fun and enjoy cozy games that help them relax and unwind after a stressful day. They often describe cozy games as cute and beautiful, highlighting the artwork and characters. In terms of gameplay, farming and puzzle games are often mentioned. Cozy games that can be played with family and friends are also popular.

The most popular games of the genre according to online conversations are Stardew Valley, Animal Crossing, and Pokémon. Millennials discuss cozy games more than other generations. While millennials make up 55% of all generational mentions around video games in general, they make up a whopping 63% of all mentions of this relaxing gaming genre.

Cozy game players emphasize the community aspect of playing cozy games. Whether playing with others, live-streaming gameplay, or discussing games on Reddit, the community aspect plays an important role in cozy game conversations.

Cozy games are particularly popular with female gamers. Looking at the gender data, 55% of the gender categorized mentions around cozy games are from female authors. In general gaming conversations, they make up only 25%.

Cozy gaming is not only about the games themselves, but also about the aesthetics and the game environment. Cozy gamers like to give their game environment a cozy vibe to enhance the gaming experience. The word "aesthetics" in cozy gaming conversations increased by over 75% from February 1, 2023 to January 31, 2024 compared to the previous 12 months.

This is a great opportunity for brands, both within and beyond the gaming industry. For example, interior design or home decor brands can work with cozy gaming influencers to promote products that can enhance their gaming setup.

Top gaming influencers on TikTok

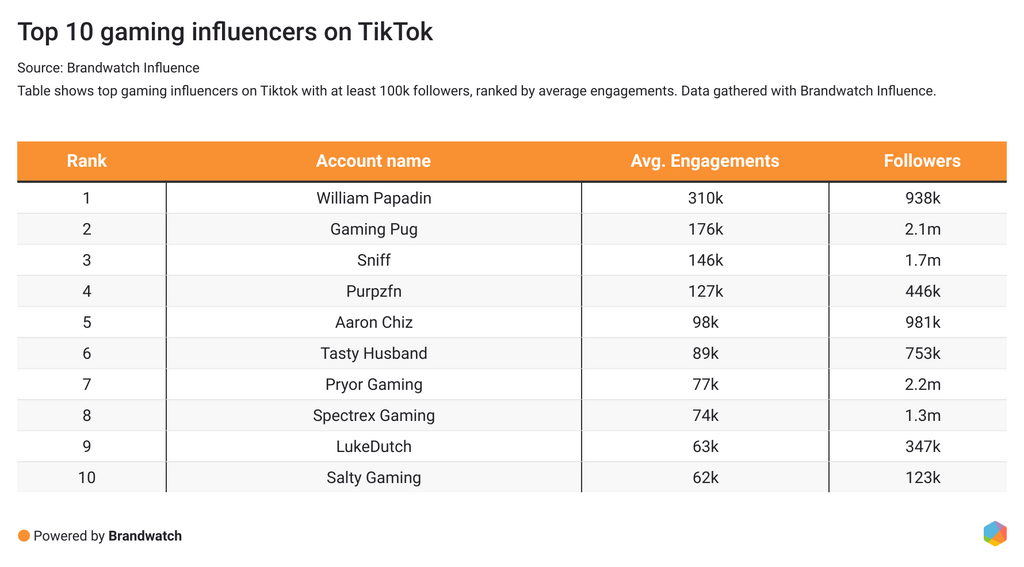

Influencers and content creators have a huge impact on the purchasing decisions of their followers. Gamers follow them to get their opinions on the latest games and watch them play the games in short videos or live streams. With Brandwatch Influence, we looked for influencers on TikTok with at least 100k followers who cover gaming topics in English.

Here are the top 10 gaming influencers on TikTok, ranked by average engagements (data gathered in February 2024):

Top 10 gaming influencers on TikTok

- William Papadin – 310k engagements

- Gaming Pug – 176k engagements

- Sniff – 146k engagements

- Purpzfn – 127k engagements

- Aaron Chiz – 98k engagements

- Tasty Husband – 89k engagements

- Pryor Gaming – 77k engagements

- Spectrex Gaming – 74k engagements

- LukeDutch – 63k engagements

- Salty Gaming – 62k engagements

Sitting comfortably at the top of the list, content creator William Papadin is not your average gaming influencer. He doesn't make gameplay clips or review the latest games he's played. Instead, he makes short, funny videos about fantasy and gaming. He dresses up as a knight or a wizard and makes jokes about the gameplay of different games. And, obviously, with great success. His videos on TikTok have received over 20.1 million likes.

Second place Gaming Pug combines gaming with the irresistible charm of a pug’s cute face. No wonder this account is so successful. The account posts short gameplay clips with the occasional cute video of the dog, captivating and entertaining a substantial audience of over 2.1 million followers.

Brands can discover the right influencers and content creators with influencer marketing tools like Brandwatch Influence. You can get a better understanding of the content the influencer is posting and how it might fit into your content strategy.

Conclusion

Consumers are faced with endless choices for entertainment, spanning shows, movies, music, concerts, and video games. Brands, in turn, face growing challenges in capturing the attention of their target audience while also feeling the harsh realities of consumers struggling with higher costs, which prompts more deliberate purchasing decisions.

Brands that analyze consumer opinions in real time with social listening platforms, like Brandwatch Consumer Research, are better poised to keep up with changing consumer preferences. By listening to shifting consumer sentiments, these brands can respond promptly, fostering deeper customer loyalty in the process.